Houston, Texas is a vibrant city known for its diverse economy, booming energy sector, and world-renowned cultural institutions. It is the fourth-largest city in the United States and a major hub for business and innovation. One important aspect of corporate operations in Houston, Texas is the process of increasing dividends for businesses. Corporate Resolutions play a crucial role in formalizing such decisions. The Houston Texas Increase Dividend-Resolution Form is a document utilized by corporations in Houston, Texas, to authorize and enact an increase in dividends for their shareholders. This form serves as a formal resolution enacted by the board of directors, outlining the details and terms of the dividend increase. Corporate Resolutions are essential in ensuring transparency, compliance, and accountability within an organization. By providing a clear record of the board's decision to increase dividends, the resolution form acts as an official documentation that binds the corporation to honor its commitment to its investors. There can be various types of Houston Texas Increase Dividend — Resolution Forms categorized based on different criteria. One classification could be based on the type of corporation, such as public, private, or non-profit organizations. Another categorization could be based on the circumstances leading to the dividend increase, such as profit growth, surplus capital, or prior accumulated reserves. Public Corporation Dividend Increase — Resolution Form: This type of resolution form is designed specifically for publicly traded corporations in Houston, Texas. Public companies are subject to numerous regulations and reporting requirements, making the dividend increase resolutions more intricate and subject to approval from regulatory bodies. Private Corporation Dividend Increase — Resolution Form: Private corporations in Houston, Texas also require a specific resolution form to increase dividends. These forms might reflect a more flexible approach as private entities possess greater autonomy to shape their dividend policies. The resolutions typically require approval from the board of directors and major shareholders. Non-Profit Corporation Dividend Increase — Resolution Form: For non-profit organizations operating in Houston, Texas, this type of resolution form is unique. Dividend increases for non-profit corporations often refer to surplus distributions or allocations, whereby excess funds accumulated are reinvested into the organization's mission instead of being distributed to shareholders. In conclusion, Houston, Texas is a prominent business hub where increasing dividends for corporations plays a significant role. Corporate Resolutions, such as the Houston Texas Increase Dividend — Resolution Form, provide the necessary framework for solidifying dividend decisions. Depending on the corporation's type and circumstances of the dividend increase, different variations of these resolution forms may be employed to ensure compliance and clarity in the process.

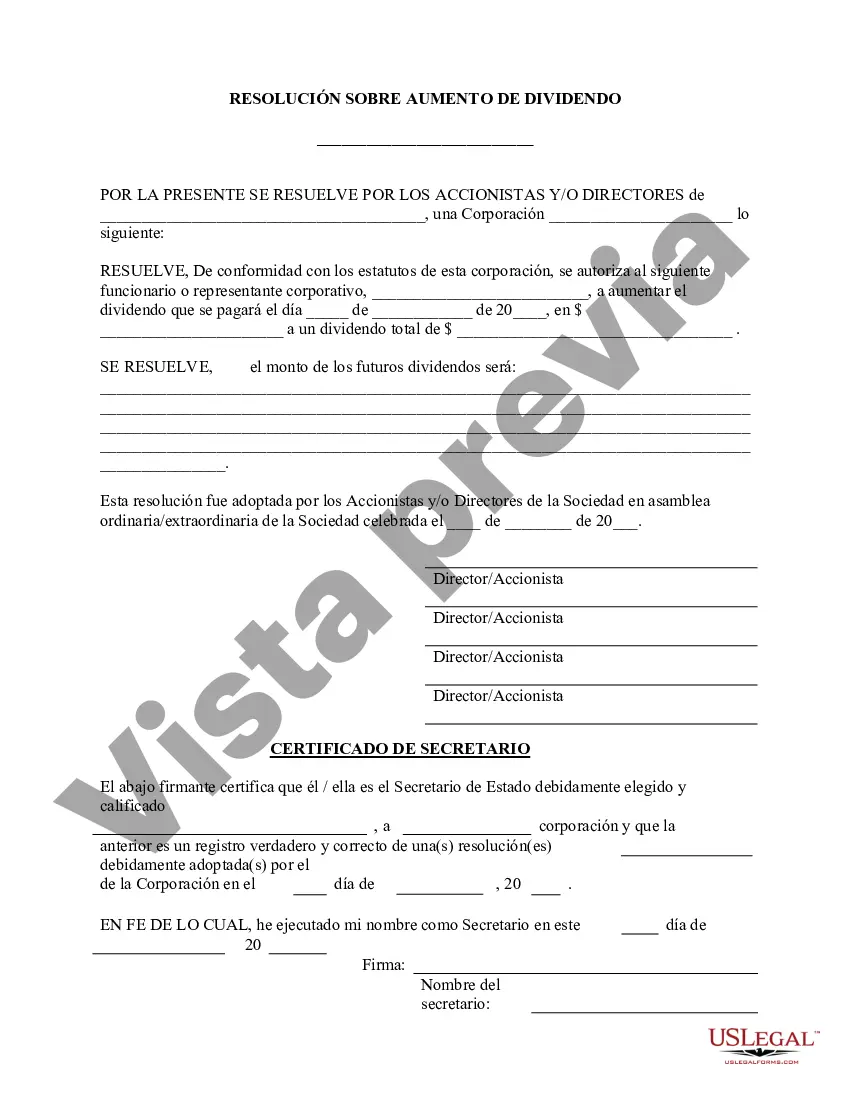

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Incrementar Dividendo - Formulario de Resoluciones - Resoluciones Corporativas - Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Houston Texas Incrementar Dividendo - Formulario De Resoluciones - Resoluciones Corporativas?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business objective utilized in your county, including the Houston Increase Dividend - Resolution Form - Corporate Resolutions.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Houston Increase Dividend - Resolution Form - Corporate Resolutions will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guide to get the Houston Increase Dividend - Resolution Form - Corporate Resolutions:

- Ensure you have opened the correct page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Look for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Houston Increase Dividend - Resolution Form - Corporate Resolutions on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!