The Wayne Michigan Agreement for Sale of Business by Sole Proprietorship with Leased Premises is a legal document that outlines the terms and conditions for the sale of a business owned by a sole proprietorship, where the business operates in a leased property in Wayne, Michigan. This agreement protects the rights and interests of both the seller and the buyer, ensuring a smooth and lawful transfer of ownership. Keywords: Wayne Michigan, agreement, sale of business, sole proprietorship, leased premises. Types of Wayne Michigan Agreement for Sale of Business by Sole Proprietorship with Leased Premises: 1. Standard Sale Agreement: This type of agreement covers the general terms and conditions of the sale, including the purchase price, payment terms, and transfer of assets. It typically includes clauses related to the lease agreement between the sole proprietorship and the property owner. 2. Lease Transfer Agreement: In cases where the business operates in a leased premise, a lease transfer agreement is necessary to transfer the leasehold rights from the seller to the buyer. This agreement ensures the continuation of the lease agreement under the new ownership. 3. Asset Purchase Agreement: Some sales of business by sole proprietorship involve the transfer of specific assets rather than the entire business entity. In such cases, an asset purchase agreement is used to outline the assets being sold, their respective values, and any obligations or liabilities associated with them. 4. Non-Compete Agreement: This type of agreement is often included in the sale of a business to prevent the seller from competing with the buyer within a certain geographical area or for a specified period of time. It protects the buyer's interests and ensures the value of the acquired business. 5. Confidentiality Agreement: In situations where sensitive information about the sole proprietorship's operations, customers, or trade secrets is shared during the sales process, a confidentiality agreement may be included to protect this information from being disclosed or used by unauthorized parties. It is essential to consult with a legal professional experienced in business transactions to draft or review the Wayne Michigan Agreement for Sale of Business by Sole Proprietorship with Leased Premises, ensuring all necessary provisions and protections are included based on the specific circumstances of the transaction.

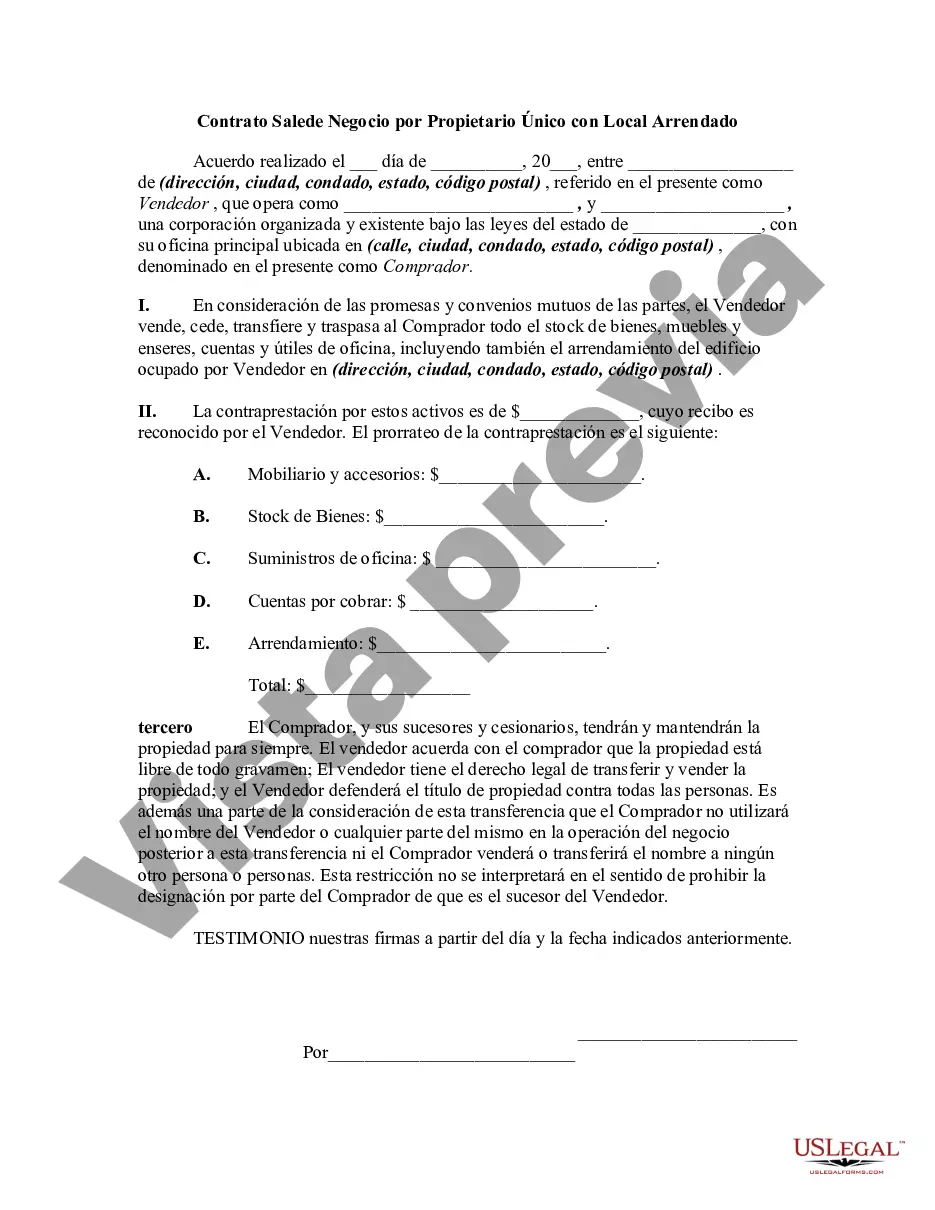

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Contrato de Venta de Negocio por Empresa Unipersonal con Local Arrendado - Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

How to fill out Wayne Michigan Contrato De Venta De Negocio Por Empresa Unipersonal Con Local Arrendado?

Preparing paperwork for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Wayne Agreement for Sale of Business by Sole Proprietorship with Leased Premises without professional assistance.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Wayne Agreement for Sale of Business by Sole Proprietorship with Leased Premises on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to obtain the Wayne Agreement for Sale of Business by Sole Proprietorship with Leased Premises:

- Examine the page you've opened and verify if it has the document you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a couple of clicks!