In view of the fact that insurance is a closely regulated business, local state law and insurance regulations should be consulted when using this form.

Montgomery County, Maryland Contract between General Agent of Insurance Company and Independent Agent In Montgomery County, Maryland, the Contract between a General Agent of an Insurance Company and an Independent Agent plays a crucial role in the insurance industry. This agreement defines the terms and conditions under which the general agent and the independent agent will collaborate to promote and sell insurance policies within the region. The primary purpose of the contract is to establish a mutually beneficial relationship that ensures the smooth functioning of insurance operations. The general agent, who represents the insurance company, appoints the independent agent to act as their representative in Montgomery County, Maryland. This enables the insurance company to expand its reach and cater to a larger customer base. Under the Montgomery Maryland contract, the independent agent acts as an intermediary between the insurance company and potential policyholders. The independent agent possesses the authority to solicit, negotiate, and bind policies on behalf of the insurance company, adhering to applicable laws and regulations. The agreement outlines the specific duties and responsibilities of both parties. The general agent is responsible for providing the necessary training and support to the independent agent, equipping them with the knowledge and tools required to effectively sell insurance products. The general agent also offers ongoing guidance and assistance to ensure compliance with the insurance company's policies and procedures. On the other hand, the independent agent is responsible for diligently promoting the insurance company's products and services in Montgomery County. They must possess in-depth knowledge of the insurance industry, products, and pricing, and offer professional advice to potential policyholders. Additionally, the independent agent must ensure accurate completion of applications, collect premiums, and handle claim-related matters within the guidelines specified by the insurance company. In Montgomery County, there are variations of contracts between a General Agent of an Insurance Company and an Independent Agent based on the specific nature of policies and agreements. These may include: 1. Life Insurance Contract: Pertaining to policies related to life insurance, including term life, whole life, and universal life insurance. 2. Health Insurance Contract: Focusing on health-related policies, such as individual health insurance, group health insurance, and Medicare plans. 3. Property and Casualty Insurance Contract: Covering policies related to property insurance (homeowners, renters, and commercial property) and casualty insurance (auto, liability, and workers' compensation). Overall, the Montgomery, Maryland Contract between a General Agent of an Insurance Company and an Independent Agent serves as a foundation for a successful partnership, ensuring that insurance products are efficiently and ethically marketed and accessible to residents of Montgomery County, Maryland.

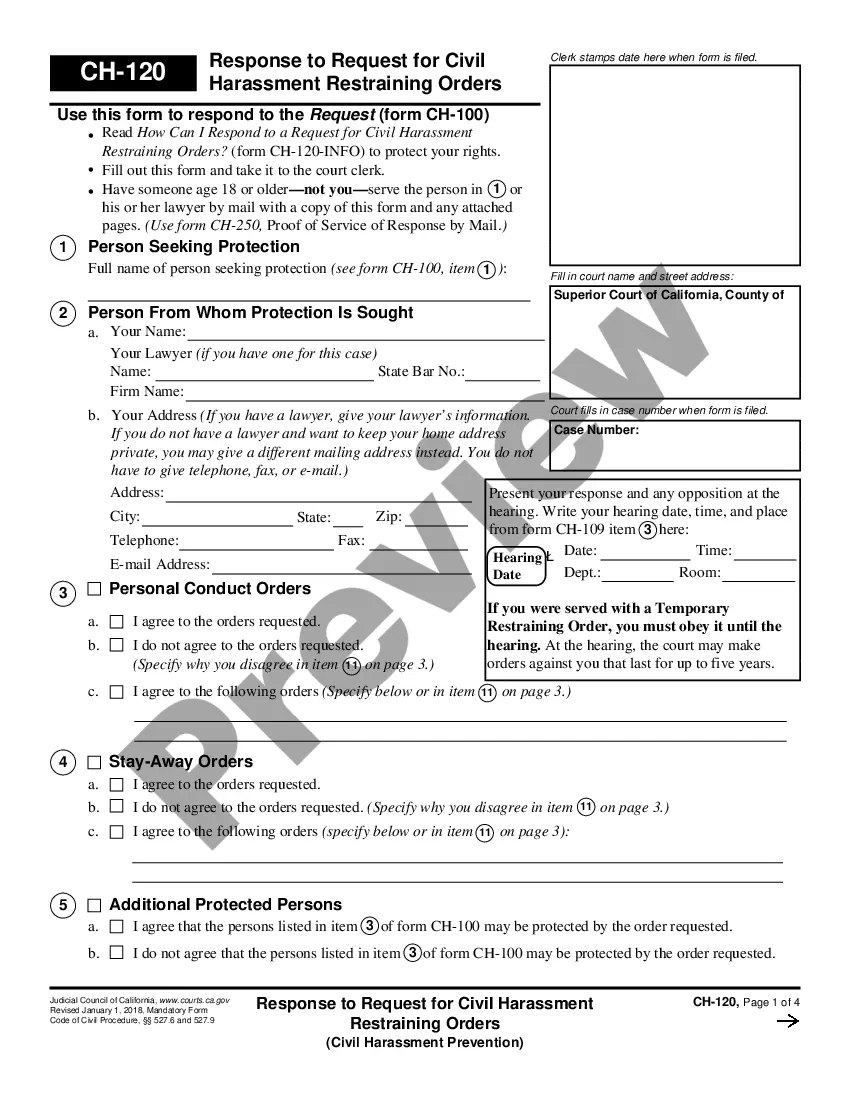

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.