A Stock Sale and Purchase Agreement, also known as an Acquisition Agreement or Share Purchase Agreement, is a legal document that outlines the terms and conditions for the sale and purchase of stock in a company. In the context of Phoenix, Arizona, there are various types of Stock Sale and Purchase Agreements — Long Form, each designed to cater to specific needs and circumstances. Here, we will provide a detailed description of what a typical Phoenix Arizona Stock Sale and Purchase Agreement — Long Form entails. The Phoenix Arizona Stock Sale and Purchase Agreement — Long Form is a comprehensive and extensive legal contract that governs the sale and purchase of stock in a company located within the Phoenix, Arizona area. This agreement serves as a vital tool for both buyers and sellers to protect their interests and ensure a smooth and fair transaction. Key components featured in a typical Phoenix Arizona Stock Sale and Purchase Agreement — Long Form include: 1. Parties involved: The agreement begins by clearly identifying the parties involved in the transaction. This includes the buyer(s) and seller(s) by their legal names and addresses. 2. Purchase and Sale Terms: The agreement outlines the details of the stock being sold, including the number of shares, the price per share, and the total purchase price. It also specifies whether the transaction is for a majority or minority stake in the company. 3. Representations and Warranties: Both the buyer and the seller are required to make certain representations and warranties regarding the stock being sold. This section provides assurances to both parties about the accuracy and authenticity of the stock, financial statements, and other vital information. 4. Due Diligence: The agreement may require the seller to provide access to their books, records, and any other necessary documents to allow the buyer to conduct due diligence on the company. 5. Conditions Precedent: This section outlines the conditions that must be met before the sale can be completed. These conditions may include obtaining necessary approvals, consents, and waivers, as well as compliance with all legal and regulatory requirements. 6. Covenants: The agreement includes various covenants that both parties must abide by during the transaction. These covenants may include non-compete clauses, non-solicitation of employees or customers, confidentiality provisions, and cooperation in obtaining necessary third-party consents. 7. Closing and Post-Closing: The agreement specifies the date and location of the closing, where the parties sign the necessary documents and exchange payment and stock certificates. It also includes provisions for any post-closing adjustments, indemnification, and dispute resolution mechanisms. Different variations or types of Phoenix Arizona Stock Sale and Purchase Agreement — Long Form may exist to cater to specific needs in various industries or for unique circumstances. These may include agreements tailored for the sale and purchase of stock in startups, multinational corporations, privately-held businesses, or distressed companies, among others. However, the fundamental principles and key components of such agreements typically remain consistent, with variations specific to each business scenario. In conclusion, a Phoenix Arizona Stock Sale and Purchase Agreement — Long Form is a critical legal document that sets out the terms and conditions for the sale and purchase of stock in a company based in Phoenix, Arizona. It is designed to provide clarity, protection, and ensure a fair transaction between the buyer and the seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Contrato de compraventa de acciones - Formato largo - Stock Sale and Purchase Agreement - Long Form

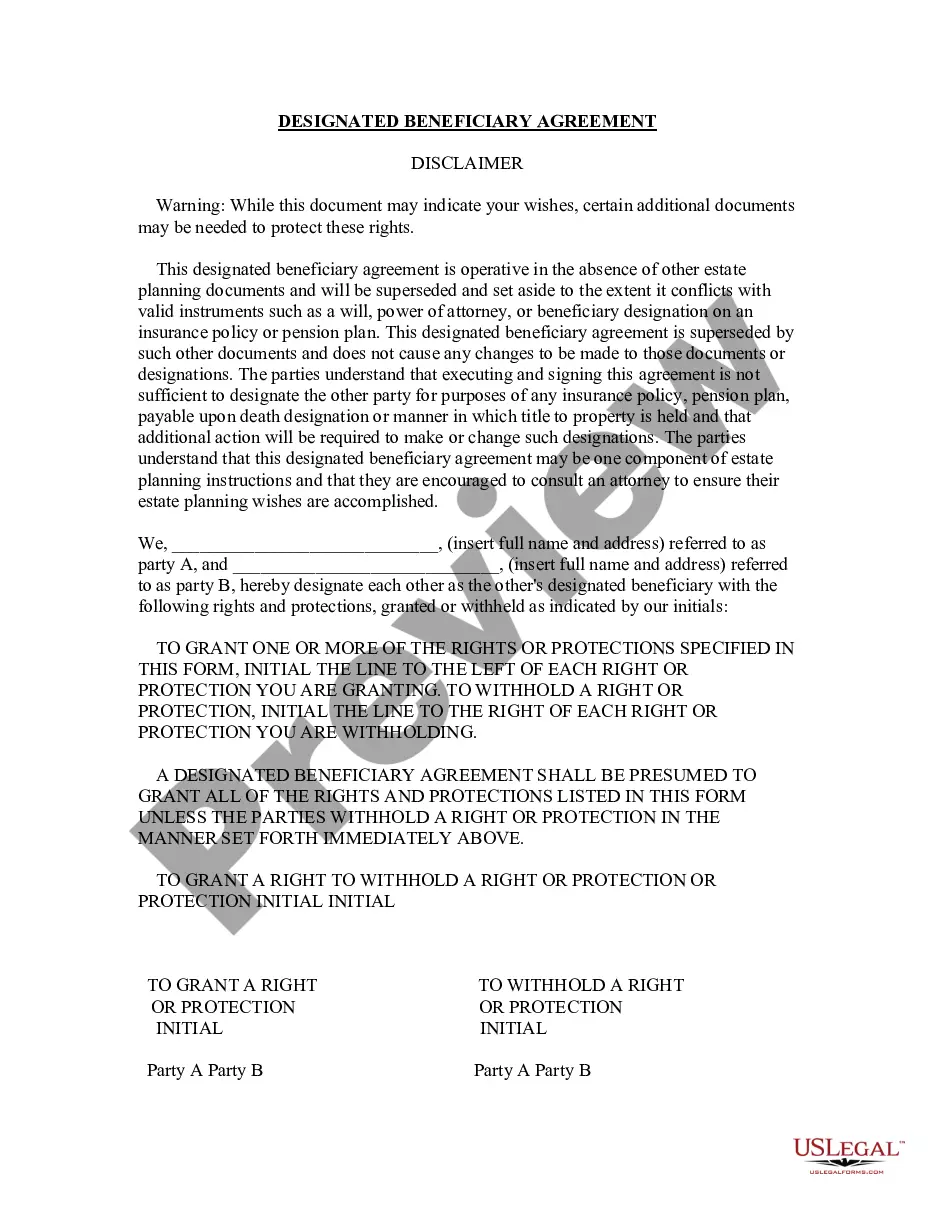

Description

How to fill out Phoenix Arizona Contrato De Compraventa De Acciones - Formato Largo?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Phoenix Stock Sale and Purchase Agreement - Long Form without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Phoenix Stock Sale and Purchase Agreement - Long Form on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, follow the step-by-step guideline below to get the Phoenix Stock Sale and Purchase Agreement - Long Form:

- Look through the page you've opened and check if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that fits your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any use case with just a few clicks!