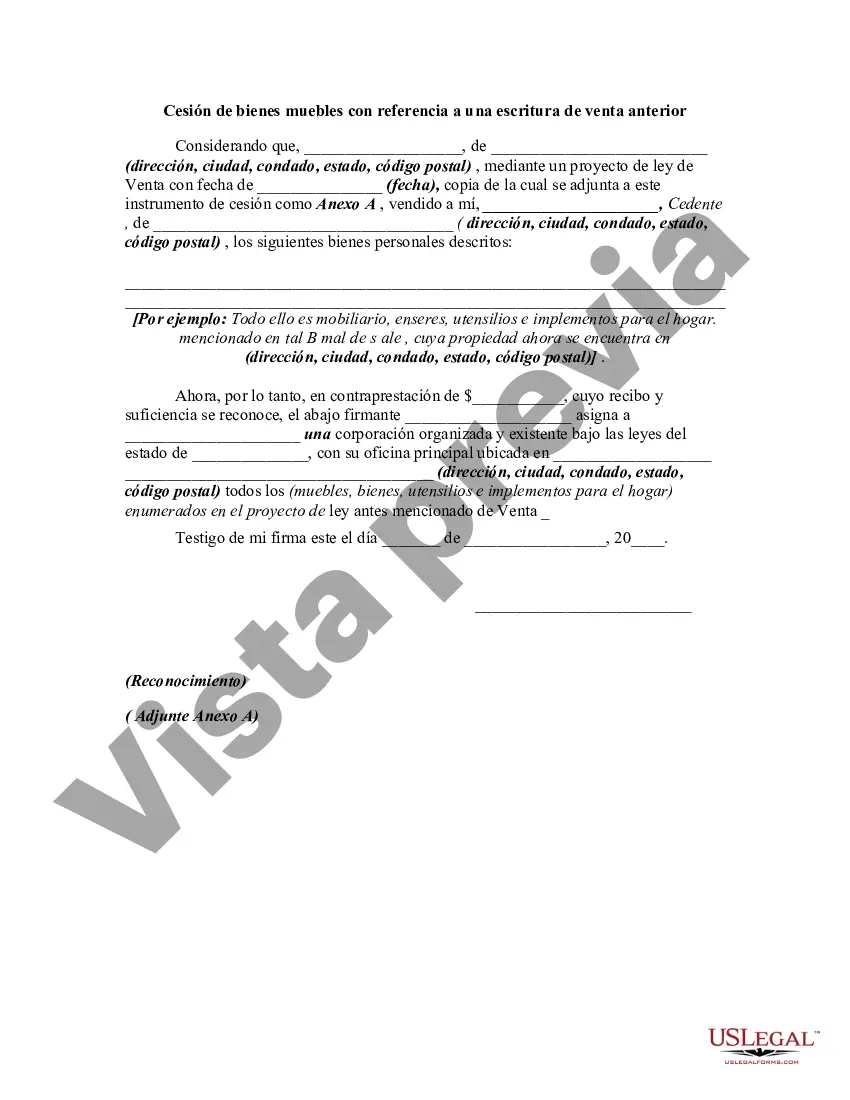

Collin, Texas Assignment of Personal Property with Reference to Former Bill of Sale: A Comprehensive Overview In Collin, Texas, an Assignment of Personal Property with Reference to a Former Bill of Sale is a legal document used to transfer ownership of personal property from one party to another. This detailed description aims to provide you with an in-depth understanding of this type of assignment, its purpose, and the different variations it may have. The Purpose of Collin, Texas Assignment of Personal Property with Reference to Former Bill of Sale: The primary purpose of this assignment is to legally document the transfer of personal property ownership rights in Collin, Texas. By referencing a former bill of sale, the assignment establishes a clear chain of ownership and ensures that the new owner acquires all rights, title, and interest in the property. Key Components of Collin, Texas Assignment of Personal Property: 1. Parties Involved: The assignment identifies the parties involved, including the assignor (current owner) and the assignee (new owner). 2. Description of Property: The document must provide a detailed description of the personal property being assigned. This description typically includes identifying features, such as serial numbers, make, model, and any other relevant information necessary for accurate identification. 3. Former Bill of Sale Reference: The assignment directly references a previous bill of sale that served as the initial transfer of the property. This reference establishes a clear link between the current assignment and the original transaction. 4. Assignment Clause: This clause explicitly states that the assignor transfers all rights, title, and interest in the personal property to the assignee. It also includes language to ensure that the assignment is legally binding and enforceable. Types of Collin, Texas Assignment of Personal Property with Reference to Former Bill of Sale: While the basic components mentioned above apply to all Collin, Texas Assignment of Personal Property with Reference to a Former Bill of Sale, there can be slight variations depending on the specific circumstances. Some common types include: 1. Collateral Assignment: This type of assignment involves using personal property as collateral for a loan or debt. The assignor uses the property as security, and in case of non-payment or default, the assignee has the right to take possession of the property to satisfy the debt. 2. Business Asset Assignment: In this type of assignment, personal property that is used in the operation of a business is transferred from one party to another. This can include machinery, equipment, vehicles, or any other assets necessary for the business's operation. 3. Intangible Asset Assignment: While most assignments deal with tangible personal property, there can be instances where intangible assets, such as intellectual property rights, patents, or copyrights, are assigned. These assignments require additional legal considerations and documentation. In conclusion, a Collin, Texas Assignment of Personal Property with Reference to Former Bill of Sale is a crucial legal document that facilitates the transfer of personal property ownership rights in the region. It ensures a transparent chain of ownership and protects the rights and interests of both the assignor and the assignee. Different variations of this assignment may exist, such as collateral assignment, business asset assignment, and intangible asset assignment, each tailored to specific circumstances and asset types.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Cesión de bienes muebles con referencia a una escritura de venta anterior - Assignment of Personal Property with Reference to Former Bill of Sale

Description

How to fill out Collin Texas Cesión De Bienes Muebles Con Referencia A Una Escritura De Venta Anterior?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official paperwork that differs throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business objective utilized in your region, including the Collin Assignment of Personal Property with Reference to Former Bill of Sale.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Collin Assignment of Personal Property with Reference to Former Bill of Sale will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Collin Assignment of Personal Property with Reference to Former Bill of Sale:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Collin Assignment of Personal Property with Reference to Former Bill of Sale on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

Si la persona muere sin conyuge y sin hijos, lo mas probable es que la herencia pase a sus padres si todavia viven. Si no hay padres a quien heredar. Entonces la propiedad podria ir a manos de sus hermanos, y si no hay hermanos, el patrimonio se destinaria a los abuelos, o tios, o primos cercanos.

El proceso debe llevarse a cabo por medio de un notario publico y firmando un contrato de compraventa. El inmueble debe encontrarse en buenas condiciones. En caso de no estarlo, el comprador debe estar de acuerdo con esta situacion. El vendedor debe entregar las escrituras de la propiedad al comprador.

Por lo general, se entiende que un testamento sigue siendo valido sin importar el tiempo que pase excepto en dos casos: cuando el testador lo revoca tacita o expresamente y cuando el documento no cumple con los requisitos legales necesarios, provocando su nulidad.

- La transferencia de la propiedad de una cosa mueble determinada se efectua con la tradicion a su acreedor, salvo dispo- sicion legal diferente. Art. 949. - La sola obligacion de enajenar un inmueble determinado hace al acreedor propietario de el, salvo disposicion legal diferente o pacto en contrario.

- La transferencia de la propiedad de una cosa mueble determinada se efectua con la tradicion a su acreedor, salvo dispo- sicion legal diferente. Art. 949. - La sola obligacion de enajenar un inmueble determinado hace al acreedor propietario de el, salvo disposicion legal diferente o pacto en contrario.

En la venta, por ejemplo, el dueno traslada o transfiere el dominio al comprador, y para efectuar la tradicion es suficiente con la entrega material de la cosa comprada para el caso de los muebles, y en el caso de los inmuebles, la inscripcion en la oficina de registro de instrumentos publicos como se ha indicado

El porcentaje de herencia de conyuge e hijos cuando hay testamento sera del 66,6% de la herencia para los descendientes en propiedad pero con un 33,3% de usufructo para el viudo o viuda. En cualquier caso, este usufructo es lo que en derecho se denomina conmutable.

La propiedad de un mueble se acredita con las facturas expedidas conforme a las disposiciones fiscales o contratos privados con los requisitos de validez.

El fallecimiento de una de las personas que aparecen en la escritura, no significa que la (s) otra (s) persona (s) que tambien figura(n), automatica y directamente, se convierta(n) en dueno(a), aunque hayan sido pareja. Primero habra que ver si quien fallecio, dejo un testamento, para saber si designo herederos.

Si el cambio de titular es por fallecimiento Acta de defuncion del actual titular. Identificacion oficial del nuevo titular y de la persona fallecida. Copia de identificacion del nuevo titular. Solicitud por escrito del nuevo titular en el cual se explique los motivos del cambio. Codigo universal del punto de suministro.

More info

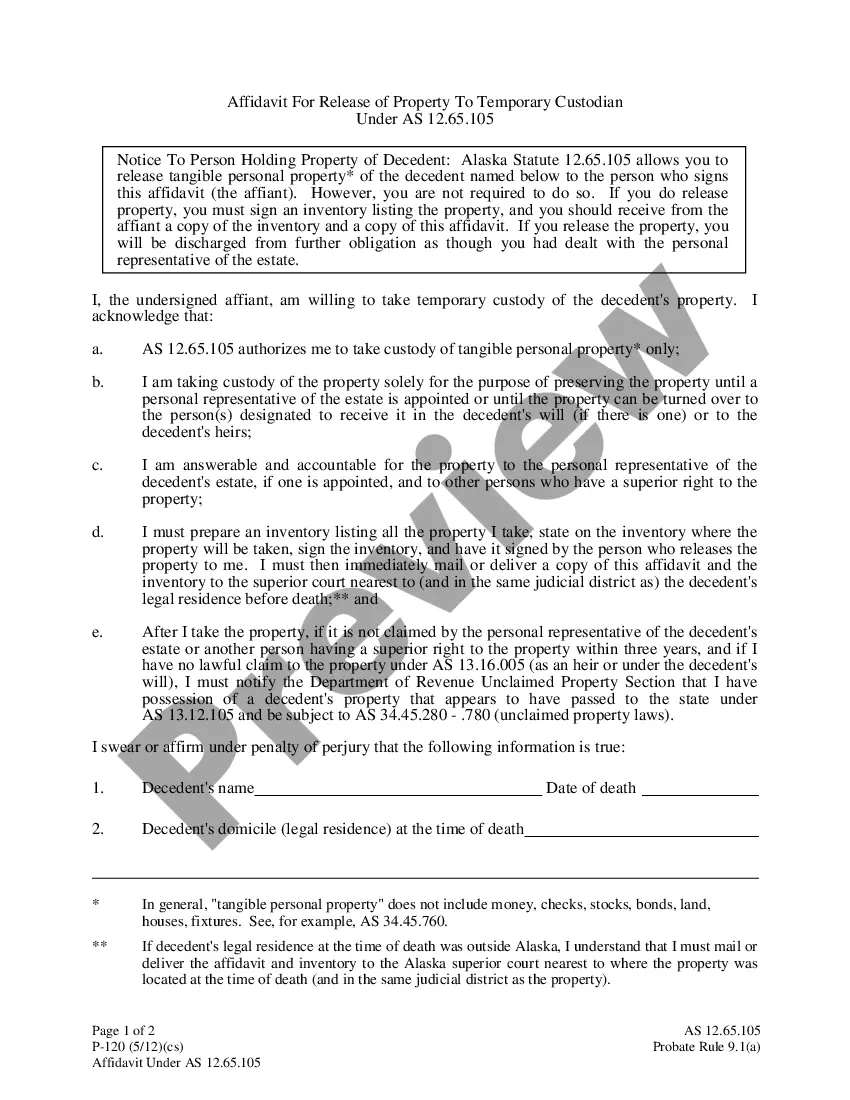

80.) Affidavit of Motor Vehicle Gift Transfer. Student residents in the spirit of these laws. Texas is among seven states in the US where it does not collect personal income taxes. State of Minnesota Answered Minnesota state statutes allow deductions up to 100 from each year's taxable income. However, in order to take advantage, you must have a minimum number of taxable years remaining to reach the threshold. The deduction is subject to the maximum allowable amount, 250,000 a year. These are the same as the Minnesota state income taxes. Income taxes include general state revenues and municipal fees (such as property taxes, water tax, sewer taxes, etc.). Property taxes that you receive from any one of these sources, like a home or a business, are separate from general state revenues. You normally do not pay the two taxes at the same time as a single tax.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.