A Sacramento California Stock Sale and Purchase Agreement is a legal document that outlines the terms and conditions surrounding the sale and purchase of a corporation's stock to a purchaser. This agreement is designed to protect the interests of both parties involved and ensure a smooth and transparent transaction. Key elements of a Sacramento California Stock Sale and Purchase Agreement include: 1. Parties: The agreement will clearly identify the corporation selling the stock (the "Seller") and the purchaser who intends to buy the stock (the "Purchaser"). It is essential to accurately provide the legal entity names and addresses of both parties. 2. Purchase Price: The agreement will state the agreed-upon purchase price for the corporation's stock. This price can be a lump sum, paid in installments, or contingent upon certain conditions. The currency and payment terms should be clearly specified. 3. Closing Date: The agreement will specify the date on which the transaction will be completed. This is known as the closing date. It is important to include provisions for extensions or conditions that may affect the closing date (such as regulatory approvals). 4. Representations and Warranties: Both parties will provide representations and warranties to ensure the accuracy of the information and protect against potential liabilities. This may include assurances that the Seller has full legal authority to sell the stock and that the stock is free from encumbrances. 5. Closing Conditions: The agreement will outline any conditions that must be fulfilled before the transaction can be completed. These conditions may include obtaining necessary approvals, consents, or clearances from third parties. 6. Indemnification and Remedies: The agreement will include provisions for indemnification, outlining the responsibilities of each party in case of breach or misrepresentation. It should also define the available remedies in case of disputes or non-compliance with the agreement terms. 7. Governing Law and Jurisdiction: The agreement will specify the governing law (e.g., California law) and the jurisdiction for any legal proceedings that may arise from the agreement. Different types of Sacramento California Stock Sale and Purchase Agreements can be categorized based on the specific details of the transaction. Some variations can include: 1. Asset Purchase Agreement: Instead of buying the corporation's stock, the purchaser acquires specific assets and liabilities of the corporation. 2. Stock Purchase Agreement with Escrow: Funds are held in escrow to ensure the fulfillment of certain conditions or indemnification obligations. The release of funds from escrow is contingent upon these conditions being met. 3. Merger Agreement: In this type of agreement, two or more corporations combine to form a new entity. The agreement outlines the terms of the merger, including the exchange ratio and governance structure of the new entity. In conclusion, a Sacramento California Stock Sale and Purchase Agreement is a crucial document to ensure a smooth and legally compliant transaction when selling or purchasing a corporation's stock. It provides a comprehensive framework for both parties and protects their rights and interests throughout the process.

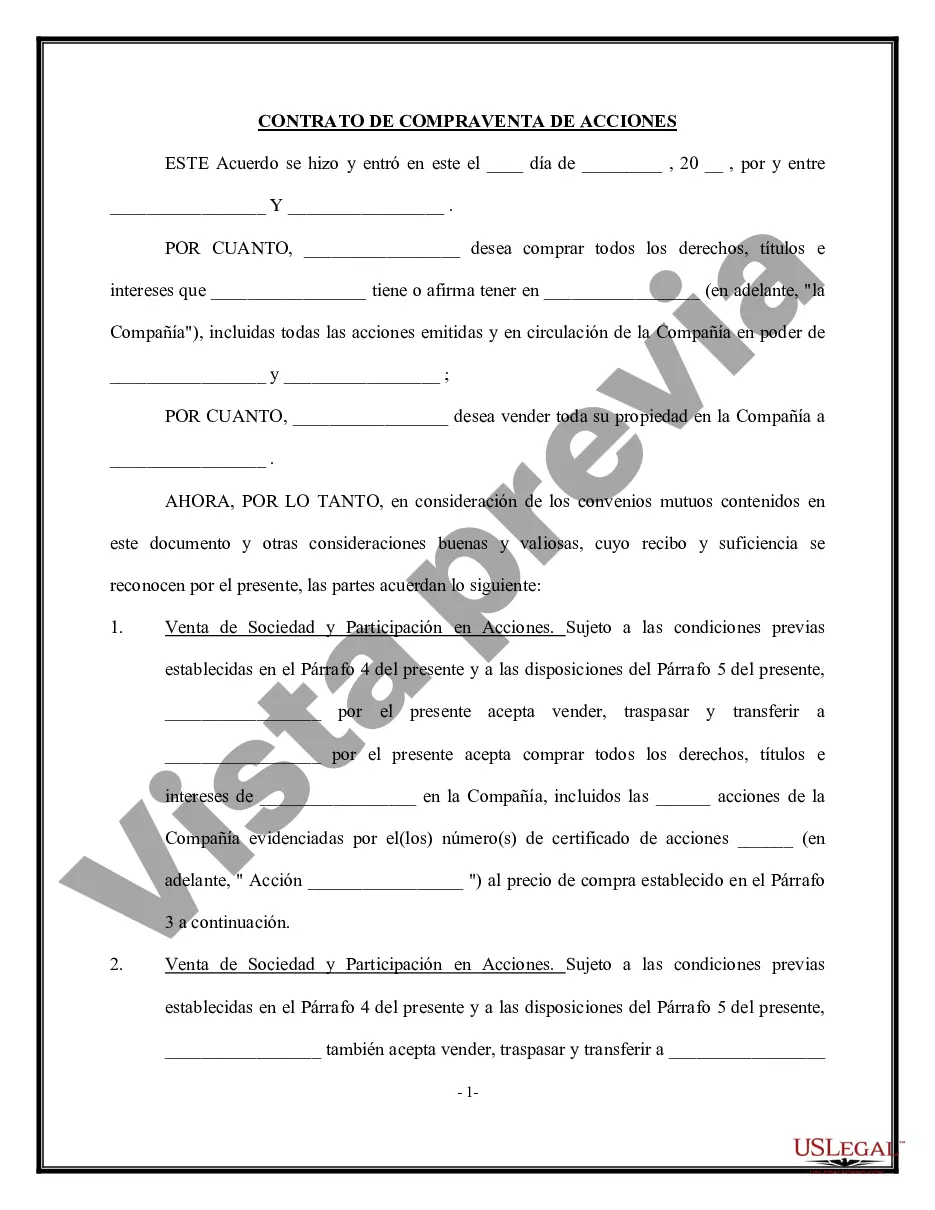

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Acuerdo de compra y venta de acciones - Venta de la Corporación y todas las acciones al Comprador - Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out Sacramento California Acuerdo De Compra Y Venta De Acciones - Venta De La Corporación Y Todas Las Acciones Al Comprador?

Creating legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including Sacramento Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less challenging. You can also find information resources and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can locate and download Sacramento Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser.

- Go over the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the related forms or start the search over to find the correct document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Sacramento Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Sacramento Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney completely. If you need to cope with an exceptionally challenging case, we recommend using the services of an attorney to examine your document before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant paperwork with ease!