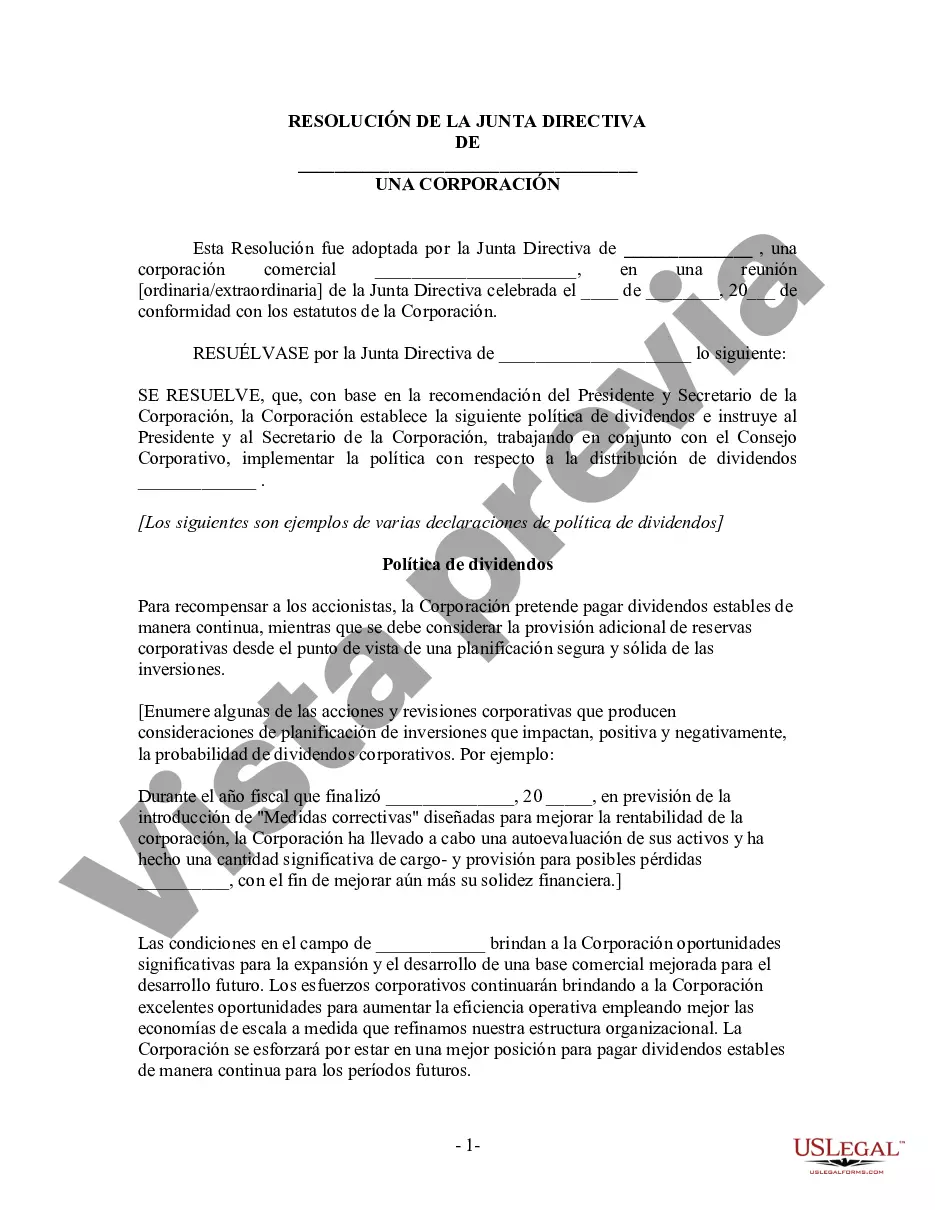

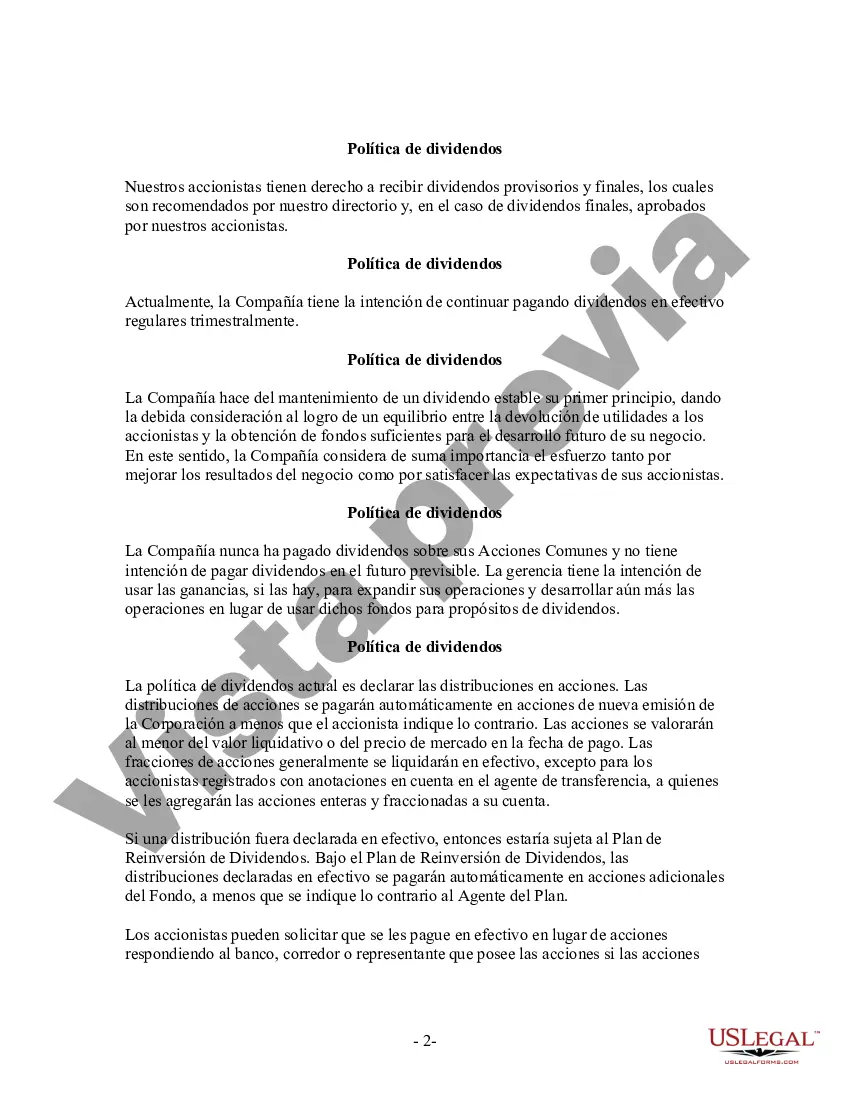

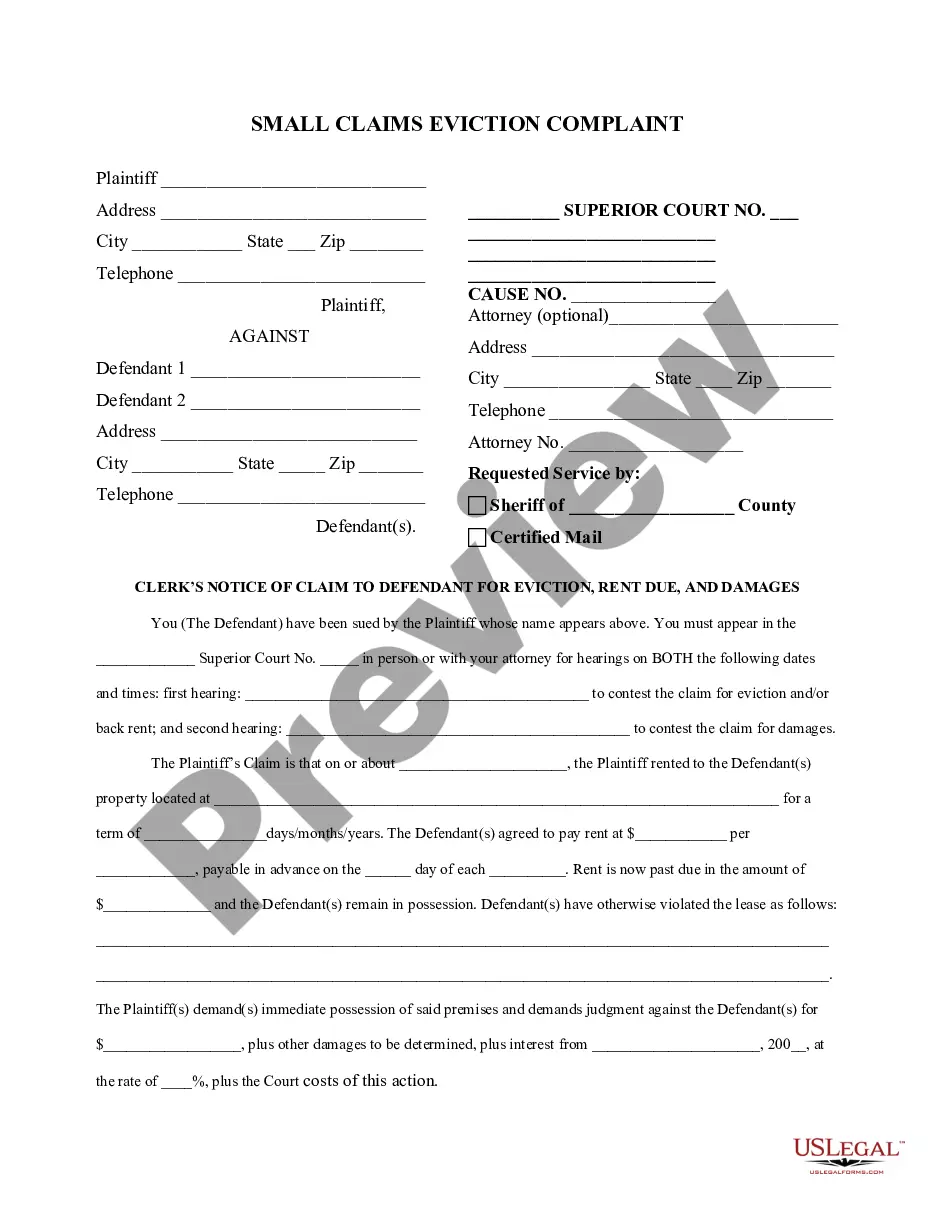

Harris Texas Dividend Policy — Resolution For— - Corporate Resolutions is a document that outlines the guidelines and procedures for distributing dividends to shareholders in the Harris Texas corporation. This policy demonstrates the company's commitment to effective dividend management and shareholder value maximization. The main purpose of this resolution form is to establish a clear framework for declaring and paying dividends to shareholders. It specifies the criteria and conditions that must be met for dividends to be distributed, ensuring transparency and fairness in the dividend allocation process. Key elements covered in the Harris Texas Dividend Policy — Resolution For— - Corporate Resolutions include: 1. Eligibility Criteria: This section outlines the shareholders who are eligible to receive dividends. It may highlight factors such as the shares' ownership duration, class of shareholders, voting rights, and other specific requirements. 2. Dividend Declaration Procedure: The resolution form outlines the process through which the board of directors declares dividends. It includes the frequency of dividend declarations, the financial criteria to be considered, and the necessary approvals or authorizations involved. 3. Dividend Calculation: This section describes the formula and methodology used for calculating dividend amounts. It may specify calculations based on earnings per share, net income, or other financial metrics. 4. Dividend Payment Schedule: The resolution form indicates the frequency and timing of dividend payments. It may stipulate whether dividends are paid quarterly, semi-annually, or annually, along with the specific dates for declaration and distribution. 5. Dividend Reinvestment: Some Harris Texas corporations may offer a dividend reinvestment program (DRIP) to provide shareholders with the option to reinvest dividends into additional company shares. The resolution form may outline the process and requirements necessary to participate in such a program. 6. Dividend Policy Amendment: Should the need arise to amend the dividend policy, this section outlines the procedures and prerequisites for proposing and implementing any changes. It may specify the majority or super majority required for approval. Different types of Harris Texas Dividend Policy — Resolution For— - Corporate Resolutions may exist based on the specific needs and circumstances of the corporation. These can include a standard dividend policy resolution form for general use, as well as specialized forms for different classes of shares or varying dividend payout scenarios. Ultimately, the Harris Texas Dividend Policy — Resolution For— - Corporate Resolutions play a crucial role in maintaining fair and consistent dividend distribution practices within the Harris Texas corporation. By adhering to this policy, the company seeks to promote transparency, bolster investor confidence, and ultimately maximize shareholder value.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Política de Dividendos - Formulario de Resoluciones - Resoluciones Corporativas - Dividend Policy - Resolution Form - Corporate Resolutions

Description

How to fill out Harris Texas Política De Dividendos - Formulario De Resoluciones - Resoluciones Corporativas?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid pricey legal assistance when preparing the Harris Dividend Policy - Resolution Form - Corporate Resolutions, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals searching for do-it-yourself templates for various life and business occasions. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Harris Dividend Policy - Resolution Form - Corporate Resolutions from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Harris Dividend Policy - Resolution Form - Corporate Resolutions:

- Take a look at the page content to ensure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the document once you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!