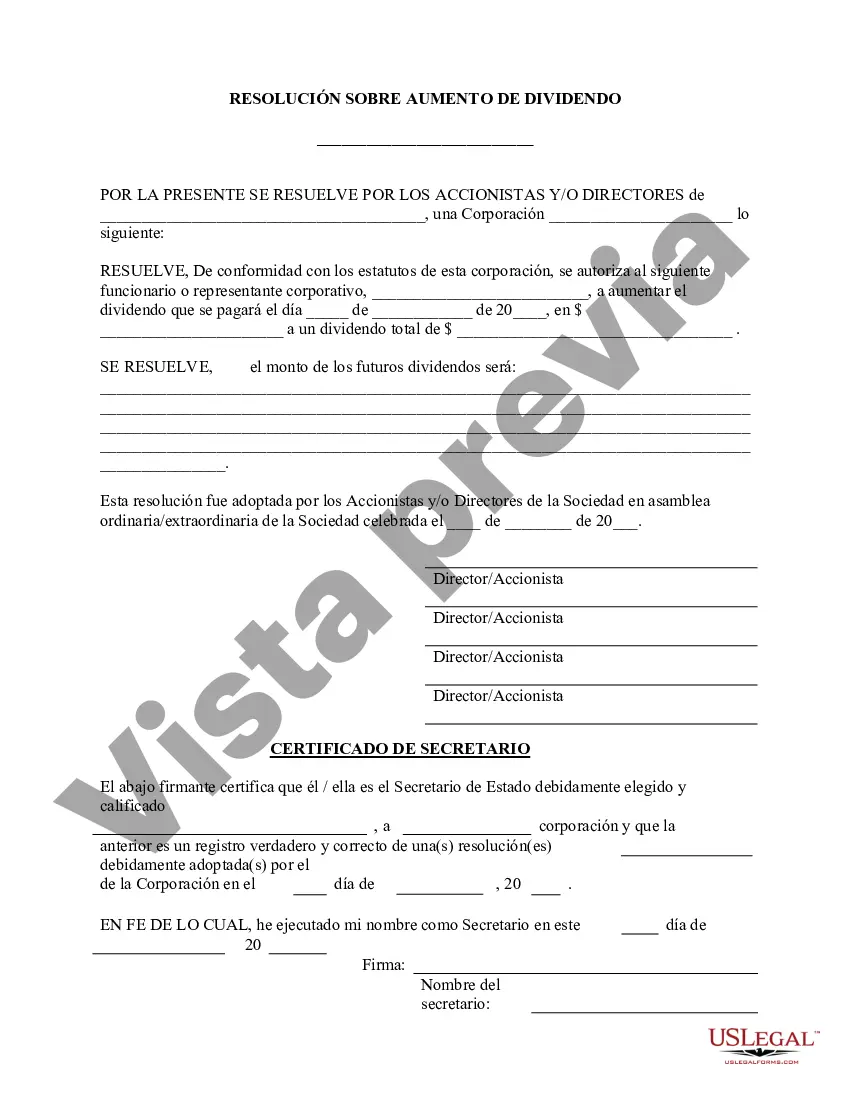

Fairfax Virginia Increase Dividend — Resolution For— - Corporate Resolutions: Fairfax, Virginia is a thriving city located in the Northern Virginia region of the United States. Known for its rich history, diverse community, and strong economy, Fairfax offers a conducive business environment for corporations and entrepreneurs alike. One of the key aspects of corporate resolutions in Fairfax is the opportunity for companies to increase dividends. By adopting a resolution to increase dividends, corporations demonstrate their commitment to rewarding shareholders and generating value. The Fairfax Virginia Increase Dividend — Resolution Form is a legal document that enables corporations to officially propose and implement a dividend increase. This form outlines the necessary details related to the dividend increase, such as the proposed dividend amount, the payment schedule, and any additional conditions or requirements. It serves as a structured method for corporations to ensure transparency, accountability, and compliance throughout the dividend increase process. There are various types of Fairfax Virginia Increase Dividend — Resolution Forms that cater to the specific needs and circumstances of different corporations. Some common types include: 1. General Increase Dividend Resolution Form: This is the standard form used by corporations to propose a general increase in dividends for all shareholders. It outlines the overall dividend amount and provides a timeline for implementation. 2. Special Dividend Increase Resolution Form: In certain situations, corporations may opt for a special dividend increase. This form is used when a one-time increase in dividends is proposed, often due to exceptional financial performance, surplus cash reserves, or specific events like asset sales or mergers. 3. Preferred Stock Dividend Increase Resolution Form: Corporations that have issued preferential shares may use this form to propose an increase in dividends for the holders of such stocks. The form addresses the specific terms and conditions associated with the preferred stock dividend increase. 4. Qualified Dividend Increase Resolution Form: In cases where corporations wish to avail tax benefits associated with qualified dividends, this form is utilized. It specifies the dividend amount that qualifies for favorable tax rates, ensuring compliance with tax regulations. Overall, the Fairfax Virginia Increase Dividend — Resolution For— - Corporate Resolutions provides a robust framework for corporations to diligently consider and propose dividend increases. This documentation ensures clarity, adherence to legal requirements, and serves as a record of the decision-making process related to dividend distributions. With these resolution forms, Fairfax corporations can effectively navigate the procedure of increasing dividends while upholding transparency and corporate governance standards.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Incrementar Dividendo - Formulario de Resoluciones - Resoluciones Corporativas - Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Fairfax Virginia Incrementar Dividendo - Formulario De Resoluciones - Resoluciones Corporativas?

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life scenario, finding a Fairfax Increase Dividend - Resolution Form - Corporate Resolutions suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, gathered by states and areas of use. In addition to the Fairfax Increase Dividend - Resolution Form - Corporate Resolutions, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Professionals verify all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the needed sample, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the website, there will be a few more actions to complete before you get your Fairfax Increase Dividend - Resolution Form - Corporate Resolutions:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Fairfax Increase Dividend - Resolution Form - Corporate Resolutions.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!