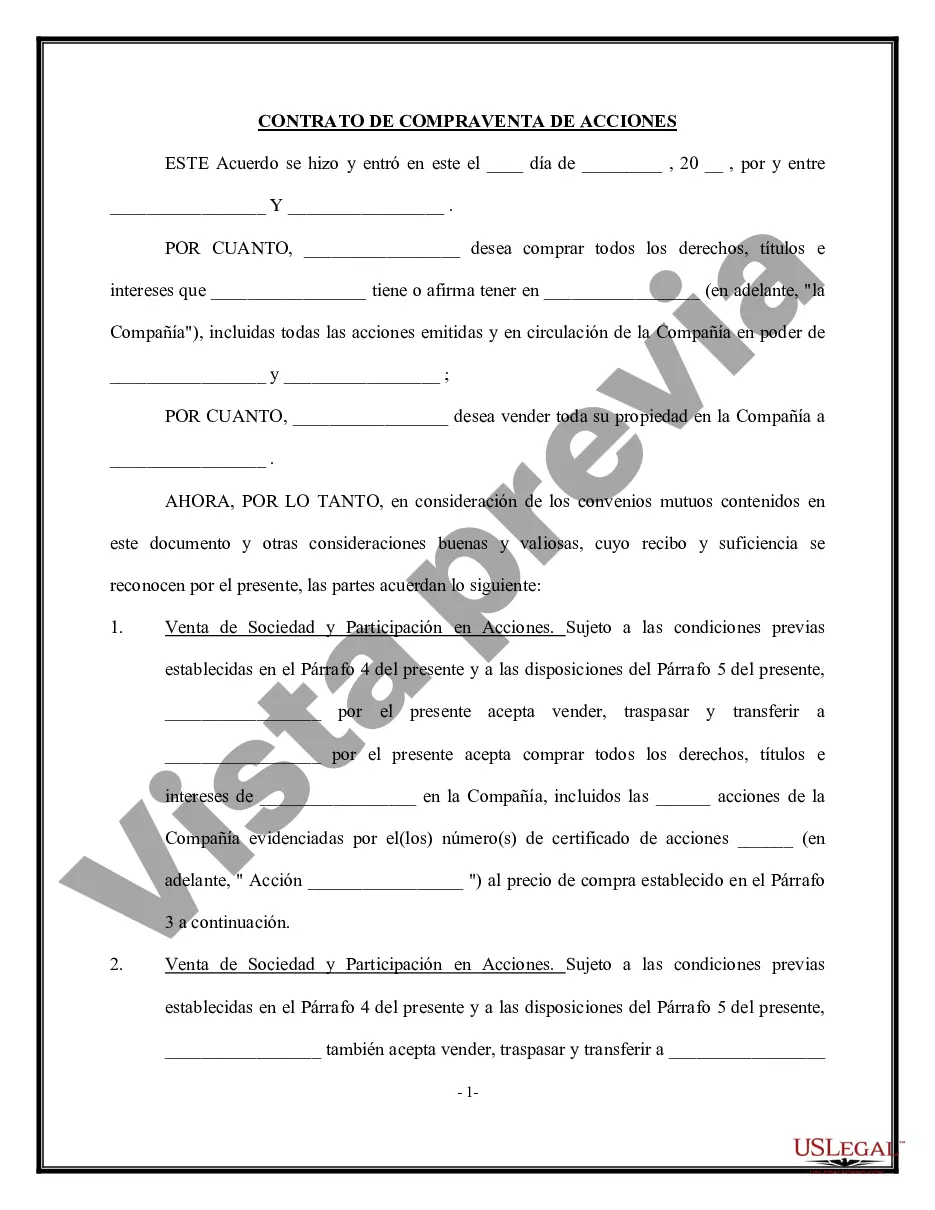

Collin Texas Stock Sale and Purchase Agreement — Sale of Corporation and all stock to Purchaser is a legal document that outlines the terms and conditions of buying or selling a corporation, including all its stocks, in Collin County, Texas. This agreement is designed to protect the rights and interests of both the seller (corporation) and the buyer (purchaser) by specifying crucial details related to the transaction. Keywords: Collin Texas Stock Sale and Purchase Agreement, Sale of Corporation, stock sale agreement, purchase agreement, corporation sale, purchaser, Collin County, Texas. Different types of Collin Texas Stock Sale and Purchase Agreement — Sale of Corporation and all stock to Purchaser may include: 1. Standard Collin Texas Stock Sale and Purchase Agreement: This is the most common type of agreement used for buying or selling a corporation in Collin County, Texas. It includes clauses related to the purchase price, payment terms, warranties, representations, and post-closing obligations. 2. Conditional Stock Sale and Purchase Agreement: In this type of agreement, the completion of the transaction is subject to certain conditions, such as obtaining necessary permits, regulatory approvals, or the satisfaction of certain obligations by either party. These conditions must be fulfilled before the sale can be finalized. 3. Asset Purchase Agreement with Stock Purchase Provisions: This type of agreement involves the sale of a corporation along with its assets, contracts, and liabilities. The purchase of stock is just one component of the overall transaction, with provisions outlining the transfer of other assets or obligations of the corporation. 4. Share Purchase Agreement: This agreement specifically deals with the purchase of shares of a corporation rather than the whole corporation. It stipulates the number of shares being sold, the purchase price per share, and other relevant terms. 5. Stock Sale Agreement with Earn-Out Provisions: An earn-out provision in this type of agreement allows the purchaser to pay a portion of the purchase price based on the future performance of the corporation. This provision typically includes specific milestones or performance targets to determine the additional payment. It is important to consult with a legal professional when preparing or entering into a Collin Texas Stock Sale and Purchase Agreement, as the specific terms and variations of the agreement may vary based on the unique circumstances of the transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Acuerdo de compra y venta de acciones - Venta de la Corporación y todas las acciones al Comprador - Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out Collin Texas Acuerdo De Compra Y Venta De Acciones - Venta De La Corporación Y Todas Las Acciones Al Comprador?

How much time does it usually take you to draft a legal document? Considering that every state has its laws and regulations for every life situation, finding a Collin Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser meeting all local requirements can be exhausting, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most popular state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Apart from the Collin Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser, here you can get any specific document to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed form, and download it. You can retain the file in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Collin Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Collin Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!