The Chicago Illinois Employment Contract of Consultant with Nonprofit Corporation is a legally binding document that outlines the terms and conditions of the working relationship between a consultant and a nonprofit organization based in Chicago, Illinois. This contract serves as a crucial agreement to protect the rights and responsibilities of both parties involved in the consulting arrangement. Key terms that may be included in such a contract are: 1. Scope of Work: This section defines the specific responsibilities, tasks, and deliverables that the consultant will be responsible for. It outlines the project objectives, timelines, and any limitations on the consultant's role. 2. Compensation: The employment contract will determine the consultant's compensation structure, whether it is an hourly rate, fixed fee, or a retainer basis. It will outline payment terms, frequency, and any additional expenses that the consultant may be entitled to. 3. Confidentiality and Non-Disclosure: This clause ensures that the consultant maintains confidentiality and does not disclose any sensitive or proprietary information of the nonprofit organization. It may also include restrictions on the consultant's use of such information even after the contract ends. 4. Ownership of Work: This section clarifies who owns the rights to any work produced by the consultant during the project. It may specify whether the nonprofit corporation retains ownership or if there will be joint ownership or licensing agreements. 5. Termination of Contract: The contract will outline the circumstances under which either party can terminate the agreement. It may include provisions for a notice period or penalties for early termination. 6. Independent Contractor Relationship: This clause establishes that the consultant is an independent contractor and not an employee of the nonprofit corporation. It clarifies the consultant's responsibility for their own taxes, insurance, and benefits. In addition to the standard employment contract, there may be variations based on the type of consulting services being provided. For example: 1. Management Consulting Contract: If the consultant is engaged in providing strategic guidance and management advice to the nonprofit, the contract may contain specific provisions regarding organizational restructuring, resource management, and performance evaluation. 2. Financial Consulting Contract: In cases where the consultant offers financial advice and support to the nonprofit, the contract may include provisions related to budgeting, financial reporting, risk management, and compliance with legal regulations. 3. Technology Consulting Contract: If the consultant provides expertise in implementing or managing technology systems for the nonprofit, the contract may address technology recommendations, system integration, data security, and data management. It is important for both the consultant and the nonprofit corporation to carefully review and negotiate the terms of the employment contract to ensure a mutually beneficial and successful working relationship. It is recommended to seek legal counsel familiar with employment law and nonprofit regulations to draft or review the employment contract thoroughly.

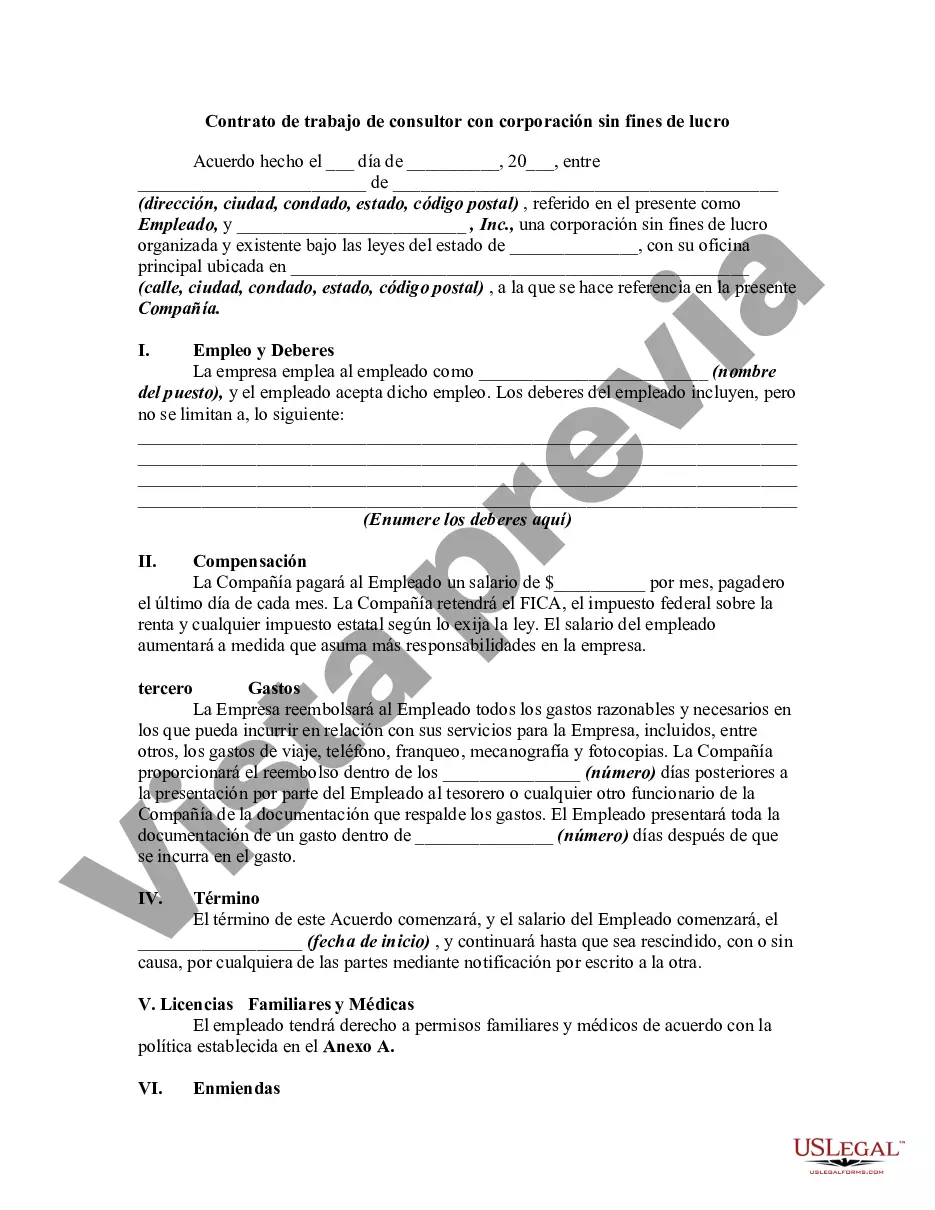

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Contrato de trabajo de consultor con corporación sin fines de lucro - Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out Chicago Illinois Contrato De Trabajo De Consultor Con Corporación Sin Fines De Lucro?

Drafting papers for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to create Chicago Employment Contract of Consultant with Nonprofit Corporation without expert help.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Chicago Employment Contract of Consultant with Nonprofit Corporation on your own, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Chicago Employment Contract of Consultant with Nonprofit Corporation:

- Look through the page you've opened and check if it has the sample you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

5 consejos para actuar en el area de servicios de consultoria Escoge tu area de actuacion. Antes de empezar, trata de identificar lo que haces mejor.Estudia tu mercado.Define el formato de tus servicios de consultoria.Divulga tu negocio.Construye una buena relacion con tus clientes.

Facilitar un mecanismo de coordinacion dentro de los diferentes actores involucrados en el proceso, de tal manera que se pueda avanzar ordenadamente, cumpliendo con los tiempos previstos en el desarrollo de las diferentes tareas y actividades, que en conjunto permitiran el logro de los objetivos y resultados planteados

Son contratos de consultoria los que celebren las entidades estatales referidos a los estudios necesarios para la ejecucion de proyectos de inversion, estudios de diagnostico, prefactibilidad o factibilidad para programas o proyectos especificos, asi como a las asesorias tecnicas de coordinacion, control y supervision.

¿Que servicios ofrece una consultoria empresarial? Servicios para el Desarrollo Organizacional. La importancia de los Recursos Humanos. Servicios de Tecnologia de la Informacion. La dimension de los riesgos y su Gestion Global. Claves para el fortalecimiento Institucional.

Un contrato no es un gasto o una perdida de tiempo, sino que reduce el impacto economico en diversos sentidos, ademas que este valor agregado proveera el soporte necesario que sera recompensado en tu cartera, en la imagen y seguridad frente a clientes y proveedores.

Cuando su equipo carece de la experiencia o los conocimientos necesarios. Si no hay nadie en el equipo con el nivel necesario de experiencia o conocimiento profundo para una funcion o proyecto en particular, es hora de contratar a un consultor.

Seleccion de Consultores Individuales Procedimiento de seleccion para contratar servicios de consultoria diferentes a consultoria de obras, en los que no se necesita equipos de personal ni apoyo profesional adicional.

Son contratos de consultoria los que celebren las entidades estatales referidos a los estudios necesarios para la ejecucion de proyectos de inversion, estudios de diagnostico, prefactibilidad o factibilidad para programas o proyectos especificos, asi como a las asesorias tecnicas de coordinacion, control y supervision.

Cuando tu organizacion tiene un proyecto que puede incrementar su rentabilidad, pero actualmente se encuentra estancado por falta de personal o falta de experiencia para completarlo, este es el momento adecuado para contratar una consultoria empresarial.

La importancia de la clasificacion de estos contratos esta relacionada con la distribucion de las culpas, ya que dependiendo del contrato asi sera la culpa por la cual se debera responder: En los contratos onerosos se responde por culpa leve, en cambio en los contratos gratuitos se exige, para quien es gratuito, que