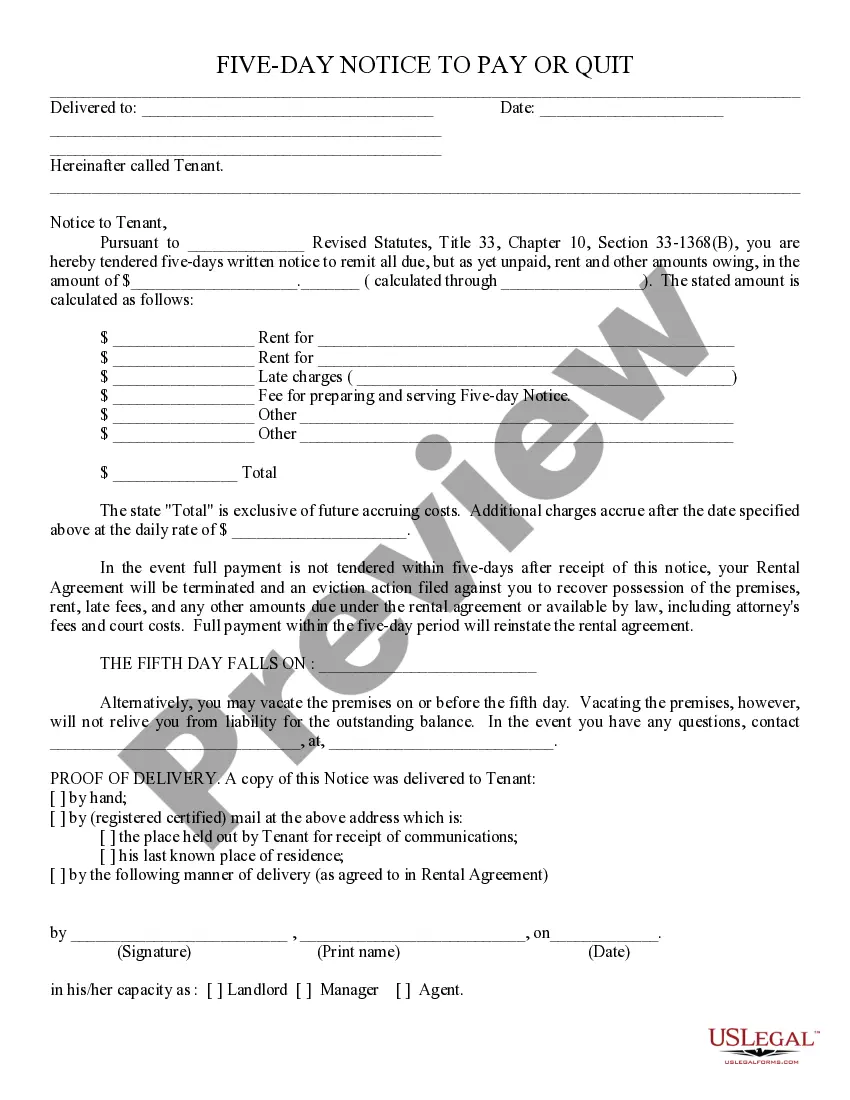

A Fulton Georgia Stock Retirement Agreement is a legal document that outlines the terms and conditions for the retirement of stockholders in Fulton, Georgia. This agreement is commonly used when a stockholder decides to retire and wants to transfer their shares or ownership interests to another party. The agreement typically includes key details such as the names and addresses of the retiring stockholder and the transferee, the number and class of stocks being transferred, the purchase price or consideration for the transfer, and any restrictions or limitations on the transfer of the stocks. It may also specify the effective date of the transfer and the steps required to complete the transaction. There can be different types of Fulton Georgia Stock Retirement Agreements, depending on the specific circumstances and preferences of the parties involved. Some common variations include: 1. Voluntary Stock Retirement Agreement: This agreement is entered into voluntarily by a stockholder who has decided to retire from the company and wishes to transfer their stocks to another person or entity. 2. Involuntary Stock Retirement Agreement: In certain situations, a stockholder may be forced to retire due to legal or contractual obligations. This type of agreement outlines the terms and conditions of the retirement, which may include buyout options or other remedies. 3. Stock Option Retirement Agreement: Stock options are often granted to employees as a part of their compensation package. When an employee retires, they may have the option to exercise their vested stock options or transfer them to another party. This agreement governs the retirement of stock options. 4. Restricted Stock Retirement Agreement: Restricted stock refers to shares that are subject to certain restrictions or conditions. When a stockholder retires, they may need to comply with specific requirements, such as holding periods or performance targets, before they can fully transfer or sell their restricted stock. This type of agreement addresses the retirement of restricted stock. In conclusion, a Fulton Georgia Stock Retirement Agreement is an essential legal document that facilitates the smooth retirement of stockholders in Fulton, Georgia. Whether it is a voluntary or involuntary retirement, or involves the transfer of regular or restricted stock, this agreement ensures that the rights and obligations of the retiring stockholder and the transferee are properly defined and protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Acuerdo de Retiro de Acciones - Stock Retirement Agreement

Description

How to fill out Fulton Georgia Acuerdo De Retiro De Acciones?

If you need to get a reliable legal document provider to find the Fulton Stock Retirement Agreement, consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support make it easy to find and execute different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to look for or browse Fulton Stock Retirement Agreement, either by a keyword or by the state/county the form is created for. After locating necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Fulton Stock Retirement Agreement template and check the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less pricey and more affordable. Create your first company, arrange your advance care planning, create a real estate agreement, or execute the Fulton Stock Retirement Agreement - all from the convenience of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

El pacto (en latin: pactum) es un convenio o tratado solemne, estricto y condicional entre dos o mas partes en que se establece una obediencia a cumplir uno o varios acapites establecidos en un contrato formal y en que ambas partes se comprometen a ejecutar ciertas acciones y a recibir retribuciones de la otra parte

Para hacer un pacto de socios, basta con la firma de un documento cuyo contenido cuente con la conformidad de todos los socios. Este acuerdo no debe confundirse con los estatutos societarios, los cuales deben ser recogidos en escritura publica ante notario.

Los pactos de organizacion agrupan los pactos segu- ramente mas relevantes y, al propio tiempo, los mas conflictivos juridicamente. Los denominamos asi porque expresan la voluntad de los socios de regla- mentar la organizacion, el funcionamiento y, en definitiva, el sistema de toma de decisiones dentro la sociedad.

Realizar un traspaso de acciones firmando ante notario o antes dos testigos habiles mayores de 18 anos. Inscribir el Traspaso de Acciones en el Registro de Accionistas. Solicitar Certificado de Anotaciones (solo Empresa en un Dia). Informar el Traspaso al Servicio de Impuestos Internos.

La mejor solucion para los conflictos entre socios es no dar lugar a que estos sucedan. Para ello, lo mejor es establecer el llamado pacto de socios. En el pacto de socios se aclaran cuestiones como los roles, el reparto de dividendos y todas aquellas cuestiones que sea necesario incluir.

Pacto, del latin pactum, es un acuerdo, alianza, trato o compromiso cuyos involucrados aceptan respetar aquello que estipulan. El pacto establece un compromiso y fija la fidelidad hacia los terminos acordados o hacia una declaracion; por lo tanto, obliga al cumplimiento de ciertas pautas.

Para los protestantes, el termino del pacto es el compromiso con Dios por medio de Jesucristo para la salvacion. Dicho pacto se conmemora, para la mayoria de ellos, mediante el ritual de la Santa Cena, celebrado desde el tiempo de Jesus y sus apostoles.

La exclusion de accionistas en las sociedades por acciones simplificadas (SAS) solo es posible cuando se verifican las causales de exclusion que se hubieren estipulado en los estatutos sociales, evento en el cual debera cumplirse con el reembolso correspondiente, en los terminos de los articulos 14 a 16 de la Ley 222

Veamos a continuacion como entrar o salir de una S.A.S.: Tener los titulos de acciones a la mano.Realizar un contrato de compraventa de acciones.Elaborar una asamblea de accionistas.Protocolizar y registra el acta constitutiva.Asentar en el libro de registro de acciones, los ultimos movimientos.

Como a expulsar un socio de la empresa paso a paso Convocatoria de la Junta General para la votacion de la expulsion.Aprobacion por mayoria de la Junta General de la expulsion del socio. En el caso que el socio expulsado sea el administrador, este debera pagar una indemnizacion a la empresa.