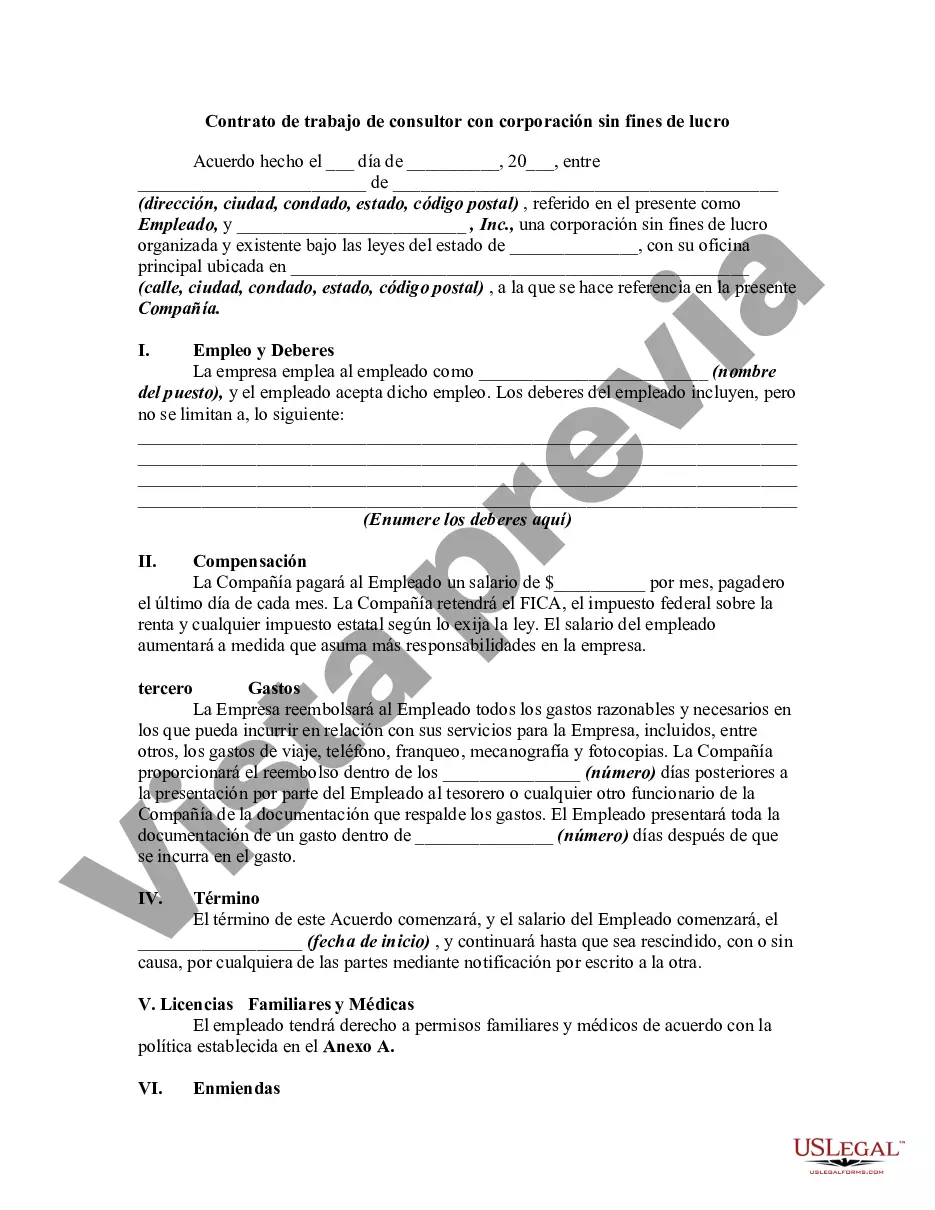

Cuyahoga Ohio is a county located in the state of Ohio, known for its vibrant and diverse community. Within this county, several nonprofit corporations operate, offering various employment opportunities for consultants. A Cuyahoga Ohio Employment Contract of Consultant with Nonprofit Corporation is a legally binding agreement that outlines the terms and conditions of employment between the consultant and the nonprofit corporation. This employment contract aims to establish a clear understanding between both parties regarding the scope of work, compensation, duration, termination, and other essential aspects of the consultancy arrangement. It ensures that the consultant's services are utilized effectively and that the nonprofit corporation's objectives are met. There may be different types of Cuyahoga Ohio Employment Contract for consultants with nonprofit corporations, such as: 1. Full-time Employment Contract: This type of contract is suitable for consultants who are committed to working exclusively for the nonprofit corporation on a full-time basis. It outlines the required work hours, benefits, responsibilities, and expectations. 2. Part-time Employment Contract: This contract is tailored for consultants who will provide their services on a part-time basis. It specifies the agreed-upon number of hours they will work each week or month and their corresponding compensation structure. 3. Fixed-Term Contract: Some consultants may be hired for a specific project or initiative within the nonprofit corporation. The fixed-term contract defines the duration of the engagement and includes provisions for project milestones, deliverables, and any applicable renewal options. 4. Independent Contractor Agreement: In cases where the consultant operates as an independent contractor rather than an employee, an independent contractor agreement is utilized. This contract clarifies that the consultant is responsible for their own taxes, insurance, and benefits, and outlines the specific project or tasks to be completed. Key elements typically included in a Cuyahoga Ohio Employment Contract of Consultant with Nonprofit Corporation may consist of: — Job title and description: Clearly outlines the nature of the consultant's role within the nonprofit corporation, including responsibilities and deliverables. — Compensation and benefits: Details the consultant's salary, payment terms, and any additional benefits, such as health insurance or retirement plans. — Work arrangement: Describes the consultant's work schedule, whether it's full-time, part-time, or project-based, including any specific location requirements. — Intellectual property ownership: Specifies who maintains the rights to any intellectual property created or utilized during the consultancy. — Confidentiality and non-disclosure: Ensures that the consultant maintains the confidentiality of the nonprofit corporation's sensitive information and prohibits the disclosure of such information to third parties. — Termination and notice period: Outlines the conditions under which either party can terminate the contract and the required notice period. — Dispute resolution: Provides a mechanism for resolving conflicts or disputes arising from the employment contract, such as through mediation or arbitration. — Governing law: Establishes the jurisdiction and laws that will govern the interpretation and enforcement of the contract. Overall, the Cuyahoga Ohio Employment Contract of Consultant with Nonprofit Corporation is a comprehensive agreement that protects the rights and interests of both the consultant and the nonprofit corporation, ensuring a mutually beneficial professional relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Contrato de trabajo de consultor con corporación sin fines de lucro - Employment Contract of Consultant with Nonprofit Corporation

Description

How to fill out Cuyahoga Ohio Contrato De Trabajo De Consultor Con Corporación Sin Fines De Lucro?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Cuyahoga Employment Contract of Consultant with Nonprofit Corporation, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in various categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any activities associated with paperwork execution straightforward.

Here's how to locate and download Cuyahoga Employment Contract of Consultant with Nonprofit Corporation.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the related document templates or start the search over to find the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Cuyahoga Employment Contract of Consultant with Nonprofit Corporation.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Cuyahoga Employment Contract of Consultant with Nonprofit Corporation, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you have to cope with an exceptionally challenging situation, we advise using the services of an attorney to examine your form before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Become one of them today and purchase your state-specific paperwork with ease!