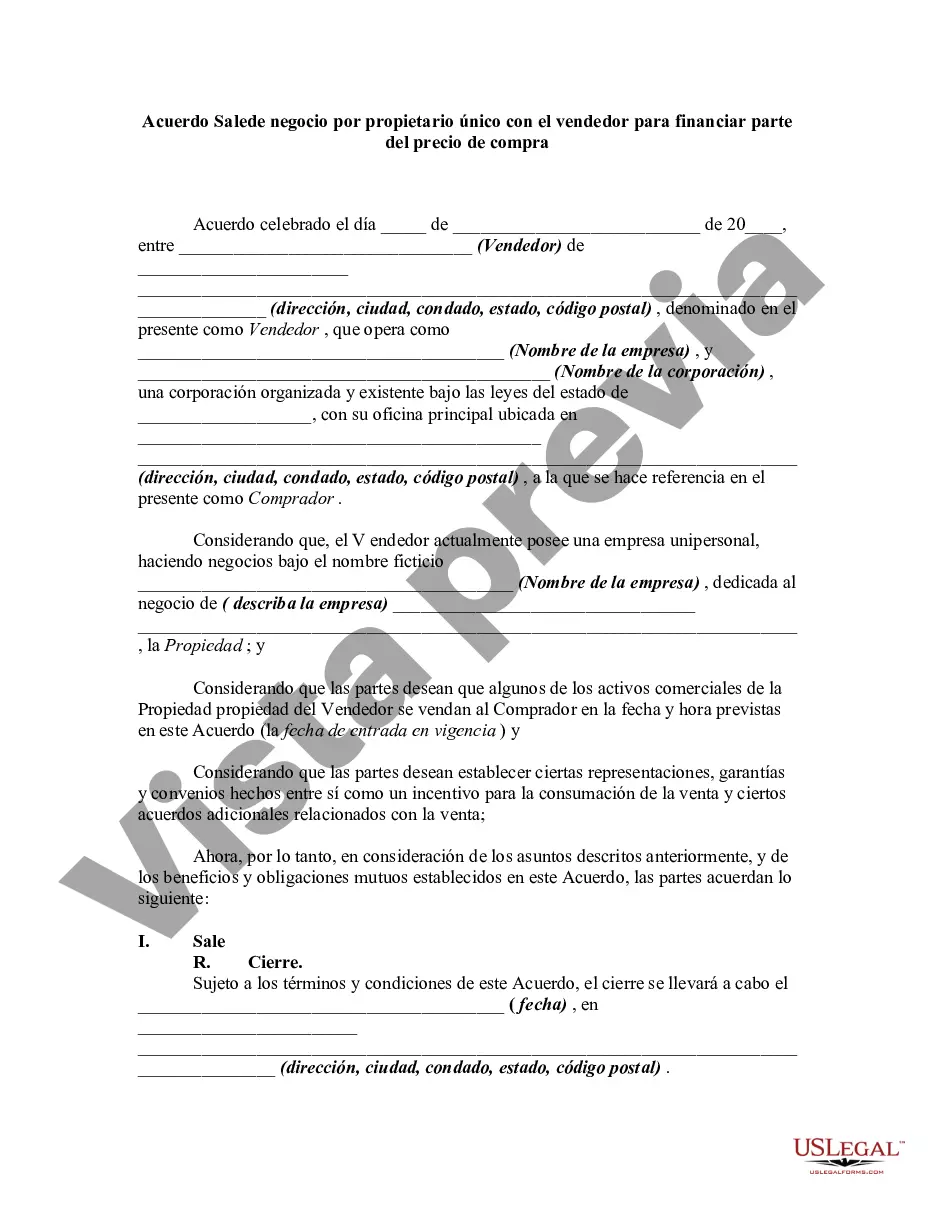

Dallas Texas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a legally binding contract that outlines the terms and conditions for the sale of a business by a sole proprietorship in Dallas, Texas. This agreement specifically includes provisions for the seller to finance a portion of the purchase price, allowing the buyer to pay in installments rather than upfront. The main objective of this agreement is to protect the interests of both parties involved in the sale. It provides a comprehensive framework for documenting essential details such as the purchase price, payment terms, assets involved, liabilities, warranties, and other involved parties. Moreover, it clearly outlines the responsibilities and obligations of the buyer and seller, ensuring a smooth and transparent transaction. The Dallas Texas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price can be tailored to meet the unique needs of different industries and types of businesses. Some examples include: 1. Retail Business Agreement: This type of agreement is specifically designed for the sale of retail businesses, such as convenience stores, boutiques, or specialty shops, where the seller offers financing options to the buyer. 2. Restaurant Business Agreement: This variant of the agreement caters to the sale of restaurant businesses, encompassing details such as fixtures, kitchen equipment, recipes, licenses, and other important aspects of the food service industry. 3. Service-Based Business Agreement: This agreement is suitable for businesses that provide services, such as consulting firms, hair salons, or repair shops. It covers aspects unique to service-based industries, including client lists, intellectual property rights, and non-compete clauses. 4. Manufacturing Business Agreement: This type of agreement is tailored for the sale of manufacturing businesses, addressing matters such as equipment, inventory, production processes, patents, and warranties. Regardless of the specific type of business being sold, the Dallas Texas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price should include provisions ensuring confidentiality, dispute resolution procedures, and legal compliance with local and federal regulations. The agreement is crucial for both buyers and sellers as it establishes a legally enforceable document that protects their rights and interests throughout the sale process. A thorough and detailed agreement minimizes the potential for disputes or misunderstandings, providing a solid foundation for a successful business sale.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Acuerdo de Venta de Negocio por Propietario Único con el Vendedor para Financiar Parte del Precio de Compra - Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Dallas Texas Acuerdo De Venta De Negocio Por Propietario Único Con El Vendedor Para Financiar Parte Del Precio De Compra?

Are you looking to quickly draft a legally-binding Dallas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price or probably any other form to handle your personal or corporate affairs? You can select one of the two options: contact a professional to write a valid paper for you or create it completely on your own. Luckily, there's another option - US Legal Forms. It will help you get professionally written legal papers without having to pay sky-high prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant form templates, including Dallas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price and form packages. We offer templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, carefully verify if the Dallas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is tailored to your state's or county's laws.

- If the document includes a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were looking for by using the search box in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Dallas Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to buy and download legal forms if you use our catalog. Additionally, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!