A stock sale and purchase agreement is a crucial legal document that outlines the terms and conditions for the sale and purchase of a corporation and all the stock held in it by a purchaser. San Antonio, Texas, being a bustling city known for its economic growth and business opportunities, witnesses numerous stock sale and purchase transactions each year. In this article, we will delve into the specifics of a San Antonio Texas Stock Sale and Purchase Agreement, highlighting its key features and different types. Key Elements of a San Antonio Texas Stock Sale and Purchase Agreement: 1. Parties: The agreement will identify the involved parties — the seller, who is the owner of the corporation and stock, and the purchaser, who intends to acquire the corporation and associated stock. 2. Purchase Price and Payment Terms: The agreement will contain details regarding the agreed-upon purchase price of the corporation and stock. It will also outline the payment terms, such as the payment method, installments (if any), and the timeline for completing the payment. 3. Representations and Warranties: Both parties will provide representations and warranties regarding the corporation and its stock. This section verifies the accuracy of information, financial statements, compliance with laws and regulations, and any potential liabilities or legal issues associated with the corporation. 4. Due Diligence and Inspections: The purchaser is typically granted a period to conduct due diligence and inspections on the corporation and its stock. This allows them to verify the accuracy of the provided information and assess any risks or potential concerns. 5. Closing and Transfer: The agreement specifies the closing date, i.e., the date on which the transfer of the corporation and stock will be completed. It includes instructions related to the transfer of stock certificates and other necessary documents to effect the ownership transfer. 6. Conditions Precedent: Certain conditions may need to be met before the agreement becomes binding. For example, the approval of existing stockholders, necessary regulatory approvals, or the absence of any material adverse changes in the corporation's financial position. Different Types of San Antonio Texas Stock Sale and Purchase Agreements: While the general structure of a stock sale and purchase agreement remains similar, variations can arise depending on specific circumstances or transaction types. Some variations that may exist within San Antonio, Texas, include: 1. Stock Sale and Purchase Agreement for Private Corporations: This type of agreement is tailored for transactions involving privately-held corporations. 2. Stock Sale and Purchase Agreement for Publicly Traded Corporations: For transactions involving publicly traded corporations, this agreement considers additional regulatory compliance, disclosure requirements, and shareholder considerations. 3. Stock Sale and Purchase Agreement with Earn out Provision: In cases where a portion of the purchase price is tied to future performance or earn out, this agreement includes provisions defining the performance metrics, payment calculations, and related terms. 4. Stock Sale and Purchase Agreement with Seller Financing: If the seller provides financing to facilitate the transaction, this agreement incorporates terms related to the loan amount, interest rates, repayment schedule, and any associated security or collateral. It is essential for parties involved in a stock sale and purchase agreement to consult legal professionals familiar with San Antonio, Texas laws and regulations to ensure compliance and protection of their interests throughout the transaction process.

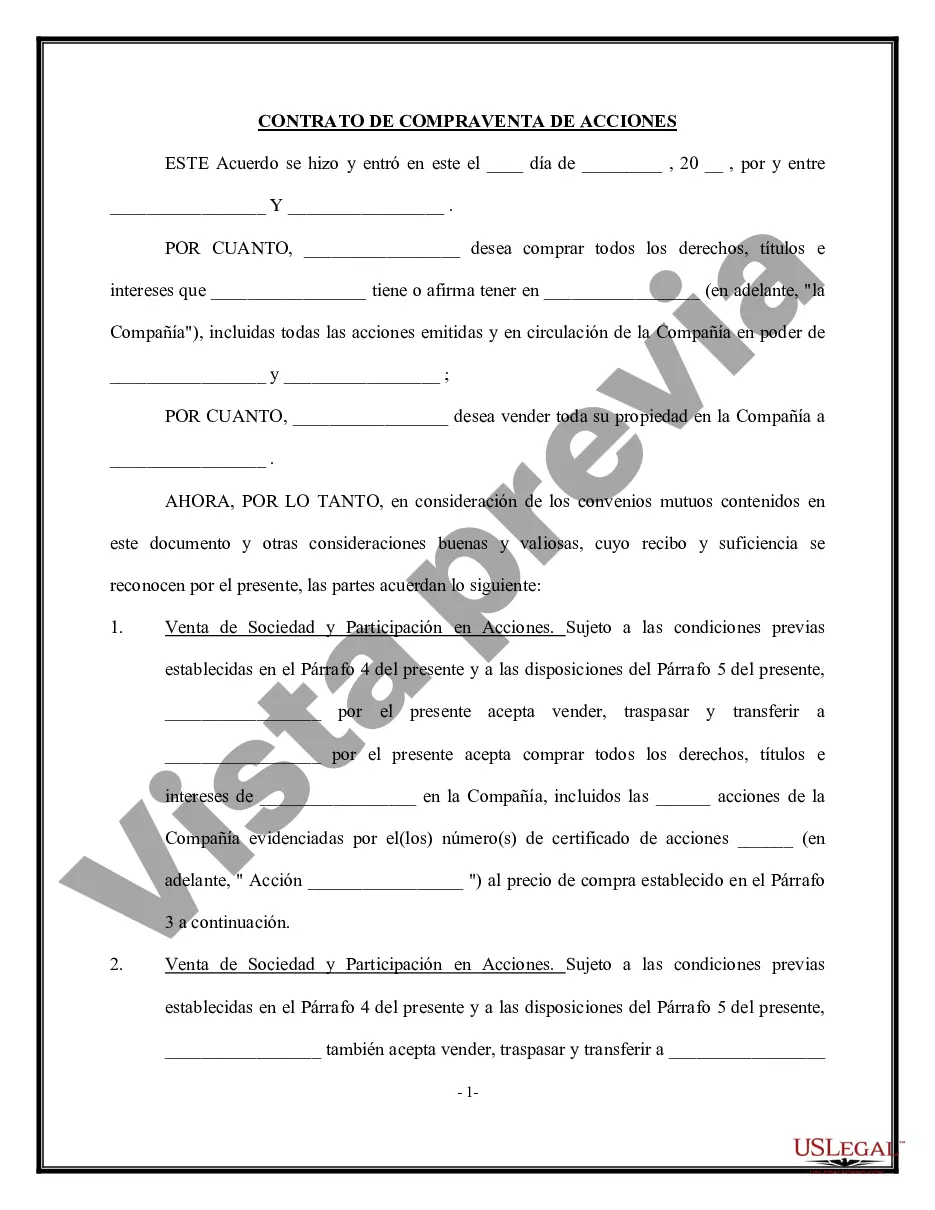

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Acuerdo de compra y venta de acciones - Venta de la Corporación y todas las acciones al Comprador - Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

How to fill out San Antonio Texas Acuerdo De Compra Y Venta De Acciones - Venta De La Corporación Y Todas Las Acciones Al Comprador?

Preparing documents for the business or individual needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state regulations of the specific area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to generate San Antonio Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser without expert assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid San Antonio Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser on your own, using the US Legal Forms online library. It is the most extensive online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the San Antonio Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser:

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!