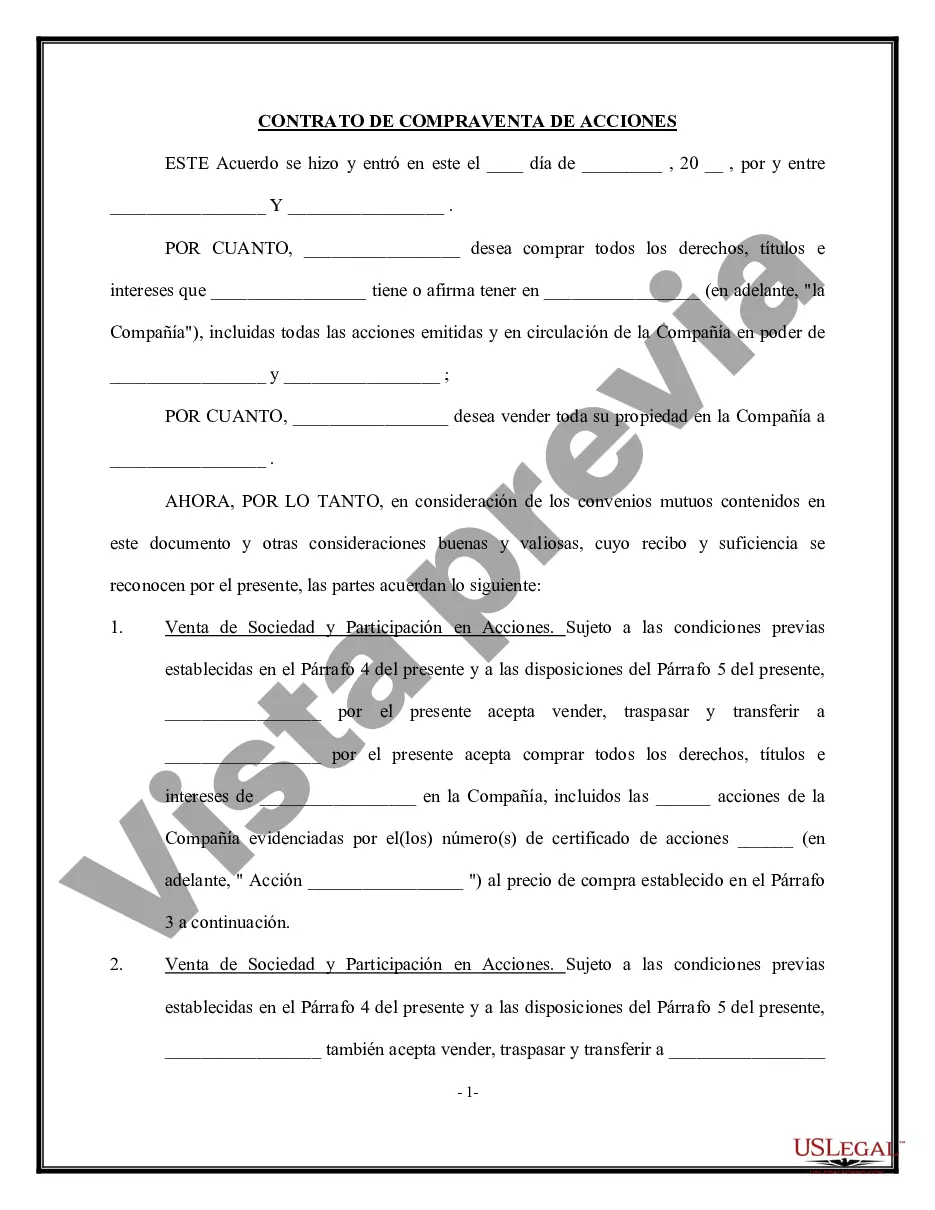

A Maricopa Arizona Stock Sale and Purchase Agreement is a legally binding contract that outlines the terms and conditions for selling a corporation and all of its associated stock to a purchaser. This agreement provides a detailed description of the transaction, including key provisions and considerations. 1. Parties involved: The agreement identifies the seller, who is the owner of the corporation, and the purchaser, who intends to buy the corporation and all its stock. 2. Purchase price and payment terms: The agreement includes the agreed-upon purchase price for the corporation and its stock. It outlines the payment terms, such as the payment schedule, any down payment required, and the method of payment (e.g., cash, bank transfer, installment payments). 3. Stock transfer: The agreement specifies the transfer of stock ownership from the seller to the purchaser, ensuring a seamless transaction. It may include details about the stock certificates, transfer requirements, and any necessary approvals. 4. Assets and liabilities: This agreement may cover the assets and liabilities of the corporation being sold. It outlines the specific assets and liabilities included in the transaction, helping to govern the transfer process and potential indemnification clauses. 5. Representations and warranties: The seller provides representations and warranties related to the corporation, its stock, and any associated matters. These representations assure the purchaser that the information provided is accurate and complete, protecting them from future liabilities. 6. Closing and conditions: The agreement establishes the closing date, by which all necessary steps and conditions for the transaction must be met. It may include conditions such as obtaining necessary consents, approvals, or releasing any encumbrances on the stock or corporation. 7. Indemnification: The agreement may outline indemnification provisions that protect both parties from any potential losses, damages, or legal proceedings arising from the transaction. It clarifies the responsibility of each party in case of a breach or misrepresentation. Additional types or variations of the Maricopa Arizona Stock Sale and Purchase Agreement- Sale of Corporation and all stock to Purchaser may include: 1. Asset Sale Agreement: Unlike a stock sale, this agreement focuses on the sale of the corporation's individual assets rather than selling the entire entity, including stocks and liabilities. 2. Share Purchase Agreement: Instead of purchasing the entire corporation, this agreement involves the purchase of specific shares from existing shareholders, typically resulting in a change in ownership. 3. Merger Agreement: In case of a merger between two corporations, this agreement outlines the terms and conditions governing the consolidation, including the transfer of stock and assets. It is essential to consult legal professionals familiar with Maricopa Arizona regulations and conduct due diligence to ensure that the agreement meets all legal requirements and protects the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de compra y venta de acciones - Venta de la Corporación y todas las acciones al Comprador - Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out Maricopa Arizona Acuerdo De Compra Y Venta De Acciones - Venta De La Corporación Y Todas Las Acciones Al Comprador?

Draftwing paperwork, like Maricopa Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser, to take care of your legal matters is a tough and time-consumming task. Many situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can get your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms created for a variety of scenarios and life circumstances. We ensure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Maricopa Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before getting Maricopa Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser:

- Ensure that your document is specific to your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or reading a quick intro. If the Maricopa Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start utilizing our service and download the document.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s easy to find and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!