A Santa Clara California Revocable Trust Agreement Granteror as Beneficiary, also known as a Living Trust or Inter Vivos Trust, is a legal document that outlines how a person's assets and property will be managed and distributed during their lifetime and after their death. This particular type of trust designates the granter (the person creating the trust) as the beneficiary, meaning they receive the benefits and control over the trust assets. The Santa Clara California Revocable Trust Agreement Granteror as Beneficiary provides several advantages and flexibility to the granter. Firstly, as the granter maintains full control over the trust assets, they can make changes or revoke the trust entirely at any time during their lifetime if their circumstances or wishes change. Additionally, by naming themselves as the beneficiary, the granter ensures that they can continue to use and enjoy the trust assets while alive, dictating how they are managed and distributed after their death. In Santa Clara California, there are various types of Revocable Trust Agreements with the granter as beneficiary, including: 1. Individual Revocable Trust Agreement Granteror as Beneficiary: This is the most common type of trust, where an individual creates a trust to hold their assets and designates themselves as the primary beneficiary. 2. Joint Revocable Trust Agreement Granteror and Spouse as Beneficiaries: Married couples often opt for this type of trust, where both spouses are named as beneficiaries. It allows them to jointly manage and control their assets and provides for an efficient transfer of assets after the death of one spouse. 3. Family Revocable Trust Agreement Granteror and Family Members as Beneficiaries: This trust type extends the beneficiary designation beyond the granter and includes family members, such as children or grandchildren. It allows for seamless wealth transfer while providing continued control and protection of assets. The Santa Clara California Revocable Trust Agreement Granteror as Beneficiary is a valuable estate planning tool as it offers flexibility, asset protection, and privacy. It helps to avoid the probate process, minimizes estate taxes, and ensures the granter's wishes are carried out effectively. It is essential to seek professional legal advice when creating a trust agreement to ensure compliance with relevant laws and to address specific needs and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Contrato de Fideicomiso Revocable - Otorgante como Beneficiario - Revocable Trust Agreement - Grantor as Beneficiary

Description

How to fill out Santa Clara California Contrato De Fideicomiso Revocable - Otorgante Como Beneficiario?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Santa Clara Revocable Trust Agreement - Grantor as Beneficiary, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Santa Clara Revocable Trust Agreement - Grantor as Beneficiary from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Santa Clara Revocable Trust Agreement - Grantor as Beneficiary:

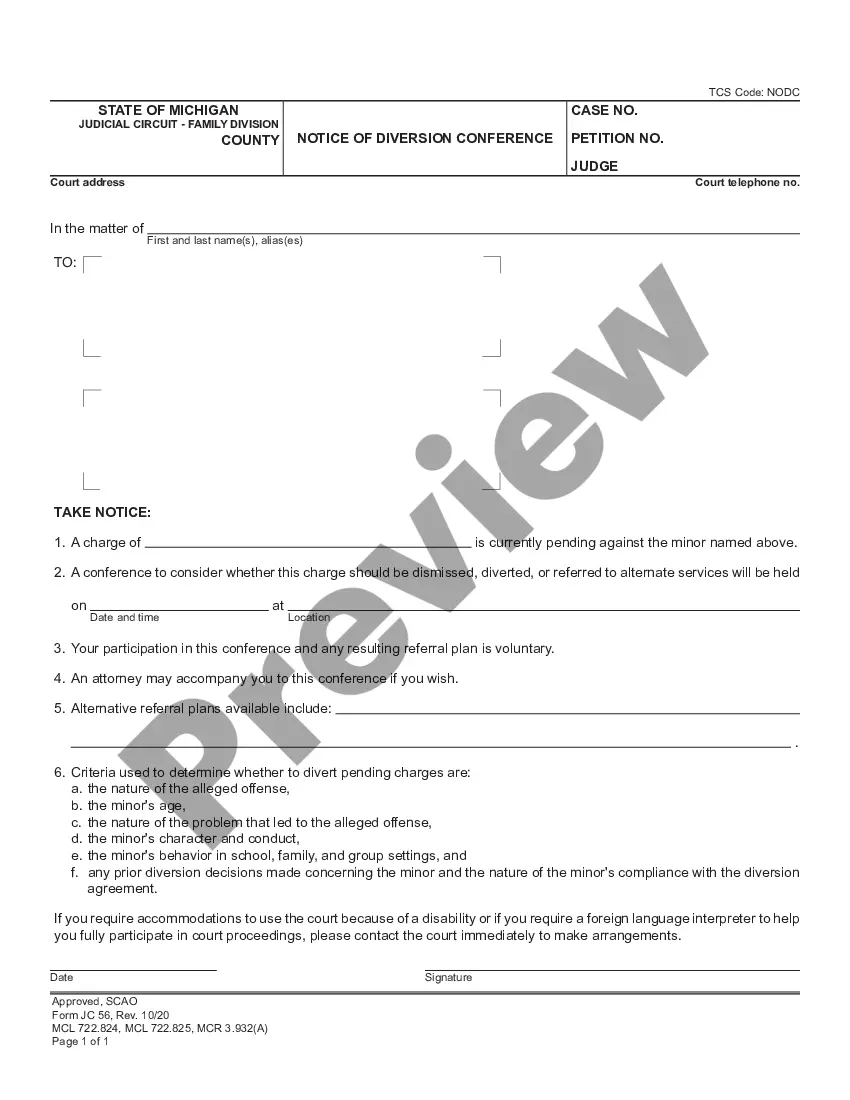

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!