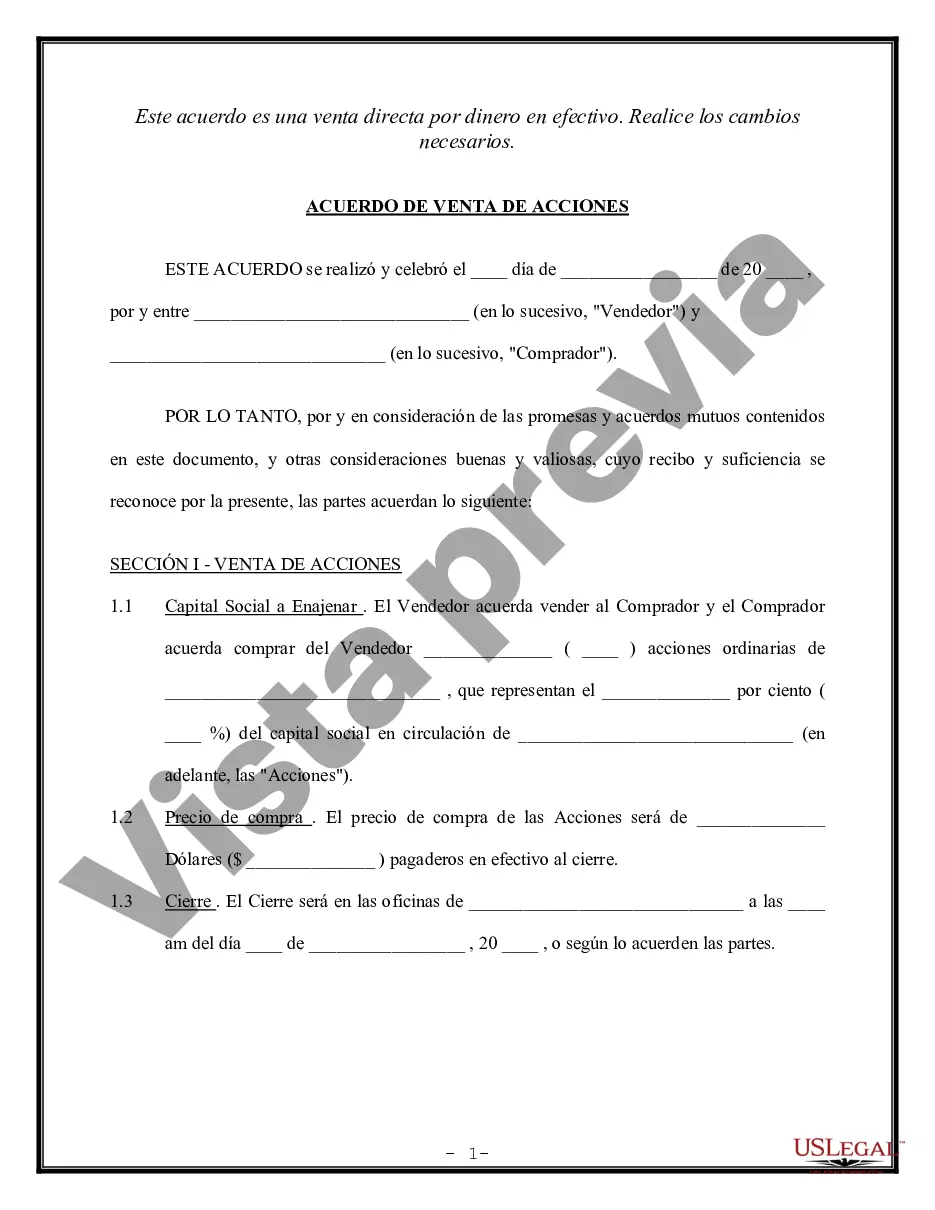

A Nassau New York Shareholder Agreement to Sell Stock to Other Shareholder is a legally binding contract that outlines the terms and conditions under which one shareholder in a corporation can sell their stock to another shareholder. This type of agreement ensures a smooth and transparent process for transferring ownership and can help avoid disputes or disagreements between the involved parties. The agreement typically covers various aspects, including the purchase price for the shares, the payment terms, any warranties or representations made by the selling shareholder, and the conditions for closing the transaction. It also specifies the rights and obligations of both parties during and after the share transfer. There are several types of Nassau New York Shareholder Agreements to Sell Stock to Other Shareholder, each catering to specific circumstances. These may include: 1. Restrictive Shareholder Agreement: This type of agreement imposes restrictions on the sale of shares, allowing existing shareholders the first right of refusal to purchase shares before they can be offered to external parties. 2. Buy-Sell Agreement: A Buy-Sell Agreement is applicable in situations where one or more shareholders wish to sell their shares due to retirement, disability, death, or other triggering events. This agreement allows shareholders to specify the terms and conditions under which the shares must be sold. 3. Shareholders' Redemption Agreement: In the case of a Shareholders' Redemption Agreement, the corporation has the option or obligation to buy back shares from a shareholder in certain situations, such as termination of employment or breach of contract. 4. Shareholders' Cross-Purchase Agreement: A Cross-Purchase Agreement is commonly used when there are only a few shareholders in a corporation. It allows the remaining shareholders to purchase the shares of a departing or selling shareholder. 5. Shareholders' Agreement for Partial Sale: This agreement is used when a shareholder wishes to sell only a portion of their shares to another shareholder, rather than transferring the entire ownership. It is crucial for shareholders to consult with legal professionals experienced in shareholder agreements to ensure the agreement aligns with their specific needs and complies with Nassau New York corporate regulations. The agreement should address issues such as valuation methods, dispute resolution mechanisms, confidentiality, non-compete clauses, and any other relevant considerations. By having a Shareholder Agreement to Sell Stock to Other Shareholder in place, shareholders can protect their interests and maintain a balanced and fair transaction process, benefiting both parties involved in the share transfer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Acuerdo de accionistas para vender acciones a otros accionistas - Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Nassau New York Acuerdo De Accionistas Para Vender Acciones A Otros Accionistas?

Creating documents, like Nassau Shareholder Agreement to Sell Stock to Other Shareholder, to manage your legal matters is a difficult and time-consumming process. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can take your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents intended for different scenarios and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Nassau Shareholder Agreement to Sell Stock to Other Shareholder form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? Don’t worry. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Nassau Shareholder Agreement to Sell Stock to Other Shareholder:

- Ensure that your document is compliant with your state/county since the rules for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or reading a brief intro. If the Nassau Shareholder Agreement to Sell Stock to Other Shareholder isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our website and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is ready to go. You can try and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!