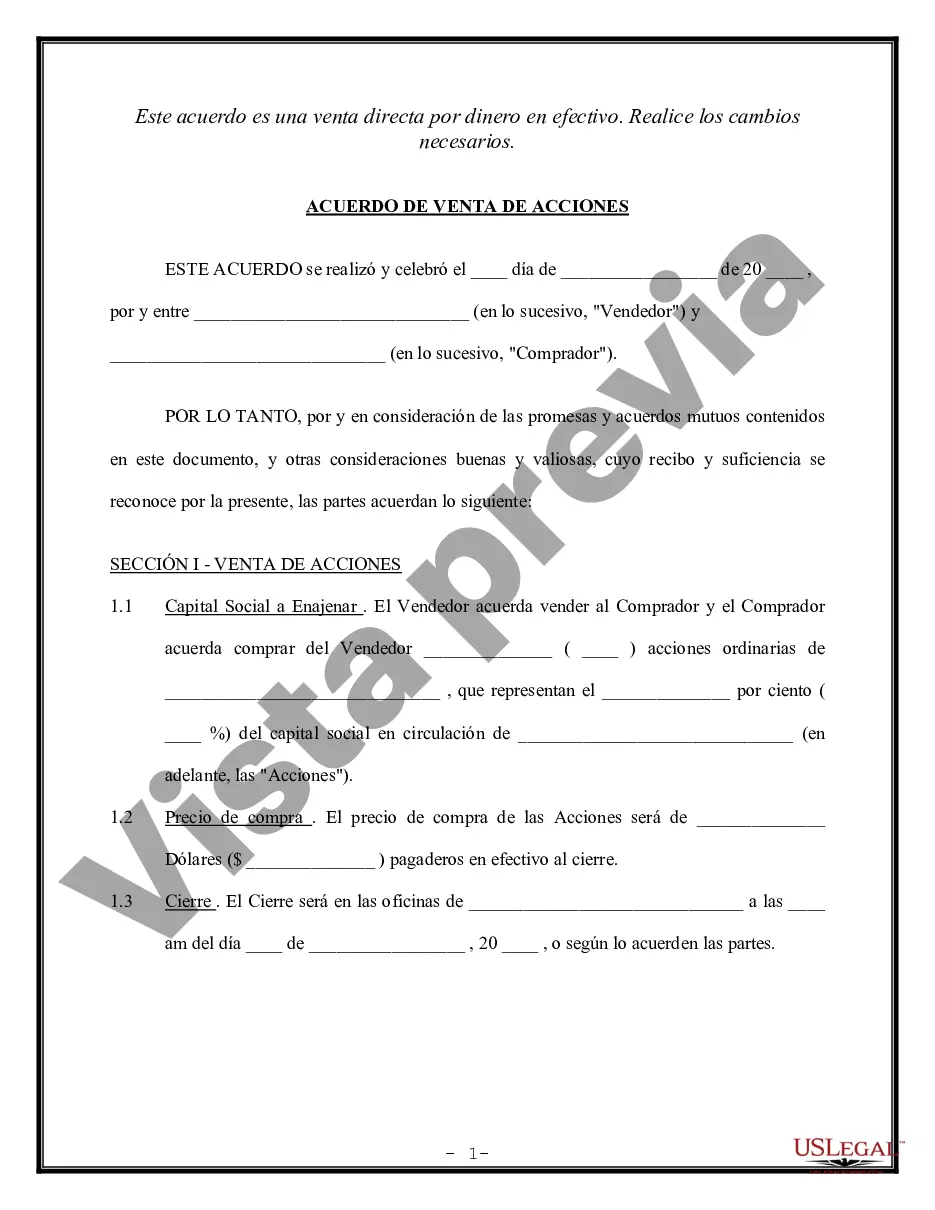

A Phoenix Arizona Shareholder Agreement to Sell Stock to Other Shareholder is a legally binding contract entered into by shareholders of a company based in Phoenix, Arizona. This agreement outlines the terms and conditions for a shareholder to sell their stock to another existing shareholder of the company. This type of agreement is crucial for maintaining transparency and establishing clear guidelines when a shareholder wishes to transfer their ownership stake to another shareholder. It provides a framework for the buying and selling process, protecting the interests of both parties involved. Key elements typically included in a Phoenix Arizona Shareholder Agreement to Sell Stock to Other Shareholder may consist of: 1. Identification of Parties: The agreement begins by identifying the parties involved, including their contact information and details of their ownership in the company. 2. Definitions: This section clarifies the terms used throughout the agreement, ensuring mutual understanding. 3. Stock Transfer Terms: The agreement outlines the specifics of the stock transfer, including the number of shares being sold, the purchase price, and any applicable warranties or representations. 4. Purchase Price and Payment Terms: This section determines the method of payment, whether it be a lump sum or installment payments, and outlines any potential adjustments to the purchase price, such as outstanding debts or liabilities associated with the shares. 5. Closing and Delivery: The agreement specifies the date by which the transfer should be completed and the necessary documents to be exchanged for a valid transaction. 6. Representations and Warranties: Both parties typically provide assurances regarding the ownership and condition of the stock being sold, protecting the buyer from any undisclosed risks or liabilities. 7. Confidentiality and Non-Compete: The agreement may include provisions to maintain the confidentiality of any proprietary information and restrict the seller from competing with the company. 8. Dispute Resolution: In the event of a dispute, this section outlines the preferred method of resolving conflicts, such as through arbitration or mediation. Types of Phoenix Arizona Shareholder Agreements to Sell Stock to Other Shareholder can vary based on the unique needs of the company and the shareholders involved. Some possible variations could include: 1. Cross-Purchase Agreements: This type of agreement allows shareholders to sell their stock to other individual shareholders rather than the company itself. 2. Redemption Agreements: In this arrangement, the company repurchases the shares from the selling shareholder directly. 3. Right of First Refusal Agreements: This agreement grants existing shareholders the right to purchase the selling shareholder's stock before any outside parties can acquire it. 4. Buy-Sell Agreements: Also known as a stock restriction or repurchase agreement, this type of agreement obligates shareholders to sell their shares in certain pre-determined circumstances, such as death, disability, retirement, or voluntary departure. Overall, a well-drafted Phoenix Arizona Shareholder Agreement to Sell Stock to Other Shareholder helps ensure a smooth and efficient transfer of ownership, protecting the rights and interests of both the selling and buying shareholders. Consulting with legal professionals experienced in Arizona corporate law is always advisable when creating such agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Acuerdo de accionistas para vender acciones a otros accionistas - Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Phoenix Arizona Acuerdo De Accionistas Para Vender Acciones A Otros Accionistas?

If you need to get a trustworthy legal document provider to find the Phoenix Shareholder Agreement to Sell Stock to Other Shareholder, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning resources, and dedicated support make it easy to find and execute various papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse Phoenix Shareholder Agreement to Sell Stock to Other Shareholder, either by a keyword or by the state/county the document is created for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Phoenix Shareholder Agreement to Sell Stock to Other Shareholder template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and select a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can execute the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our comprehensive variety of legal forms makes these tasks less pricey and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate agreement, or execute the Phoenix Shareholder Agreement to Sell Stock to Other Shareholder - all from the convenience of your home.

Sign up for US Legal Forms now!