Santa Clara California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a legal document that outlines the terms and conditions of a business sale between a sole proprietor and a buyer, with the purchase price being contingent upon the results of an audit. This agreement is specifically designed for businesses located in Santa Clara, California, ensuring compliance with local laws and regulations. Keywords: Santa Clara California, Agreement for Sale of Business, Sole Proprietorship, Purchase Price, Contingent on Audit, Types of Santa Clara California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit: 1. Standard Santa Clara California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit: This is the standard agreement that covers the essential terms and conditions of the sale, purchase price contingency, audit process, and other relevant clauses. 2. Santa Clara California Agreement for Sale of Business with Confidentiality Clause and Purchase Price Contingent on Audit: In addition to the standard terms, this agreement includes a confidentiality clause to protect sensitive information during the audit process, ensuring the confidentiality of proprietary business data. 3. Santa Clara California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit and Non-compete Clause: This type of agreement includes a non-compete clause to restrict the seller from engaging in similar business activities within a specific time frame and geographic area, safeguarding the buyer's interests. 4. Santa Clara California Agreement for Sale of Business with Seller Financing and Purchase Price Contingent on Audit: This agreement offers seller financing options, allowing the buyer to make payments in installments, with the purchase price still contingent upon the audit results. 5. Santa Clara California Agreement for Sale of Business with Intellectual Property Transfer and Purchase Price Contingent on Audit: This agreement includes clauses related to the transfer of intellectual property rights, ensuring that all patents, trademarks, and copyrights associated with the business are properly transferred to the buyer. In conclusion, the Santa Clara California Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit is a flexible legal document that can be tailored to specific needs and circumstances. It ensures compliance with local laws and protects the rights and interests of both the seller and the buyer during the business sale process.

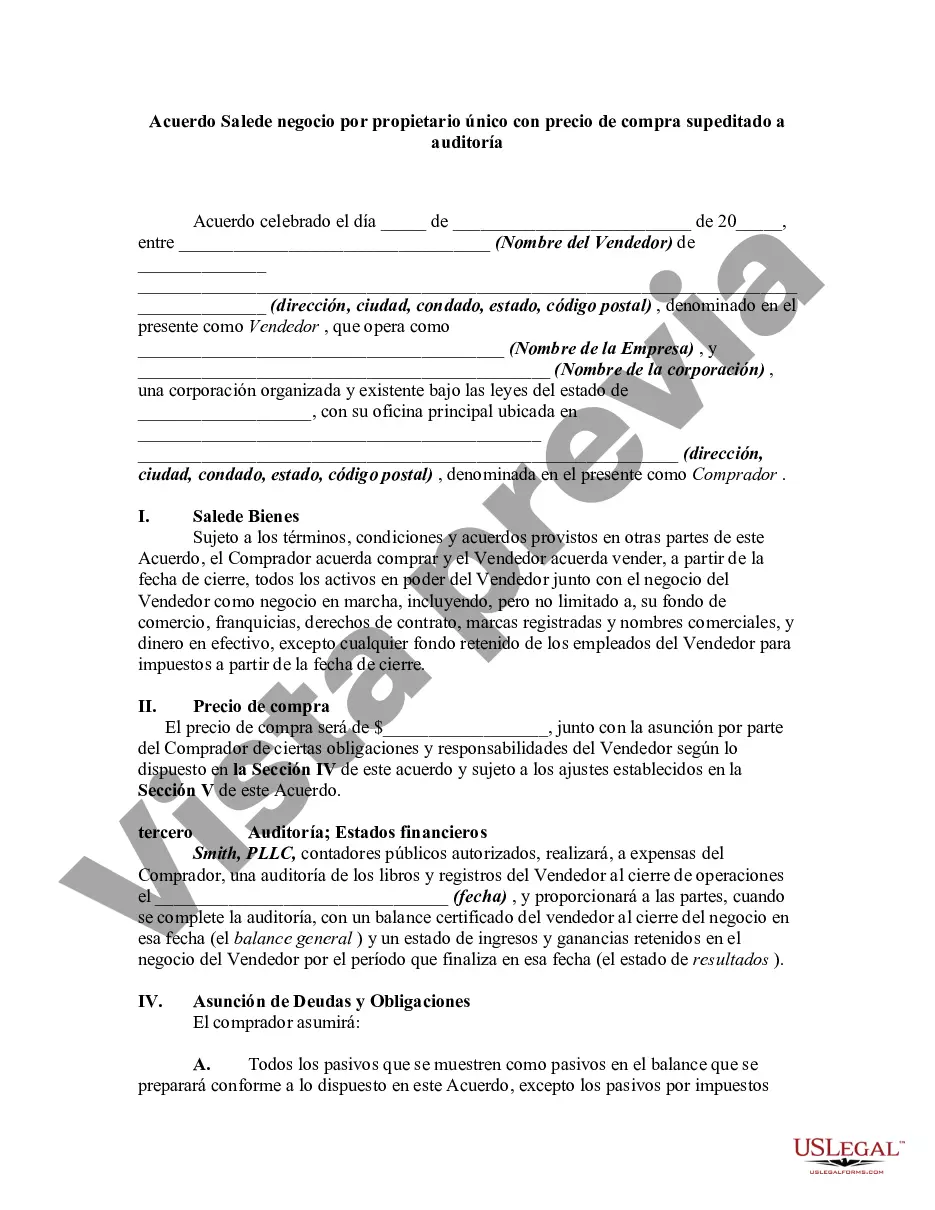

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Acuerdo de venta de negocio por propietario único con precio de compra sujeto a auditoría - Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit

Description

How to fill out Santa Clara California Acuerdo De Venta De Negocio Por Propietario único Con Precio De Compra Sujeto A Auditoría?

If you need to get a reliable legal paperwork supplier to get the Santa Clara Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can search from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of learning resources, and dedicated support make it easy to locate and execute various paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of customers since 1997.

You can simply select to search or browse Santa Clara Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Santa Clara Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription option. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less costly and more affordable. Set up your first company, arrange your advance care planning, draft a real estate agreement, or complete the Santa Clara Agreement for Sale of Business by Sole Proprietorship with Purchase Price Contingent on Audit - all from the comfort of your sofa.

Join US Legal Forms now!