Chicago, Illinois Shareholder Agreement to Sell Stock to Other Shareholder: A Comprehensive Overview In the bustling city of Chicago, Illinois, shareholder agreements play a pivotal role in maintaining orderly business operations and facilitating smooth transactions among shareholders. Specifically, a Chicago Shareholder Agreement to Sell Stock to Another Shareholder serves as a legally binding document that establishes the conditions and procedures governing the sale and transfer of company stocks from one shareholder to another. While there might be various types of Chicago Shareholder Agreements, specifically designed to cater to different business scenarios and requirements, three noteworthy types are commonly encountered: 1. General Shareholder Agreement to Sell Stock to Other Shareholder: This type of agreement forms the bedrock for most sale transactions and encompasses the fundamental principles guiding stock transfers within a company. It outlines essential elements such as the identification of parties involved, the nature and class of shares being sold, the agreed-upon purchase price or valuation methodology, and any specific terms or conditions applicable to the sale process. 2. Right of First Refusal Shareholder Agreement: In certain situations, shareholders may wish to ensure that they have the first opportunity to purchase shares being sold by another shareholder, rather than those shares being sold to a third party. A Right of First Refusal Shareholder Agreement stipulates that the selling shareholder must first offer their shares to the existing shareholders of the company, giving them the chance to exercise their right to purchase the shares before entertaining offers from external parties. 3. Buy-Sell Shareholder Agreement: Often utilized in closely-held corporations or partnerships, a Buy-Sell Shareholder Agreement outlines predetermined provisions that govern the transfer of shares when specific triggering events occur. These events may include a shareholder's retirement, death, disability, bankruptcy, or voluntary departure from the company. Such agreements ensure the orderly transfer of shares by defining the valuation methodology, purchase terms, and other relevant considerations. Although the specifics of Chicago Shareholder Agreements may vary based on the unique circumstances, some common provisions often found within these agreements include: 1. Restrictions on Transfer: These provisions define restrictions on who can purchase the shares, ensuring that they are only sold to other existing shareholders or approved parties. These clauses are vital to maintaining control over share ownership and preventing unwanted transfers that may disrupt the company's operations or overall coherence. 2. Valuation Methodology: Determining the fair market value of shares being sold is crucial. Shareholder agreements outline the agreed-upon valuation method, which may include factors such as book value, asset-based valuation, market-based appraisal, or a combination of these approaches. Clear valuation guidelines help minimize disputes and ensure a fair and transparent transaction process. 3. Purchase Price and Payment Terms: Agreements should include details on the purchase price, payment terms, and any related considerations (e.g., payment in installments, interest rates). Clarifying the financial aspects safeguards both parties' interests and prevents any misunderstandings regarding payment-related obligations. 4. Conditions and Closing Procedures: These sections outline the specific conditions that need to be met before the sale becomes final. This can include obtaining necessary regulatory approvals, securing financing, and fulfilling any outstanding obligations, ensuring a smooth and legally compliant transaction. In conclusion, a Chicago Shareholder Agreement to Sell Stock to Other Shareholder empowers businesses in Illinois to navigate stock sales and transfers effectively. The different types of agreements, such as a General Shareholder Agreement, Right of First Refusal Shareholder Agreement, and Buy-Sell Shareholder Agreement, cater to diverse situations that shareholders may encounter. By addressing critical elements like transfer restrictions, valuation methodology, purchase price and payment terms, and closing procedures, these agreements protect the interests of both parties involved and foster transparency and harmony in the business ecosystem.

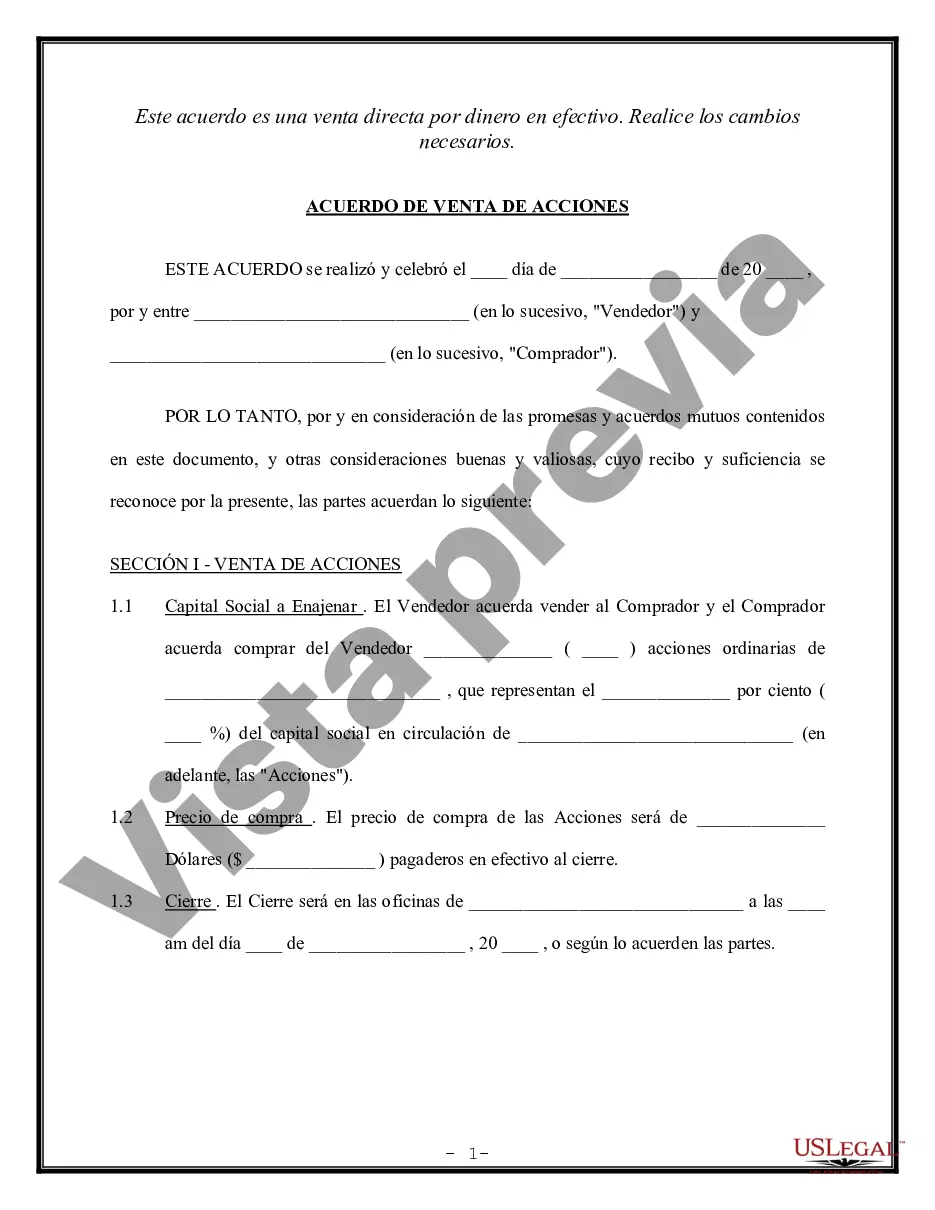

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de accionistas para vender acciones a otros accionistas - Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Chicago Illinois Acuerdo De Accionistas Para Vender Acciones A Otros Accionistas?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life sphere, finding a Chicago Shareholder Agreement to Sell Stock to Other Shareholder suiting all local requirements can be tiring, and ordering it from a professional lawyer is often expensive. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web collection of templates, collected by states and areas of use. Apart from the Chicago Shareholder Agreement to Sell Stock to Other Shareholder, here you can find any specific form to run your business or individual affairs, complying with your regional requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the file in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Chicago Shareholder Agreement to Sell Stock to Other Shareholder:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Chicago Shareholder Agreement to Sell Stock to Other Shareholder.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!