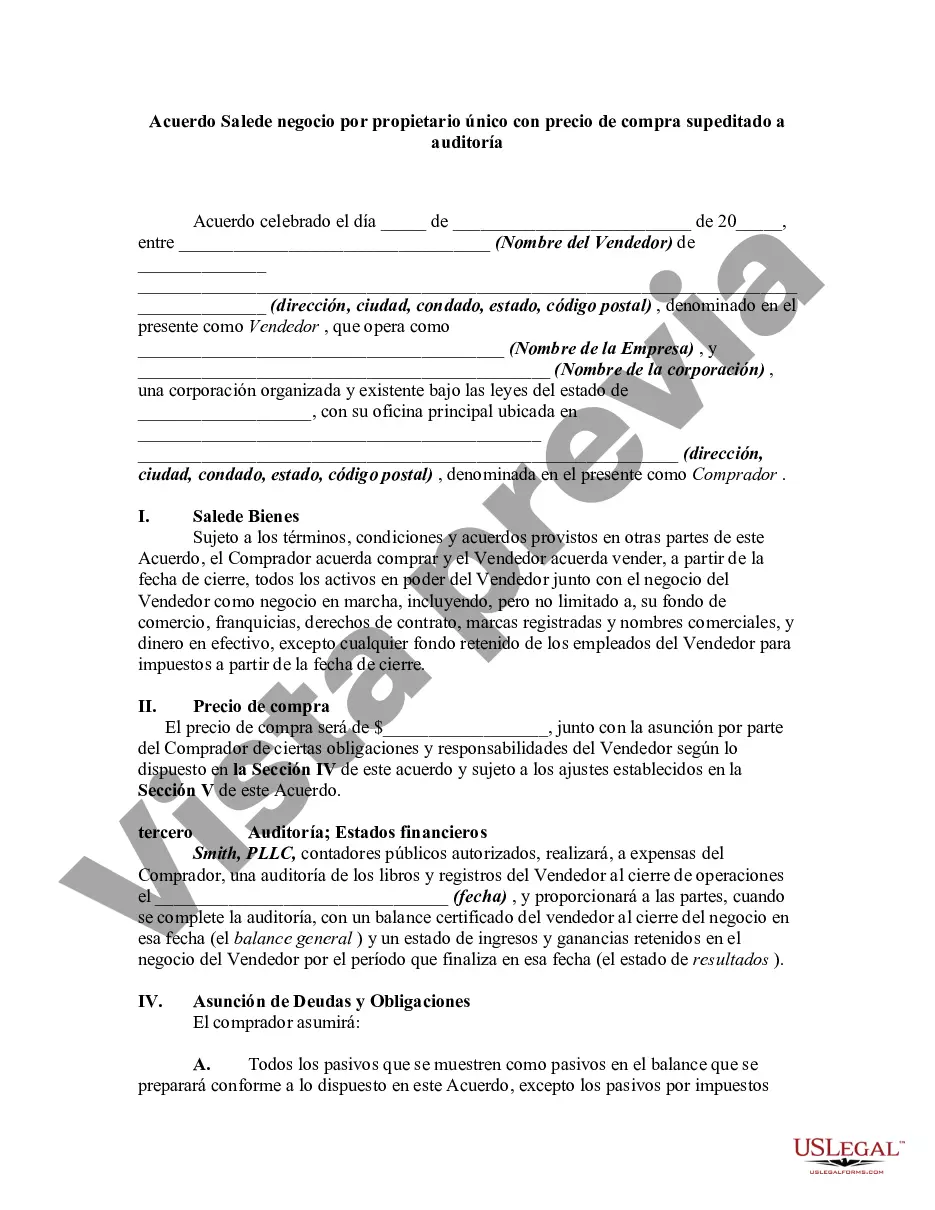

The Alameda California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legally binding contract specifically designed for business transactions involving sole proprietorship in the city of Alameda, California. This agreement sets out the terms, conditions, and contingencies for selling a sole proprietorship business, where the purchase price is dependent on the results of an audit conducted post-agreement. The agreement outlines the responsibilities and obligations of both the seller (the sole proprietor) and the buyer, ensuring a transparent and fair transaction. It covers various aspects, including the business's assets, liabilities, financial statements, inventory, contracts, intellectual property, leases, and more. The primary purpose of this agreement is to protect both parties' interests by including a provision for an audit. The audit ensures that the buyer has accurate and reliable information about the business's financials, allowing them to make an informed decision regarding the purchase price. The audit may be conducted by an independent third-party auditor agreed upon by both parties. If discrepancies or inaccuracies are discovered during the audit process, the purchase price shall be adjusted accordingly. Different types of Alameda California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit can be categorized based on the specific industry or nature of the sole proprietorship business being sold. For example: 1. Alameda California Agreement for Sale of Retail Sole Proprietorship with Purchase Price Contingent on Audit: This specific agreement would cater to businesses operating in the retail industry, such as clothing stores, convenience stores, or specialty retail shops. 2. Alameda California Agreement for Sale of Service-based Sole Proprietorship with Purchase Price Contingent on Audit: This type of agreement would be suitable for businesses offering professional services like consulting firms, beauty salons, or accounting firms. 3. Alameda California Agreement for Sale of Restaurant Sole Proprietorship with Purchase Price Contingent on Audit: This agreement would be tailored for businesses in the food industry, including restaurants, cafés, or food trucks. In conclusion, the Alameda California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit provides a comprehensive framework for selling a sole proprietorship business while safeguarding the interests of both the seller and the buyer. By including an audit provision, it ensures transparency and accuracy in the financial aspects of the transaction, leading to a fair and successful sale.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Acuerdo de venta de negocio por propietario único con precio de compra sujeto a auditoría - Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out Alameda California Acuerdo De Venta De Negocio Por Propietario único Con Precio De Compra Sujeto A Auditoría?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Alameda Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit meeting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Alameda Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, here you can get any specific form to run your business or personal affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your documentation correctly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you obtain your Alameda Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Alameda Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!