San Jose, California is a bustling city known for its thriving technology industry and diverse communities. However, when it comes to hiring and managing employees who will be working in a foreign country, employers often need to establish a San Jose California Contract with Employee to Work in a Foreign Country. This contract is a legally binding agreement between an employer and an employee, outlining the terms and conditions of employment in a foreign country. It is crucial for both parties involved to clearly understand their rights, obligations, and responsibilities throughout the duration of the employment. Here are some key elements that should be included in a San Jose California Contract with Employee to Work in a Foreign Country: 1. Introduction: The contract should start with a clear identification of both the employer and the employee, including their legal names and contact information. It should also state the purpose of the contract, which is to define the terms of employment for the employee in the foreign country. 2. Term of Employment: The contract should specify the length of the employment, including the start date and the anticipated end date. If there are any provisions for contract extensions or early terminations, they should be clearly outlined. 3. Job Description: A detailed job description should be provided, outlining the employee's duties, roles, and responsibilities in the foreign country. It should include information about any relevant qualifications, certifications, or special skills required for the position. 4. Compensation and Benefits: The contract should clearly state the employee's salary or hourly rate, payment frequency, and any additional benefits or allowances provided by the employer, such as housing, transportation, health insurance, or retirement plans. It should also mention the currency in which the salary will be paid. 5. Immigration and Work Permits: As the employee will be working in a foreign country, it is important to address the necessary immigration and work permit requirements. The contract should specify who will be responsible for obtaining and covering the costs associated with the required permits, visas, and related documents. 6. Taxation and Social Security: The contract should outline the employee's tax obligations, including any applicable income tax, social security contributions, or other payroll deductions, in compliance with the laws of the foreign country. It should also mention the employer's responsibilities in terms of withholding and remitting these taxes on behalf of the employee. 7. Repatriation and Termination: The contract should include provisions for repatriation, which outline what happens when the employee's assignment is completed or terminated. It should address issues such as return transportation, severance pay, and any additional benefits or compensation entitled to the employee upon termination. Different types of San Jose California Contracts with Employee to Work in a Foreign Country may exist depending on various factors. Some common variations include fixed-term contracts (with a predetermined end date), indefinite contracts (without a specified end date), or expatriate contracts (specifically tailored for employees sent abroad by their employer). In conclusion, a San Jose California Contract with Employee to Work in a Foreign Country is a crucial document that helps establish a clear understanding between the employer and the employee regarding their rights and obligations while working abroad. By carefully considering and including the relevant keywords mentioned above, employers can ensure a comprehensive and effective agreement that protects both parties' interests in an international employment context.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Contrato con Empleado para Trabajar en un País Extranjero - Contract with Employee to Work in a Foreign Country

Description

How to fill out San Jose California Contrato Con Empleado Para Trabajar En Un País Extranjero?

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to create some of them from scratch, including San Jose Contract with Employee to Work in a Foreign Country, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories varying from living wills to real estate papers to divorce papers. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any activities related to document completion straightforward.

Here's how you can find and download San Jose Contract with Employee to Work in a Foreign Country.

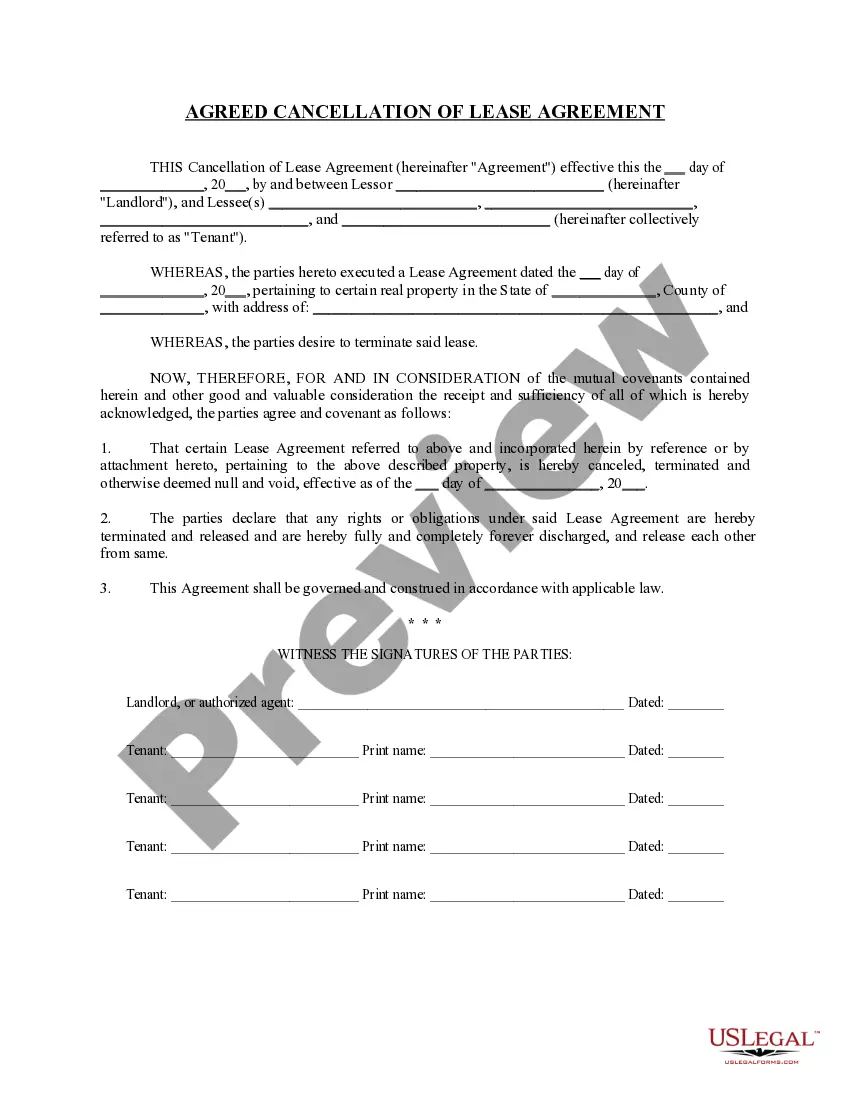

- Take a look at the document's preview and description (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar forms or start the search over to locate the right document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the pricing {plan, then a suitable payment gateway, and purchase San Jose Contract with Employee to Work in a Foreign Country.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate San Jose Contract with Employee to Work in a Foreign Country, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional entirely. If you need to cope with an exceptionally complicated situation, we advise using the services of an attorney to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and purchase your state-compliant documents effortlessly!