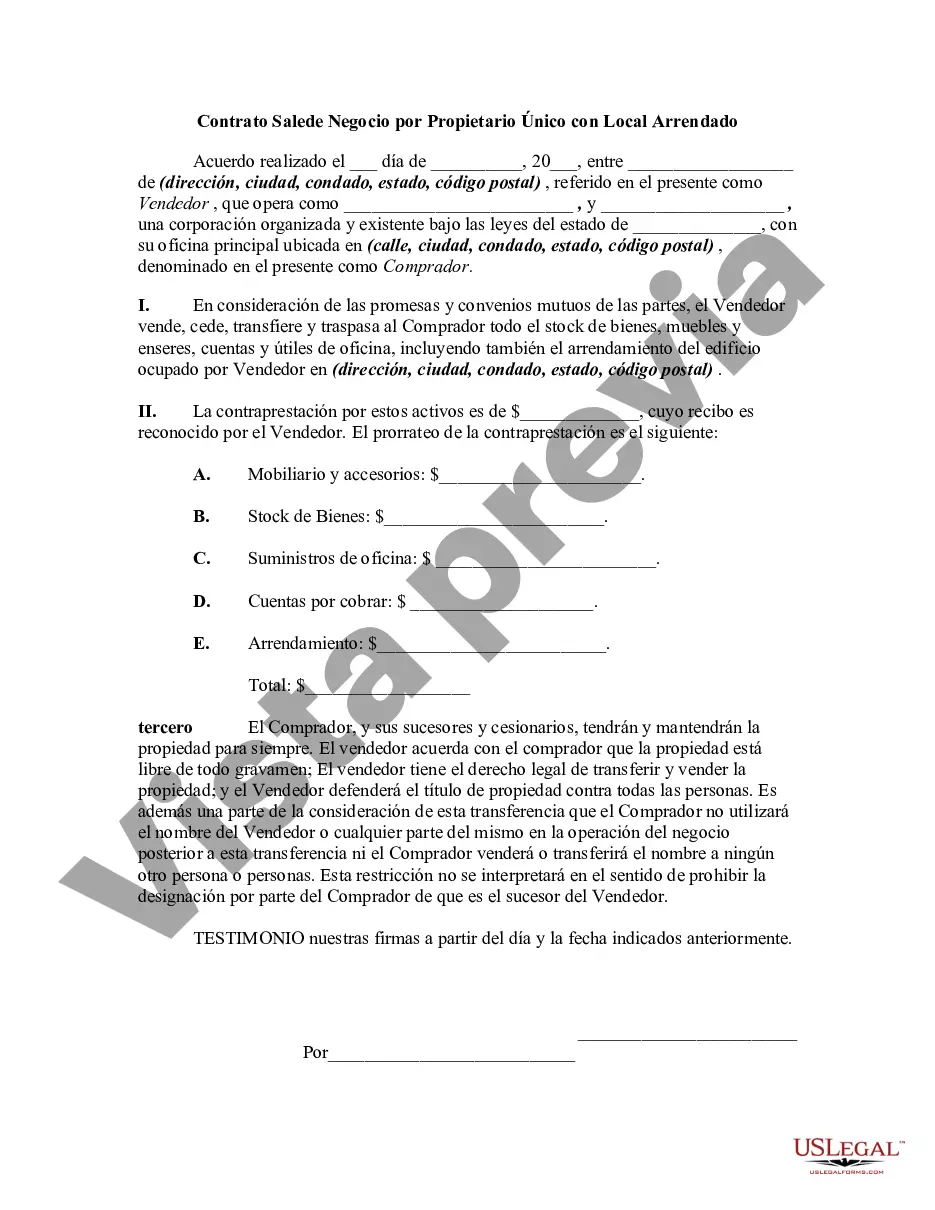

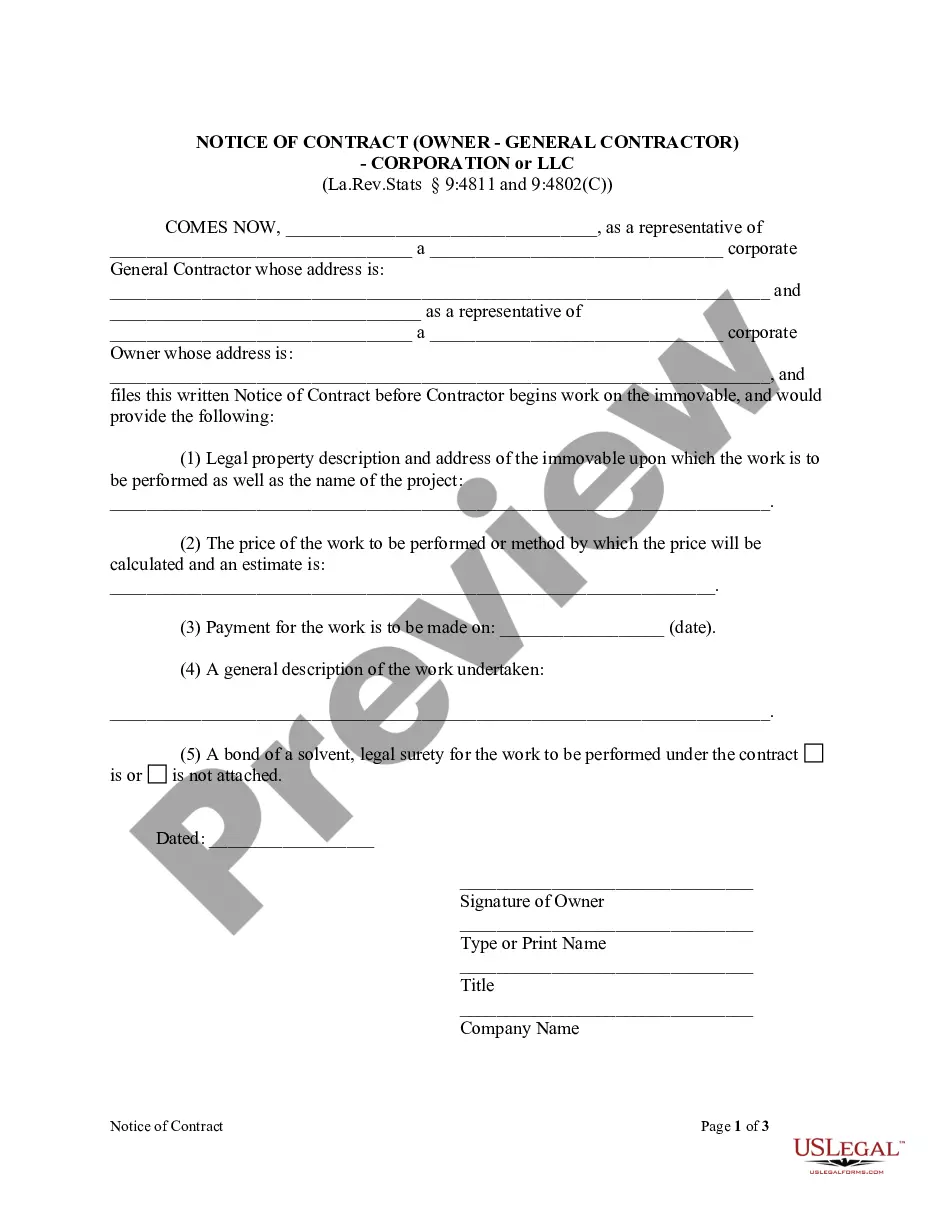

The Franklin Ohio Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a legal document specifically designed for individuals in Franklin, Ohio, who operate a sole proprietorship business and wish to sell it along with the leased premises. This agreement outlines the terms and conditions of the sale, protecting the interests of both the seller and the buyer. Keywords: Franklin Ohio, Agreement for Sale of Business, Sole Proprietorship, Leased Premises, legal document, terms and conditions, seller, buyer. There are a few different types of Agreement for Sale of Business by Sole Proprietorship with Leased Premises in Franklin, Ohio, each catering to specific circumstances. Here are some variations that individuals may consider: 1. Franklin Ohio Agreement for Sale of Business by Sole Proprietorship with Leased Premises — Asset Purchase: This type of agreement focuses on the sale of specific business assets rather than the entire business. It can be beneficial if the seller intends to retain certain assets or if the buyer is only interested in acquiring particular elements of the business. 2. Franklin Ohio Agreement for Sale of Business by Sole Proprietorship with Leased Premises — Stock Purchase: Unlike an asset purchase agreement, this type of agreement involves the sale of stocks or shares of a sole proprietorship business. It allows the buyer to acquire the entire ownership interest in the business, including all assets, liabilities, and contracts associated with it. 3. Franklin Ohio Agreement for Sale of Business by Sole Proprietorship with Leased Premises — Lease Assignment: This agreement comes into play when the seller has a lease agreement in place for the premises where the business operates. In this scenario, the seller transfers the lease to the buyer, along with the business, ensuring a smooth transition and avoiding potential disruptions. 4. Franklin Ohio Agreement for Sale of Business by Sole Proprietorship with Leased Premises — Seller Financing: In cases where the buyer does not have immediate access to sufficient funds, this type of agreement allows the seller to provide financing options for the purchase. The terms for repayment, interest rates, and other financial details are negotiated and outlined in the agreement. Remember, it is always essential to consult with a qualified legal professional to ensure that the Franklin Ohio Agreement for Sale of Business by Sole Proprietorship with Leased Premises aligns with local laws and regulations, and to receive tailored advice based on your specific business circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Contrato de Venta de Negocio por Empresa Unipersonal con Local Arrendado - Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

How to fill out Franklin Ohio Contrato De Venta De Negocio Por Empresa Unipersonal Con Local Arrendado?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Franklin Agreement for Sale of Business by Sole Proprietorship with Leased Premises, it may cost you a fortune. So what is the best way to save time and money and draft legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case collected all in one place. Therefore, if you need the current version of the Franklin Agreement for Sale of Business by Sole Proprietorship with Leased Premises, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Franklin Agreement for Sale of Business by Sole Proprietorship with Leased Premises:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Franklin Agreement for Sale of Business by Sole Proprietorship with Leased Premises and save it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!