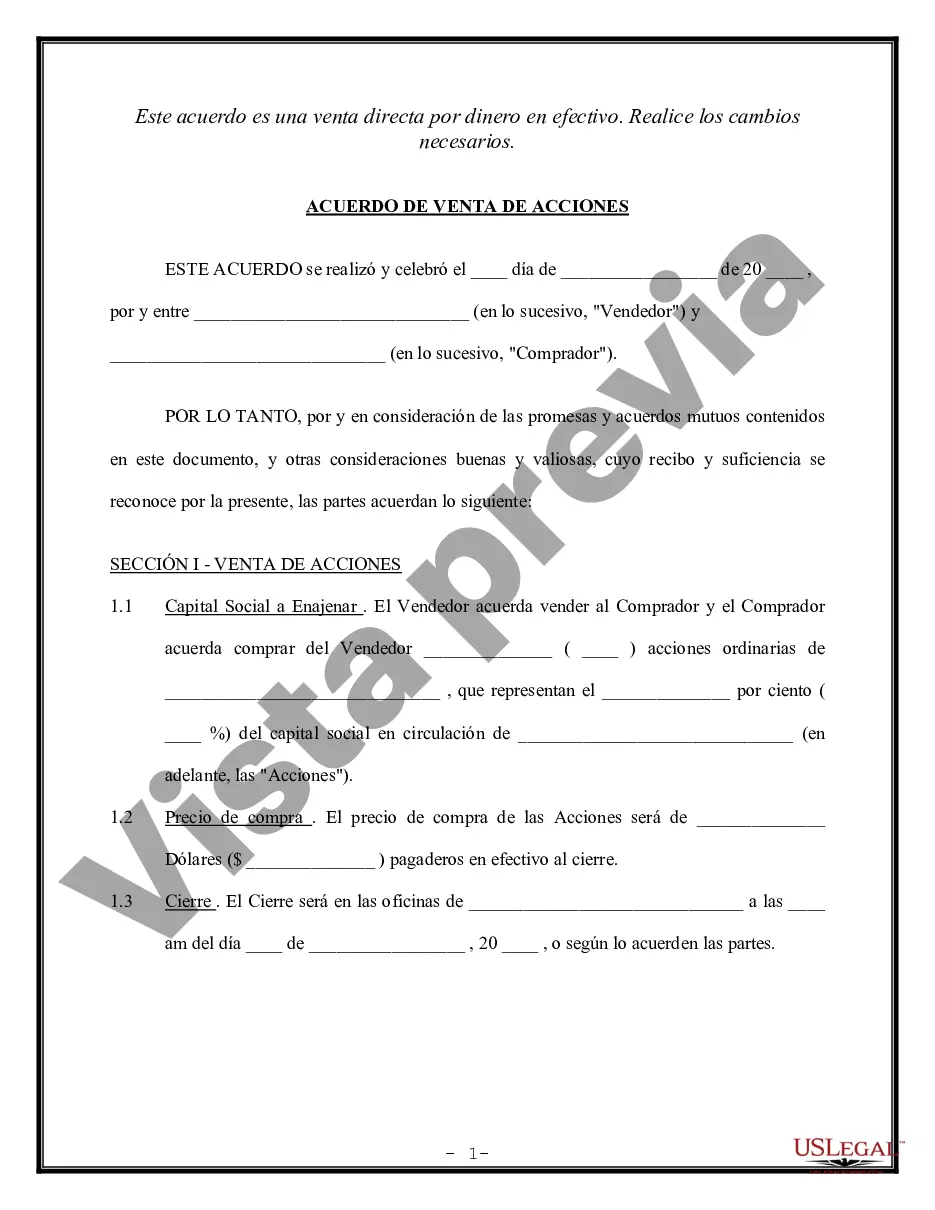

Wayne Michigan Shareholder Agreement to Sell Stock to Other Shareholder is a legal document that outlines the terms and conditions for the sale and transfer of company shares from one shareholder to another within Wayne, Michigan. This agreement is crucial in facilitating a smooth and transparent process and is commonly utilized in various business transactions and corporate restructuring. The primary objective of a Wayne Michigan Shareholder Agreement to Sell Stock to Other Shareholder is to govern the transfer of shares between existing shareholders. It provides a framework for the buying and selling parties, ensuring that the rights and obligations are clearly defined, and potential conflicts or disagreements are resolved in a fair and efficient manner. There are different types of Wayne Michigan Shareholder Agreement to Sell Stock to Other Shareholder tailored to cater to specific situations and conditions. Some common variations include: 1. Standard Wayne Michigan Shareholder Agreement: This agreement sets out the general terms and conditions for the sale of shares between shareholders. It covers essential aspects such as purchase price, payment terms, timing, conditions precedent, representations and warranties, and dispute resolution mechanisms. 2. Buy-Sell Agreement: This type of agreement includes specific provisions that allow shareholders to sell their shares in predefined circumstances. Such circumstances can include events like death, disability, retirement, or other triggering events. A buy-sell agreement ensures that the ownership of shares remains within the existing shareholders or predetermined individuals or entities. 3. Drag-Along Agreement: A drag-along agreement enables majority shareholders to force minority shareholders to sell their shares in the event of a sale by majority shareholders to a third party. This type of agreement ensures that all shareholders are treated equally and facilitates the completion of a larger transaction. 4. Tag-Along Agreement: Conversely, a tag-along agreement allows minority shareholders to join in and sell their shares along with majority shareholders when a third party expresses interest in acquiring the shares of majority shareholders. This protects the minority shareholders from being left behind in a transaction that could potentially disadvantage them. Regardless of the specific type, a Wayne Michigan Shareholder Agreement to Sell Stock to Other Shareholder must comply with relevant laws and regulations, both at the federal and state levels. This agreement should be carefully drafted, reviewed, and executed by all parties involved with the assistance of legal professionals to ensure that it accurately reflects the intentions and protects the rights of the shareholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Acuerdo de accionistas para vender acciones a otros accionistas - Shareholder Agreement to Sell Stock to Other Shareholder

Description

How to fill out Wayne Michigan Acuerdo De Accionistas Para Vender Acciones A Otros Accionistas?

Laws and regulations in every area differ from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Wayne Shareholder Agreement to Sell Stock to Other Shareholder, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Wayne Shareholder Agreement to Sell Stock to Other Shareholder from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Wayne Shareholder Agreement to Sell Stock to Other Shareholder:

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the document once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Realizar un traspaso de acciones firmando ante notario o antes dos testigos habiles mayores de 18 anos. Inscribir el Traspaso de Acciones en el Registro de Accionistas. Solicitar Certificado de Anotaciones (solo Empresa en un Dia). Informar el Traspaso al Servicio de Impuestos Internos.

Si uno comprara todas las acciones, uno seria dueno de todo el capital, podria decidir sobre todos los activos, y seria responsable de pagar todos los pasivos. Cuando un inversionista compra una accion, se vuelve socio de dicha compania y adquiere derechos economicos y corporativos.

El pacto social podra hacerse constar por medio de escritura publica, o en otra forma, siempre que sea atestado por un Notario Publico o por cualquiera otro funcionario que este autorizado para hacer atestaciones en el lugar del otorgamiento.

El paso a paso para vender acciones y otros valores en la Bolsa de Valores de Lima (BVL) es el siguiente: Dirijase a la Sociedad Agente de Bolsa.Formule su orden de venta.Verificacion de la SAB.La SAB ejecuta la operacion.Se efectua el pago.Entrega de Poliza.

¿Que son las acciones? Son un activo financiero o un titulo que consiste en un fraccion del capital de una sociedad anonima, en otras palabras es una parte minima en la que se encuentra representado el capital de una empresa.

La compraventa de acciones es una transaccion comercial muy comun dentro de las Sociedades Anonimas de Capital Variable, la principal manera de transmitirlas es por medio del endoso y entrega del titulo, sin perjuicio que puedan transmitirse por cualquier otro medio legal de acuerdo al articulo 26 de la Ley General de

La enajenacion de las acciones nominativas podra hacerse por el simple acuerdo de las partes; mas para que produzca efecto respecto de la sociedad y de terceros, sera necesaria su inscripcion en el libro de registro de acciones, mediante orden escrita del enajenante.

¿Como comprar online acciones en Peru? Tienes que elegir un corredor de bolsa (plataforma online) que opere en Peru. Luego abre una cuenta en dicha plataforma. Ingresa fondos en tu cuenta (con tarjeta de credito, debito, PayPal, etc.). Busca la empresa donde quieres invertir en el dashboard de la plataforma.

Las acciones son uno de los instrumentos mas populares de los mercados financieros. Representa una participacion en el capital de una empresa y convierte a quien las adquiere en accionista o socio de una compania. A traves de las acciones, el inversor se convierte en un dueno de la empresa que elige comprar.

Interesting Questions

More info

Hearing H. Kept. 111-24. May 13, 2005. Retrieved from. Washington. U.S. Government Printing Office. Office of the Chief Financial Officer. 2005.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.