The Cook Illinois Agreement for Sale of Liquor Store Business, including Liquor License, is a legally binding contract that outlines the terms and conditions of selling a liquor store business in Cook County, Illinois. This agreement is essential to protect both the buyer and the seller, ensuring a smooth and transparent transaction. Keywords: Cook Illinois, Agreement for Sale, Liquor Store Business, Liquor License, terms and conditions, buyer, seller, transaction. The agreement typically includes the following key elements: 1. Parties involved: This section identifies the buyer and seller of the liquor store business, providing their complete legal names and contact information. 2. Business description: This section provides a detailed description of the liquor store business being sold, including its name, address, equipment, inventory, and any other assets included in the sale. It may also mention the store's current licenses and permits. 3. Purchase price and payment terms: The agreement specifies the agreed-upon purchase price for the liquor store business. It may outline the payment structure, including down payment, installment options, or lump sum payment, as well as any financing arrangements or loans involved. 4. Inventory valuation: In cases where inventory is included in the sale, this section may outline how the inventory will be valued, calculated, and adjusted at the time of closing the sale. 5. Assets and liabilities: The agreement may state which specific assets are included in the sale, such as fixtures, equipment, furnishings, and licenses. It also typically addresses the allocation of liabilities, making sure the buyer assumes responsibility for any outstanding debts or obligations. 6. Liquor license transfer: This crucial section addresses the liquor license transfer process. It includes steps to obtain necessary approvals from the appropriate licensing authority, ensuring legal compliance and a seamless transition of the liquor license to the buyer. 7. Representations and warranties: Both parties make certain representations and warranties about the business. The seller typically guarantees that all information provided is accurate, while the buyer assures that they are entering into the agreement in good faith and have the necessary funds to complete the purchase. 8. Closing and possession: This section outlines the closing date, at which point ownership and possession of the liquor store business will transfer to the buyer. It details the necessary documentation and actions to be taken by both parties before the closing. Different types of Cook Illinois Agreement for Sale of Liquor Store Business, including Liquor License, may arise based on specific circumstances, such as: 1. Asset Purchase Agreement: Focuses primarily on the sale and transfer of specific assets of the liquor store business, including inventory, fixtures, and licenses. 2. Stock Purchase Agreement: Involves the sale and transfer of shares or stocks of the liquor store business, where the buyer acquires the ownership rights and controlling interest in the company. 3. Installment Sale Agreement: Enables the buyer to make payments over a specified period, often with interest, until the full purchase price is paid. These different types of agreements may have slight variations in terms and conditions, reflecting the specific details negotiated between the buyer and seller. However, the core elements of protecting both parties, ensuring a fair purchase price, addressing liquor license transfer, and outlining payment terms remain consistent throughout.

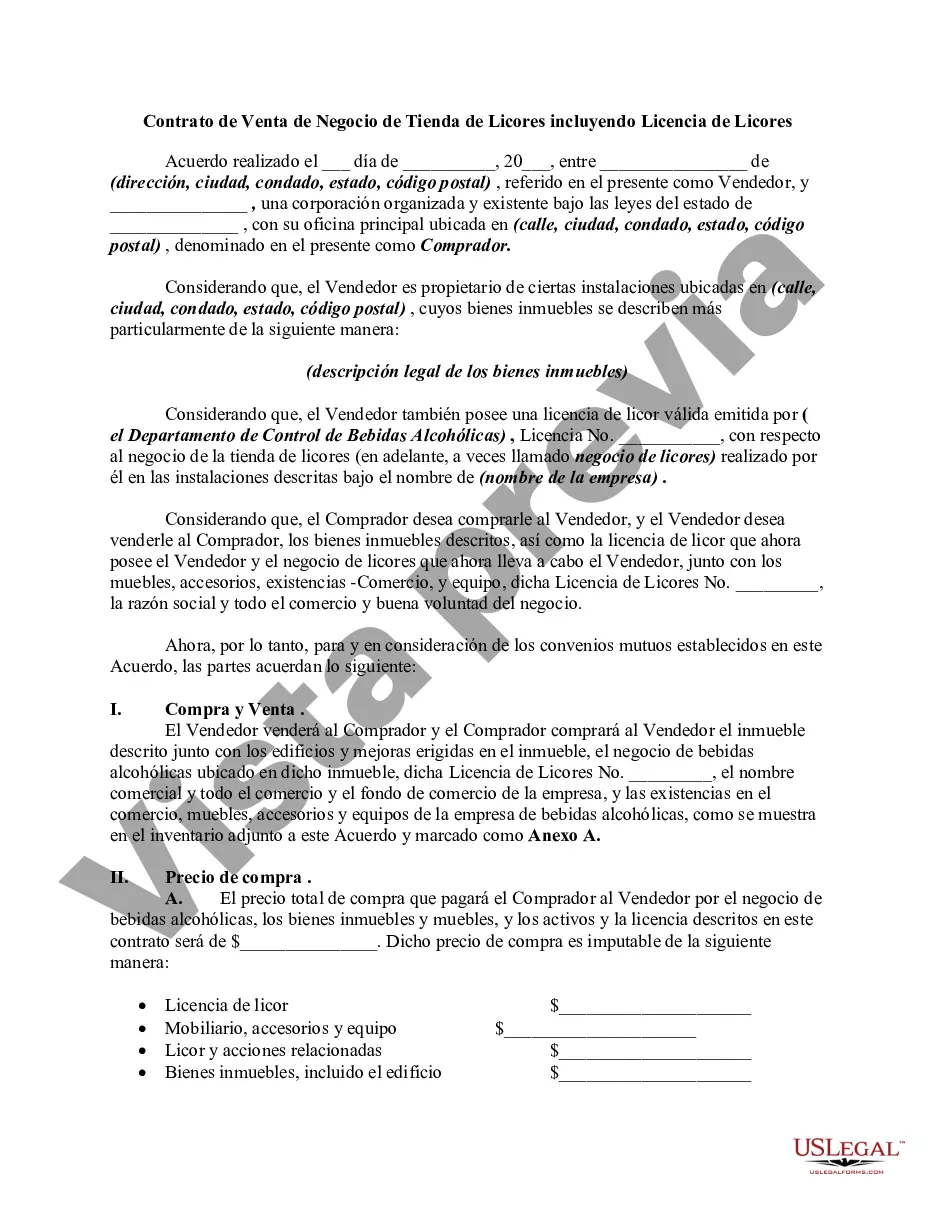

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Contrato de Venta de Negocio de Tienda de Licores incluyendo Licencia de Licores - Agreement for Sale of Liquor Store Business including Liquor License

Description

How to fill out Cook Illinois Contrato De Venta De Negocio De Tienda De Licores Incluyendo Licencia De Licores?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask a legal professional to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Cook Agreement for Sale of Liquor Store Business including Liquor License, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case accumulated all in one place. Therefore, if you need the latest version of the Cook Agreement for Sale of Liquor Store Business including Liquor License, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cook Agreement for Sale of Liquor Store Business including Liquor License:

- Look through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the file format for your Cook Agreement for Sale of Liquor Store Business including Liquor License and download it.

When done, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!