Fulton Georgia Revocable Trust Agreement Granteror as Beneficiary is a legal document that establishes a trust, allowing the granter (the person creating the trust) to name themselves as the primary beneficiary. This type of trust provides flexibility and the ability to manage assets while ensuring their own financial security. With the Fulton Georgia Revocable Trust Agreement Granteror as Beneficiary, the grantor has the authority to make changes or even revoke the trust entirely. There are several types or variations within the Fulton Georgia Revocable Trust Agreement Granteror as Beneficiary, including: 1. Fulton Georgia Living Revocable Trust Agreement Granteror as Beneficiary: This particular trust is designed to manage the granter's assets during their lifetime, ensuring their financial security and allowing for the smooth transfer of assets to beneficiaries upon their passing. 2. Fulton Georgia Irrevocable Revocable Trust Agreement Granteror as Beneficiary: Unlike the living revocable trust, this type cannot be easily modified or revoked. It offers additional asset protection and often has specific tax planning advantages. 3. Fulton Georgia Family Revocable Trust Agreement Granteror as Beneficiary: This trust is ideal for individuals who wish to transfer assets to multiple family members or beneficiaries while retaining control during their lifetime. It provides a way to avoid probate, minimize estate taxes, and ensure a smooth distribution of assets. 4. Fulton Georgia Testamentary Revocable Trust Agreement Granteror as Beneficiary: This trust is established through a will and becomes effective only upon the granter's passing. It provides an opportunity for the granter to dictate specific instructions on the distribution of assets, taking into consideration the needs and well-being of their loved ones. In conclusion, the Fulton Georgia Revocable Trust Agreement Granteror as Beneficiary is a versatile legal tool that offers granters the ability to manage assets while providing for their own financial security. With different variations available, individuals can choose the type of trust that best aligns with their specific needs and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fulton Georgia Contrato de Fideicomiso Revocable - Otorgante como Beneficiario - Revocable Trust Agreement - Grantor as Beneficiary

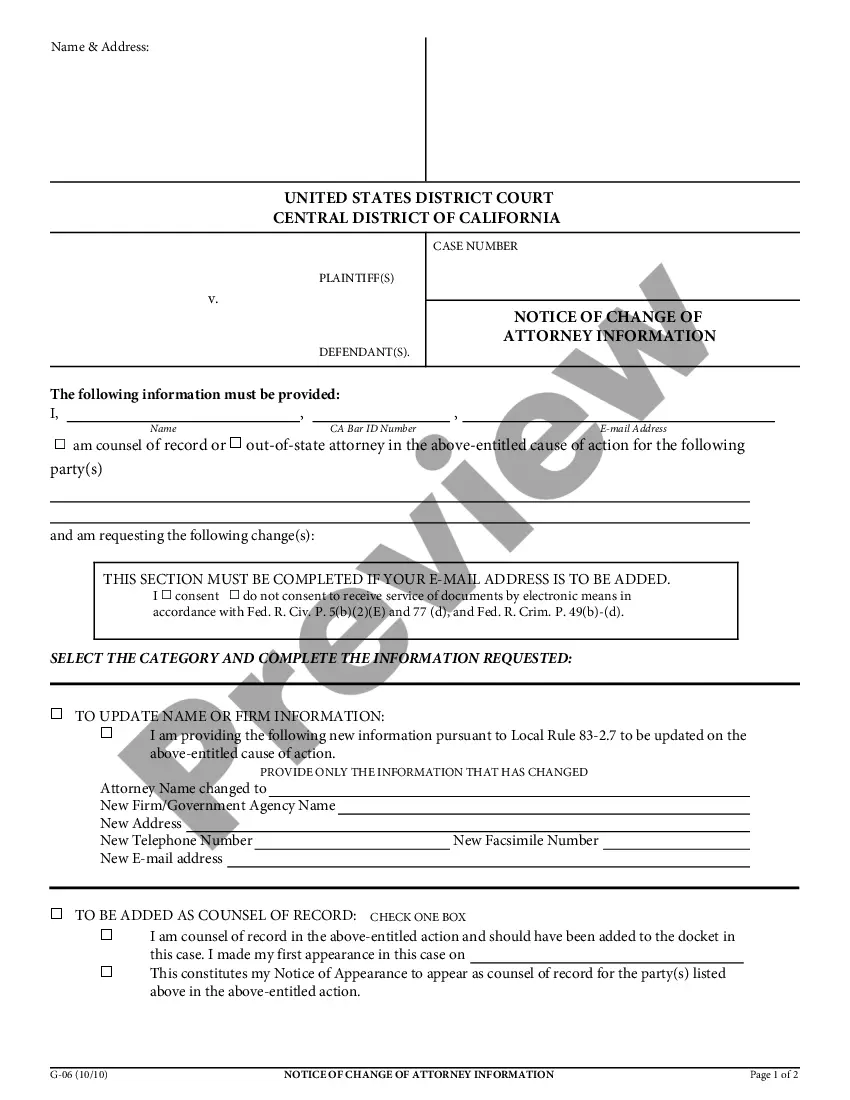

Description

How to fill out Fulton Georgia Contrato De Fideicomiso Revocable - Otorgante Como Beneficiario?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Fulton Revocable Trust Agreement - Grantor as Beneficiary.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Fulton Revocable Trust Agreement - Grantor as Beneficiary will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to obtain the Fulton Revocable Trust Agreement - Grantor as Beneficiary:

- Ensure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Fulton Revocable Trust Agreement - Grantor as Beneficiary on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!