The Kings New York Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is a legally binding document that outlines the terms and conditions for the sale of a business by a sole proprietorship. This agreement is specifically designed to include provisions for the seller to finance a portion of the purchase price. In this agreement, the seller, who is the sole proprietor of the business, agrees to sell the business to the buyer in exchange for a specified purchase price. However, instead of requiring the buyer to pay the entire purchase price upfront, the seller agrees to finance a portion of the price. The agreement includes detailed information about the business being sold, such as its name, location, and any assets or liabilities associated with it. It also outlines the terms of the seller financing, including the amount being financed, the interest rate, and the repayment schedule. The purpose of this agreement is to provide a flexible and mutually beneficial arrangement for both the seller and the buyer. The seller can benefit from receiving a steady stream of income through the financed portion of the purchase price, while the buyer can acquire the business they desire without having to secure traditional financing from a bank or other financial institution. Types of Kings New York Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price may include: 1. Asset Purchase Agreement: This type of agreement focuses on the sale and transfer of specific assets of the business, such as equipment, inventory, and intellectual property rights. 2. Stock Purchase Agreement: In this agreement, the buyer acquires the business by purchasing the seller's shares or stocks. This type of agreement is commonly used for businesses organized as corporations. 3. Goodwill Purchase Agreement: This agreement specifically addresses the sale of intangible assets associated with the business, such as its reputation, customer base, and brand value. 4. Business Merger Agreement: This type of agreement occurs when two businesses combine their operations to form a new entity. The agreement outlines the terms and conditions of the merger, including the financing arrangements. Overall, the Kings New York Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price provides a comprehensive framework for the successful sale of a business, allowing both parties to achieve their desired outcomes.

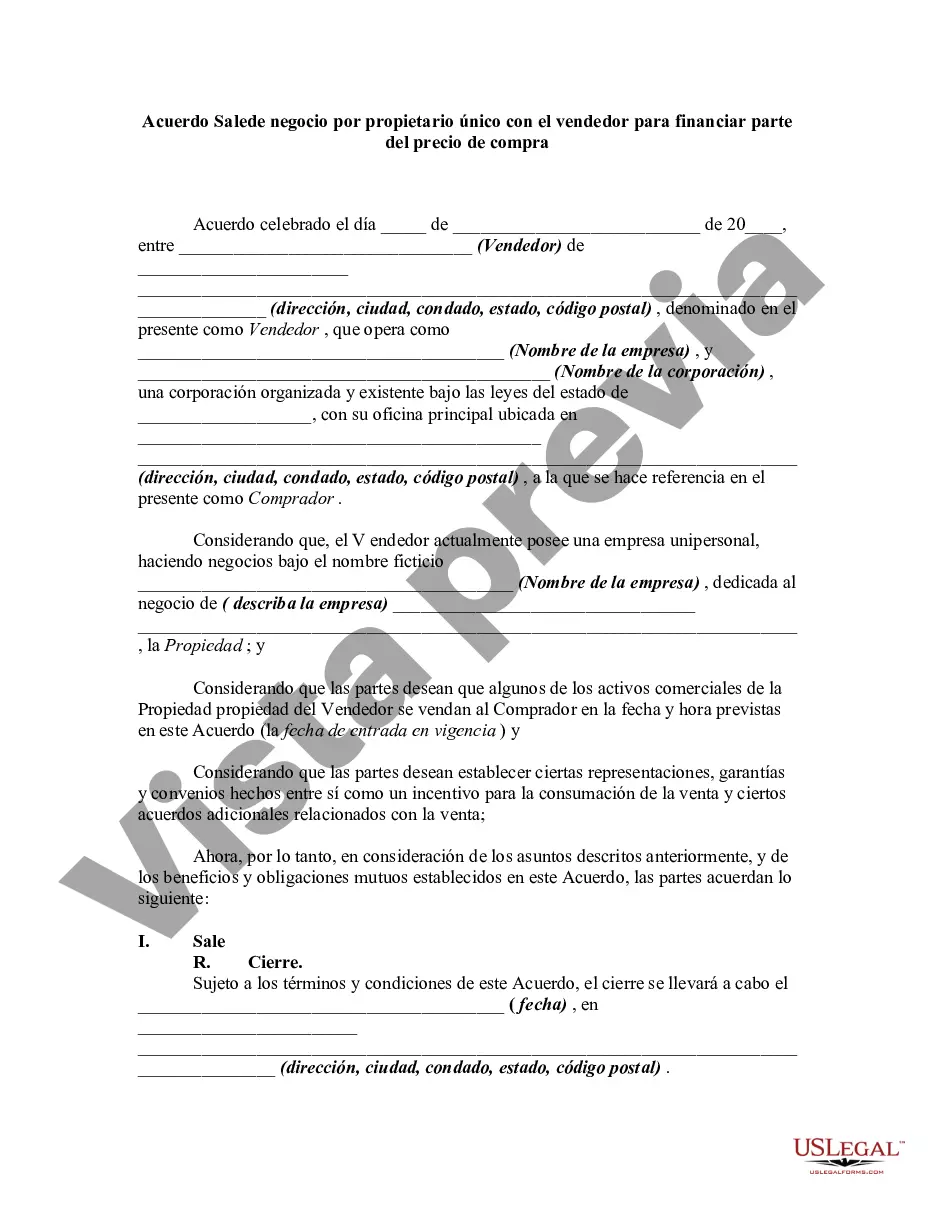

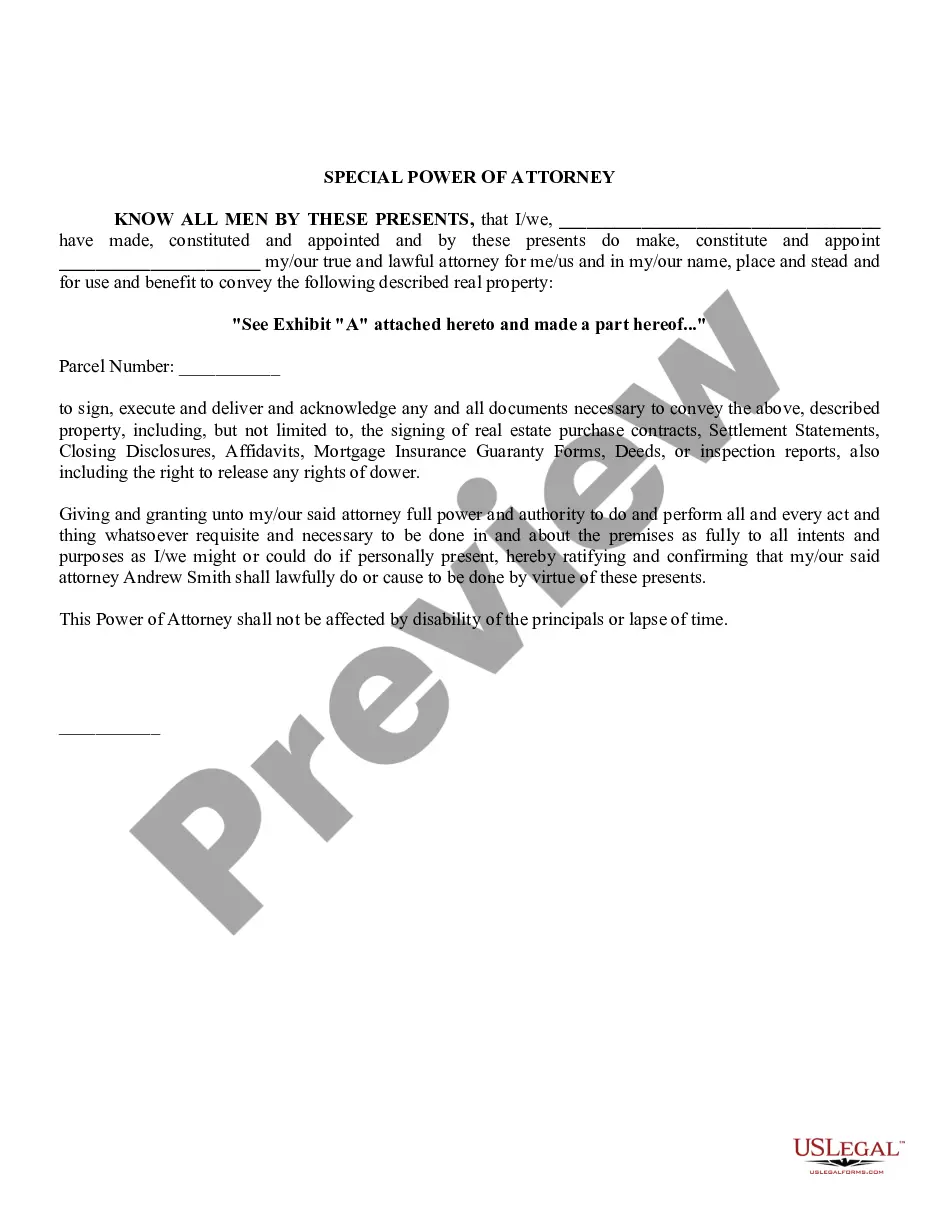

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Acuerdo de Venta de Negocio por Propietario Único con el Vendedor para Financiar Parte del Precio de Compra - Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price

Description

How to fill out Kings New York Acuerdo De Venta De Negocio Por Propietario Único Con El Vendedor Para Financiar Parte Del Precio De Compra?

Whether you plan to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal templates for any individual or business occasion. All files are grouped by state and area of use, so opting for a copy like Kings Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Kings Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price. Adhere to the guide below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Select the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Kings Agreement for Sale of Business by Sole Proprietorship with Seller to Finance Part of Purchase Price in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our website are reusable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!