Title: Mecklenburg North Carolina Shareholder Agreement to Sell Stock to Other Shareholder: A Comprehensive Understanding Introduction: In Mecklenburg County, North Carolina, a Shareholder Agreement to Sell Stock to Other Shareholder is a legal contract that outlines the terms and conditions under which one shareholder agrees to transfer or sell their stock or shares to another shareholder within the same company. This agreement is essential for establishing clear guidelines and protecting the rights and interests of both parties involved. Let's delve deeper into the specifics of this agreement and explore potential variations. 1. Key Elements of a Mecklenburg North Carolina Shareholder Agreement: — Identifying the Parties: Clearly state the names and roles of the shareholders entering into the agreement, along with details of their respective shareholdings. — Stock Transfer Terms: Outline the terms and conditions for the transfer of stock, including the number of shares, price, and payment method. — Rights and Obligations: Specify the rights and obligations of both the selling shareholder and the buying shareholder, such as voting rights, dividend entitlements, and any restrictions on transferring shares in the future. — Purchase Price: Determine how the purchase price of the shares will be determined, for example, through negotiation, fair market value, or appraisal. — Payment Terms: Establish the payment terms, including whether it will be made in lump sum or installments, and the timeline for payment completion. — Conditions Precedent: Outline any conditions that must be satisfied before the share transfer can take place, such as obtaining necessary regulatory approvals or consents. — Non-Compete and Non-Solicitation Clauses: Include provisions that prevent the selling shareholder from engaging in competitive activities or soliciting employees or customers after the transfer. — Governing Law: Specify that the agreement will be governed by the laws of Mecklenburg County, North Carolina. 2. Types of Mecklenburg North Carolina Shareholder Agreement to Sell Stock to Other Shareholder: a) Voluntary Share Transfer Agreement: This type of agreement is entered into willingly by both shareholders, typically to allow for succession planning, strategic restructuring, or personal reasons. b) Right of First Refusal Agreement: This agreement grants certain shareholders the first opportunity to purchase shares offered for sale by another shareholder before they are offered to outside parties. c) Forced Share Transfer Agreement: In certain situations, a shareholder may be compelled to sell their shares based on predetermined events or triggers, such as bankruptcy, retirement, or breach of agreement. Conclusion: A Mecklenburg North Carolina Shareholder Agreement to Sell Stock to Other Shareholder is a vital legal document that ensures a transparent and fair process regarding the transfer of shares between shareholders within a corporation. By addressing crucial elements and variations of this agreement, it aims to safeguard the rights and interests of both parties involved and provides a solid foundation for any future share transfers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Passport Photos 00682 - Shareholder Agreement to Sell Stock to Other Shareholder

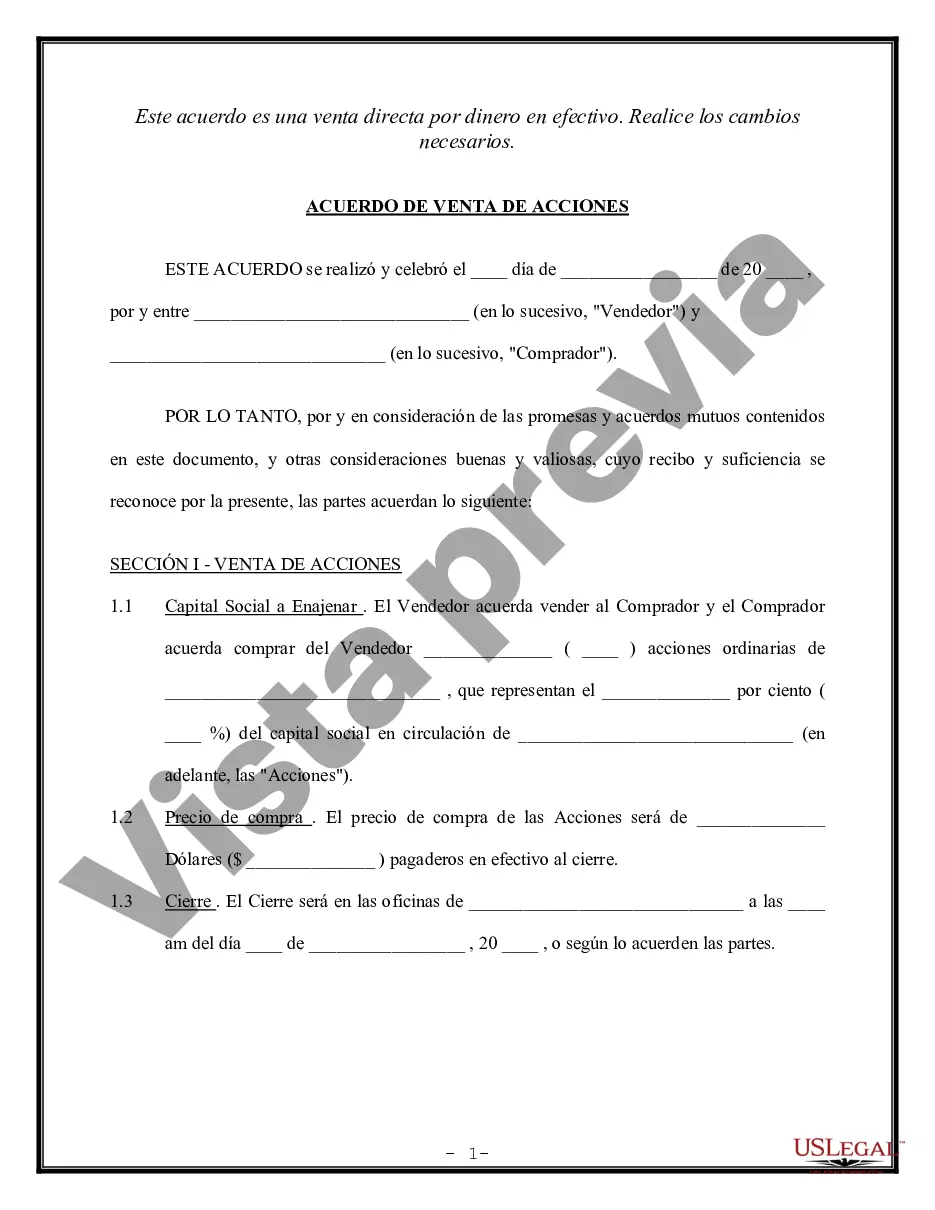

Description

How to fill out Mecklenburg North Carolina Acuerdo De Accionistas Para Vender Acciones A Otros Accionistas?

How much time does it typically take you to draw up a legal document? Given that every state has its laws and regulations for every life sphere, finding a Mecklenburg Shareholder Agreement to Sell Stock to Other Shareholder meeting all regional requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Mecklenburg Shareholder Agreement to Sell Stock to Other Shareholder, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Experts verify all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Mecklenburg Shareholder Agreement to Sell Stock to Other Shareholder:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Mecklenburg Shareholder Agreement to Sell Stock to Other Shareholder.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can locate all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!