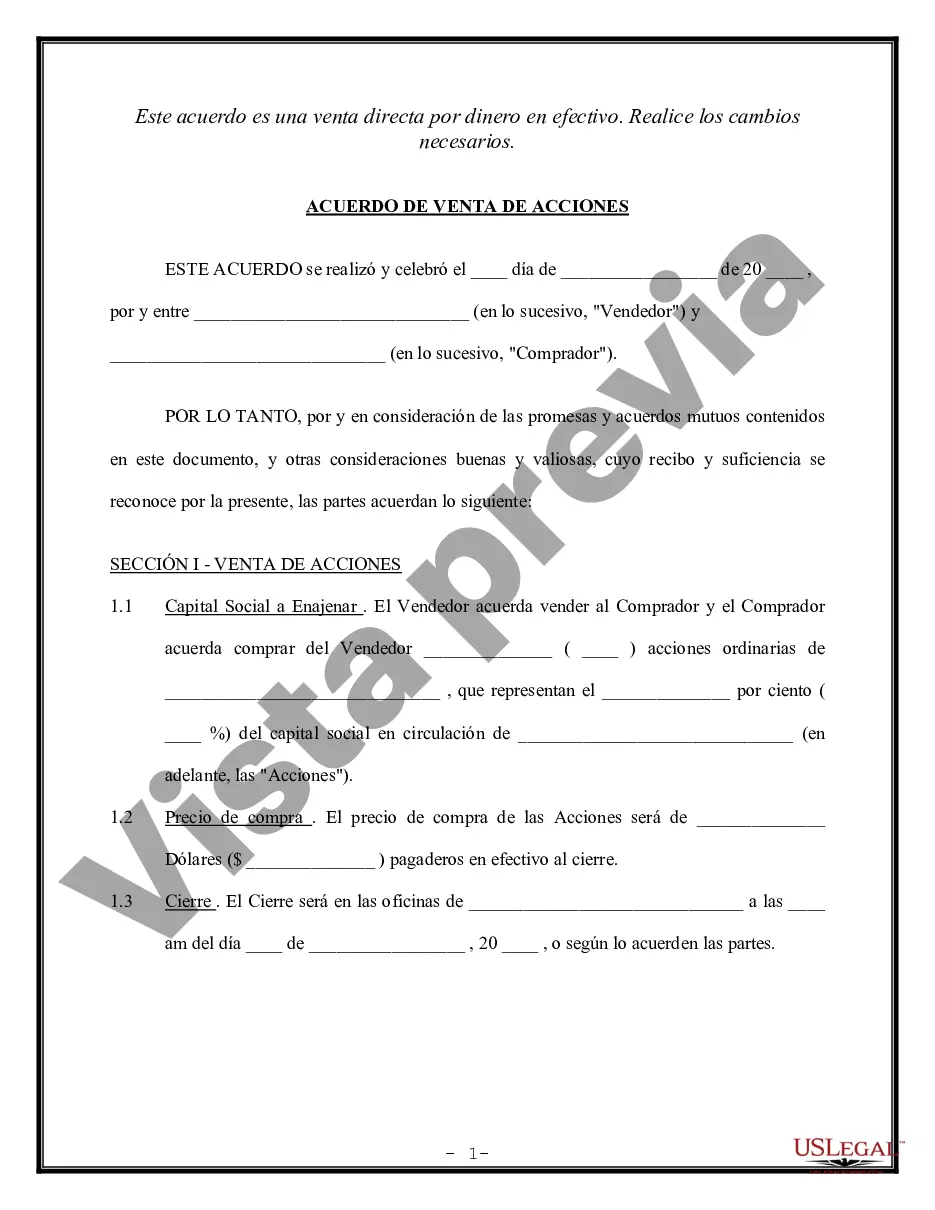

Fairfax Virginia Shareholder Agreement to Sell Stock to Other Shareholder provides a comprehensive legal framework for the transfer or sale of shares between shareholders within the jurisdiction of Fairfax, Virginia. This type of agreement is crucial for ensuring a smooth transition of ownership and protecting the rights and interests of both parties involved. Here are some key elements typically found in a Fairfax Virginia Shareholder Agreement to Sell Stock to Other Shareholder: 1. Parties involved: Clearly identify the participating shareholders, including their names, addresses, and contact information. 2. Stock details: Specify the type and class of stock being transferred, such as preferred shares or common shares, along with the total number or percentage of shares being sold. 3. Purchase terms: Outline the terms and conditions of the sale, including the purchase price or valuation of the shares, payment methods, and any potential adjustments or earn-out provisions. 4. Closing procedure: Describe the procedures and timeline for completing the transaction, including the necessary documentation, approvals, and any applicable regulatory filings. 5. Representations and warranties: Include statements and guarantees made by both the selling and purchasing shareholders regarding the share ownership, their authority to enter into the agreement, and the absence of any undisclosed liabilities or encumbrances. 6. Non-compete and non-solicitation clauses: Address any restrictions on the selling shareholder from engaging in competitive activities or soliciting clients/customers following the share transfer, ensuring fair competition and protection of the purchasing shareholder's interests. 7. Dispute resolution: Establish a mechanism for resolving any disputes arising from the agreement, such as mediation, arbitration, or litigation, while specifying Fairfax, Virginia, as the designated jurisdiction for such proceedings. 8. Confidentiality and non-disclosure: Include provisions that require both parties to maintain the confidentiality of any proprietary or sensitive information shared during the sale process. Types of Fairfax Virginia Shareholder Agreement to Sell Stock to Other Shareholder can vary depending on factors such as the nature of the business, the rights associated with the shares, and specific shareholder requirements. Some common variations include: 1. Cross-Purchase Agreement: Allows individual shareholders to sell their shares directly to other shareholders, rather than the company itself. This method is commonly utilized in smaller closely-held corporations. 2. Redemption Agreement: Enables the company to buy back shares from shareholders, often following predetermined terms and conditions outlined in the agreement. This type of agreement is a common choice for larger corporations. 3. Buy-Sell Agreement: Also known as a "shotgun" agreement, this arrangement provides a mechanism for resolving ownership disputes by giving shareholders the right to force a sale of their shares at a specified price. The remaining shareholders can then decide to buy the shares or sell their own shares on the same terms. It is essential for Fairfax, Virginia shareholders engaging in stock transfers to consult with legal professionals familiar with corporate and securities law to customize the agreement according to their specific needs and comply with local regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Acuerdo de accionistas para vender acciones a otros accionistas - Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Fairfax Virginia Acuerdo De Accionistas Para Vender Acciones A Otros Accionistas?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, locating a Fairfax Shareholder Agreement to Sell Stock to Other Shareholder meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Fairfax Shareholder Agreement to Sell Stock to Other Shareholder, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can retain the file in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Fairfax Shareholder Agreement to Sell Stock to Other Shareholder:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Fairfax Shareholder Agreement to Sell Stock to Other Shareholder.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!