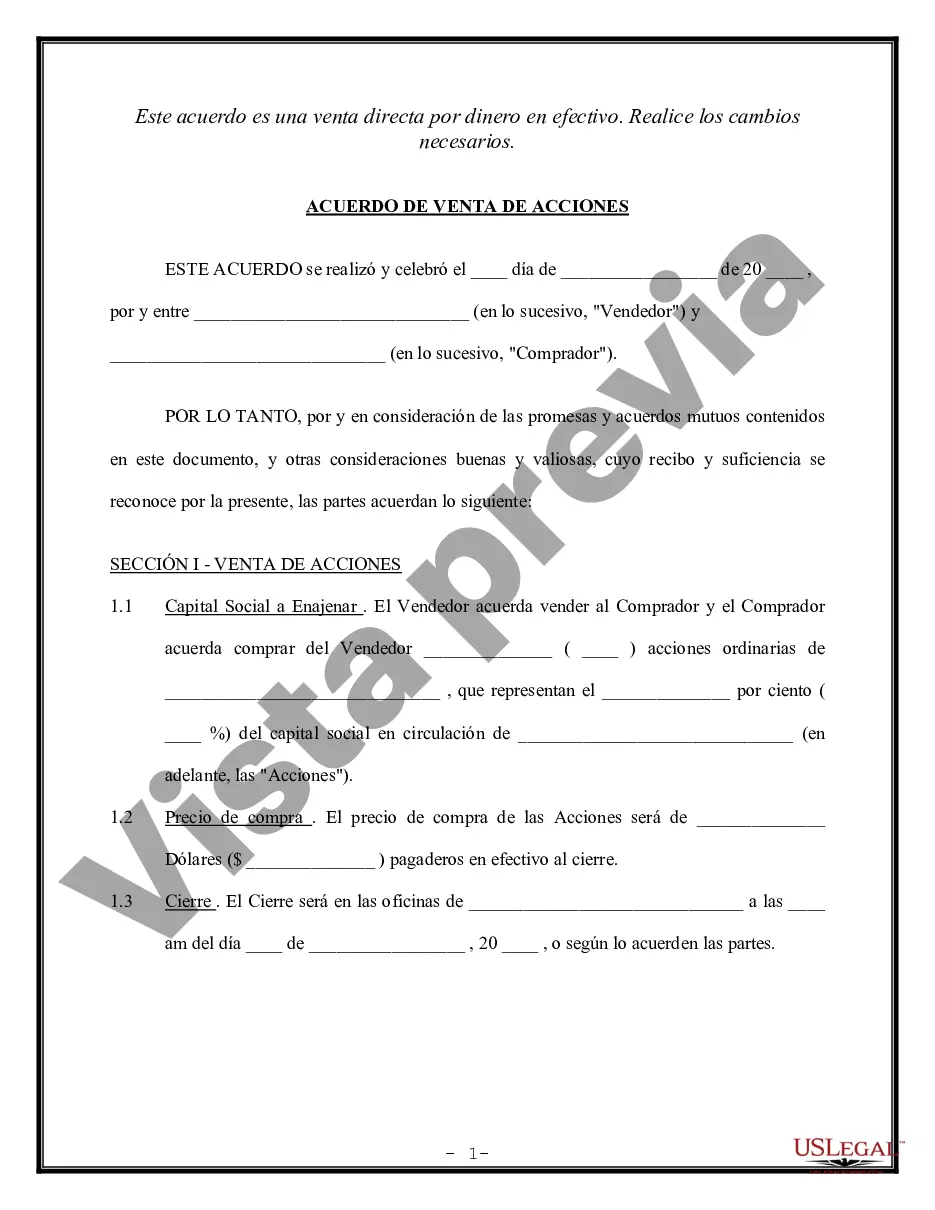

Travis Texas Shareholder Agreement to Sell Stock to Other Shareholder is a legally binding contract that outlines the terms and conditions under which a shareholder in a company located in Travis, Texas can sell their stocks to another shareholder. This agreement aims to provide a clear and structured framework for the sale of stocks, ensuring fairness and protection for both parties involved. The Travis Texas Shareholder Agreement to Sell Stock to Other Shareholder typically covers various aspects, including the purchase price, payment terms, and the number of shares being sold. It also addresses any restrictions or limitations on the sale, such as rights of first refusal or non-competition clauses. Moreover, the agreement may include provisions regarding the resolution of disputes and the termination or modification of the agreement. There are different types of Travis Texas Shareholder Agreement to Sell Stock to Other Shareholder, tailored to specific circumstances or preferences: 1. Simple Shareholder Agreement: This type of agreement is commonly used in straightforward transactions where the sale is between two shareholders without any complex conditions or additional provisions. 2. Right of First Refusal Agreement: In this type of agreement, the selling shareholder is obligated to offer the stocks to the other shareholders before selling to an external party. If the other shareholders decline, the selling shareholder can proceed with the sale to an outside buyer. 3. Put and Call Agreement: This agreement provides the selling shareholder with the option to sell their shares (a put option) and the purchasing shareholder with the option to buy the shares (a call option) at a predetermined price within a specified timeframe. 4. Non-Competition Agreement: In some cases, a shareholder who intends to sell their stocks may be subject to restrictions on competing with the company. A non-competition agreement can limit the selling shareholder from engaging in similar business activities within a certain geographical area and for a specific period. 1. Share Purchase Agreement: A comprehensive agreement that encompasses various provisions related to the purchase of shares, including warranties, representations, and indemnification clauses. 2. Stock Transfer Agreement: This type of agreement specifically focuses on the transfer of stocks between shareholders, outlining the transfer process, financial terms, and any associated conditions or restrictions. By utilizing a Travis Texas Shareholder Agreement to Sell Stock to Other Shareholder, shareholders can establish a clear and mutually agreed-upon framework for the sale of stocks, ensuring transparency and minimizing disputes or misunderstandings. It is essential for shareholders to consult legal professionals to draft or review such agreements to protect their interests and comply with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Acuerdo de accionistas para vender acciones a otros accionistas - Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Travis Texas Acuerdo De Accionistas Para Vender Acciones A Otros Accionistas?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Travis Shareholder Agreement to Sell Stock to Other Shareholder, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario gathered all in one place. Therefore, if you need the latest version of the Travis Shareholder Agreement to Sell Stock to Other Shareholder, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Travis Shareholder Agreement to Sell Stock to Other Shareholder:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the file format for your Travis Shareholder Agreement to Sell Stock to Other Shareholder and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!