The Clark Nevada Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a legal document that outlines the terms and conditions of a business sale transaction where the seller, who is a sole proprietor, agrees to finance a portion of the purchase price for the buyer. This agreement is specific to the state of Nevada, particularly Clark County. In this agreement, the seller and buyer enter into a contractual arrangement that details various aspects of the sale, such as the purchase price, payment terms, and financing arrangement. The agreement serves as a legally binding contract that outlines the rights and obligations of both parties involved. The Clark Nevada Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price typically includes the following key provisions: 1. Parties Involved: Clearly identifies the seller, who is the sole proprietor of the business, and the buyer who intends to acquire the business. 2. Sales Price and Payment Terms: Specifies the total purchase price of the business and the amount that the buyer will pay upfront. It also outlines the financing arrangement, including the amount to be financed by the seller and the terms of repayment. 3. Assets Included: Lists all assets included in the sale, such as inventory, equipment, trademarks, and customer lists. 4. Liabilities: Specifies which liabilities, if any, will be assumed by the buyer, and which will remain the responsibility of the seller. 5. Purchase Price Adjustment: Outlines any adjustments to the purchase price, such as a reduction in price if certain conditions are not met or financial discrepancies arise during the due diligence process. 6. Representations and Warranties: States that all information provided by the seller regarding the business is accurate and complete, protecting the buyer from any misrepresentation or fraud. 7. Closing Date and Conditions: Specifies the date by which the transaction should be completed and any conditions required for the closing of the sale. 8. Default and Remedies: Outlines the consequences of default by either party and the available remedies, such as specific performance or monetary damages. 9. Governing Law and Jurisdiction: Indicates the jurisdiction and laws that will govern any disputes arising from the agreement. 10. Signatures: The agreement must be signed by both the seller and the buyer to be legally enforceable. Different types of Clark Nevada Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price could include variations based on specific industry or business type, additional clauses regarding non-competition agreements, seller financing terms, or unique circumstances that may require additional provisions to protect the interests of both parties. In summary, the Clark Nevada Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a comprehensive legal document that governs the sale of a business by a sole proprietor, with the seller financing a portion of the purchase price. This agreement protects the rights and interests of both parties involved and ensures a smooth and legally compliant transaction.

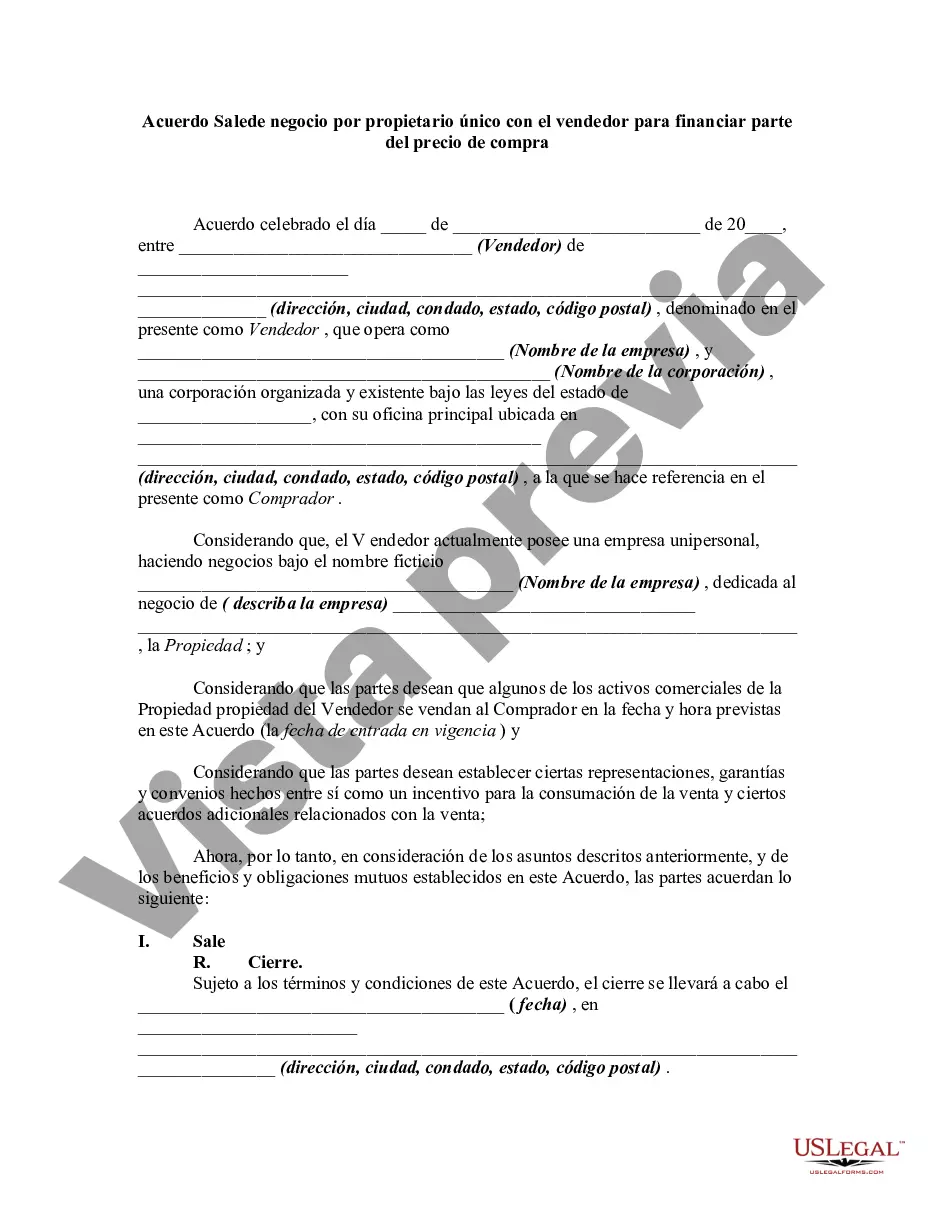

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Acuerdo de Venta de Negocio por Propietario Único con el Vendedor para Financiar Parte del Precio de Compra - Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Clark Nevada Acuerdo De Venta De Negocio Por Propietario Único Con El Vendedor Para Financiar Parte Del Precio De Compra?

How much time does it normally take you to draft a legal document? Given that every state has its laws and regulations for every life situation, locating a Clark Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price suiting all regional requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, gathered by states and areas of use. Aside from the Clark Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price, here you can get any specific document to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the file in your profile at any time in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Clark Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Clark Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!