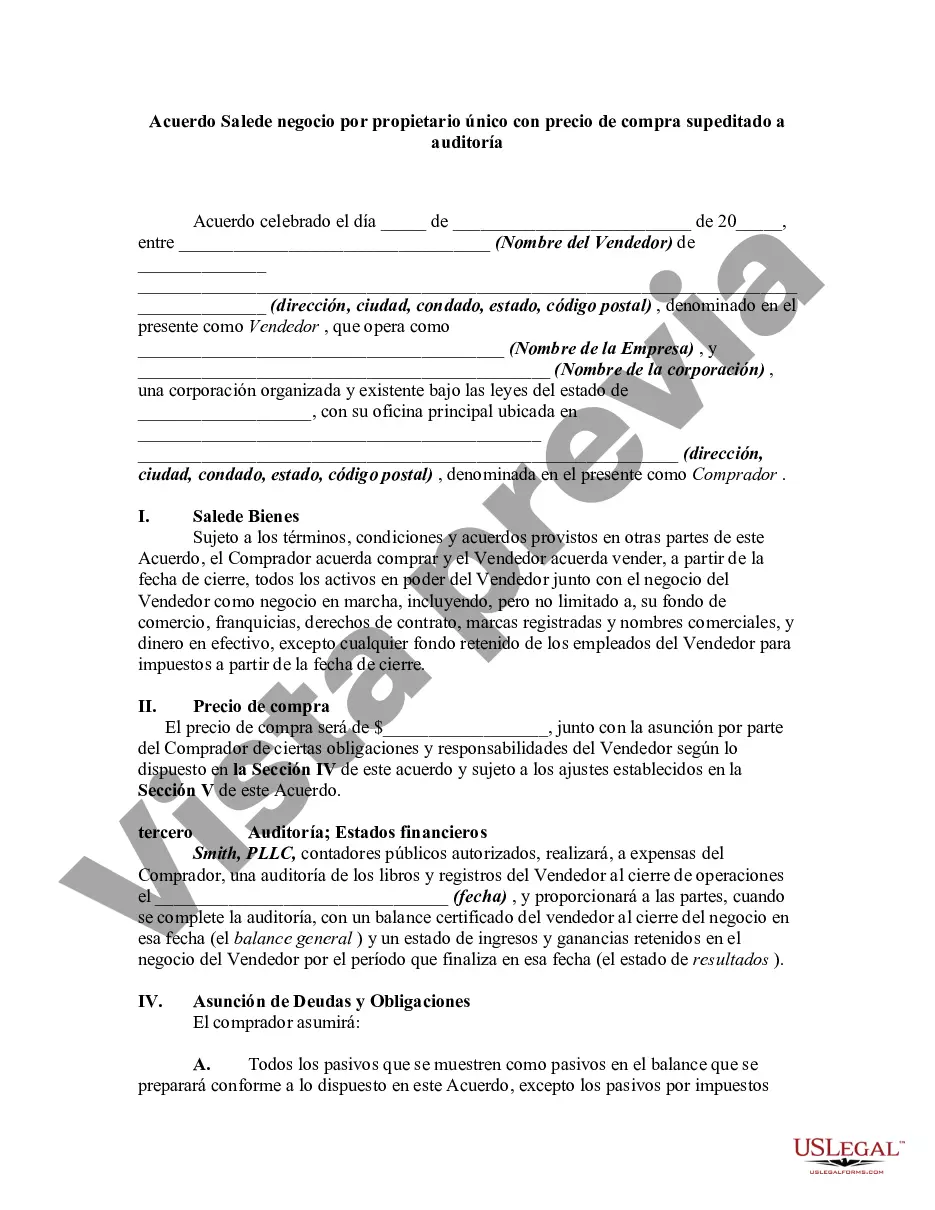

Houston, Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legally binding document that outlines the terms and conditions of a business sale in Houston, Texas. This agreement is specifically designed for sole proprietorship, where a single individual owns and operates the business. The purchase price specified in the agreement is contingent upon the completion of an audit to determine the true value of the business. Keywords: Houston, Texas, Agreement for Sale of Business, Sole Proprietorship, Purchase Price, Contingent, Audit. One type of Houston, Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is the Standard Agreement which covers the basic terms and conditions of the sale. It includes provisions for the identification of the sole proprietorship being sold, the purchase price that will be determined after the audit, and the payment terms agreed upon by both parties. Additionally, it outlines the rights and responsibilities of the buyer and the seller during the sale process. Another type of Agreement is the Confidentiality Agreement, which is an essential component when handling sensitive information during the audit and sale process. This agreement ensures that both the buyer and seller will keep all business-related information strictly confidential and will not disclose any trade secrets or proprietary information to third parties. Moreover, there is the Due Diligence Checklist which is often attached to the Agreement for Sale of Business. This comprehensive checklist helps the buyer to conduct a thorough investigation into the sole proprietorship's financial records, assets, liabilities, contracts, and other relevant information. It serves as a guide for the buyer to ensure that all necessary due diligence steps are taken before finalizing the purchase. Lastly, the Escrow Agreement may be used to hold the purchase price in an escrow account until the audit is completed. This agreement ensures that the funds are safely held by a neutral third party until all conditions of the sale are met. It provides additional security for both the buyer and the seller during the transaction. In conclusion, the Houston, Texas Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a crucial legal document that protects the rights and interests of both parties involved in the sale. Including various types of agreements and checklists makes the process smoother and ensures compliance with legal requirements. Note: It is important to consult with a legal professional to ensure that the specific terms and conditions of the Agreement align with the laws and regulations of the state of Texas and meet the unique needs of the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Acuerdo de venta de negocio por propietario único con precio de compra sujeto a auditoría - Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out Houston Texas Acuerdo De Venta De Negocio Por Propietario único Con Precio De Compra Sujeto A Auditoría?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Houston Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit.

Locating samples on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Houston Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Houston Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit:

- Make sure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Houston Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!