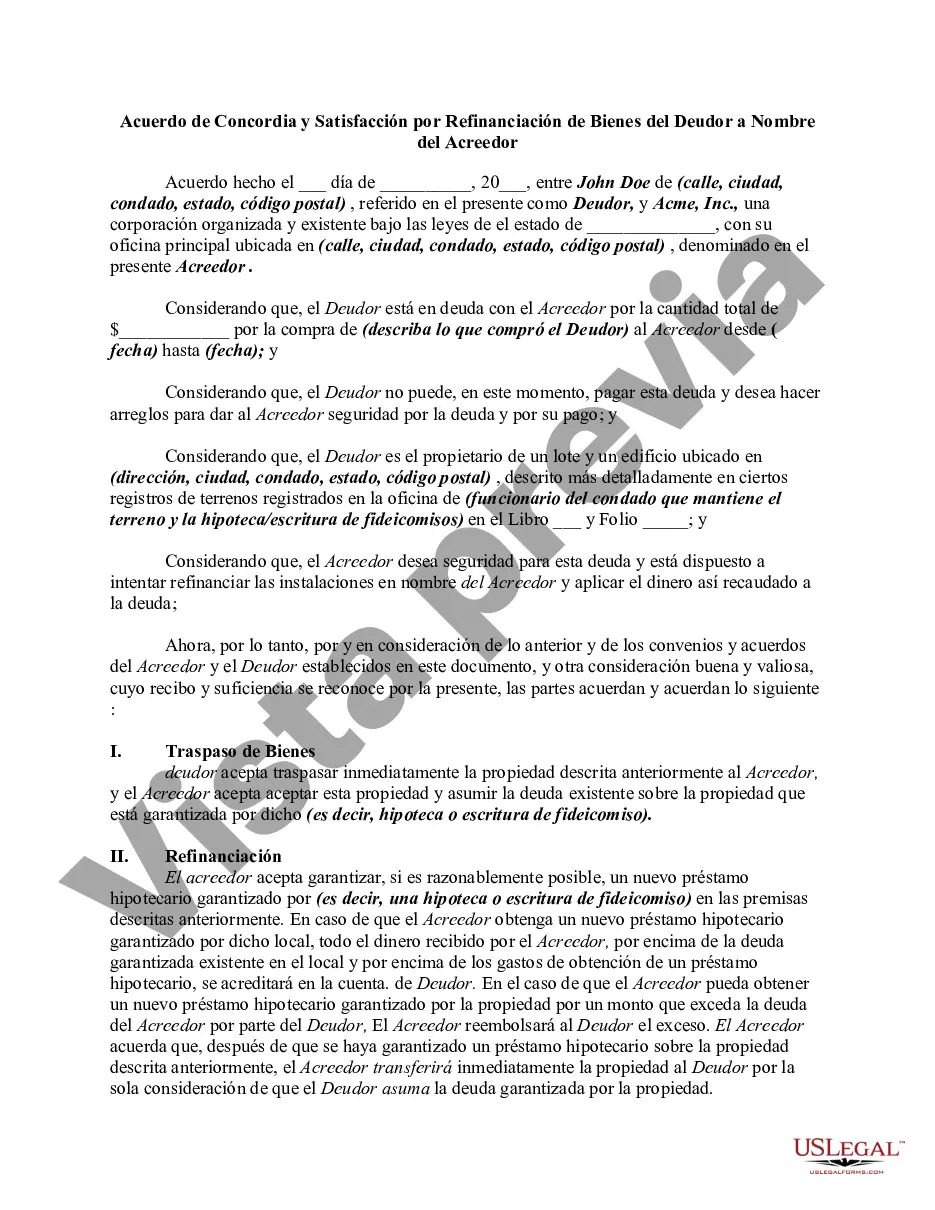

An accord and satisfaction is a method of discharging a contract by substituting for the contract an agreement for its satisfaction and the execution of the substituted agreement. The accord is the agreement. The satisfaction is the execution or performance of the agreement.

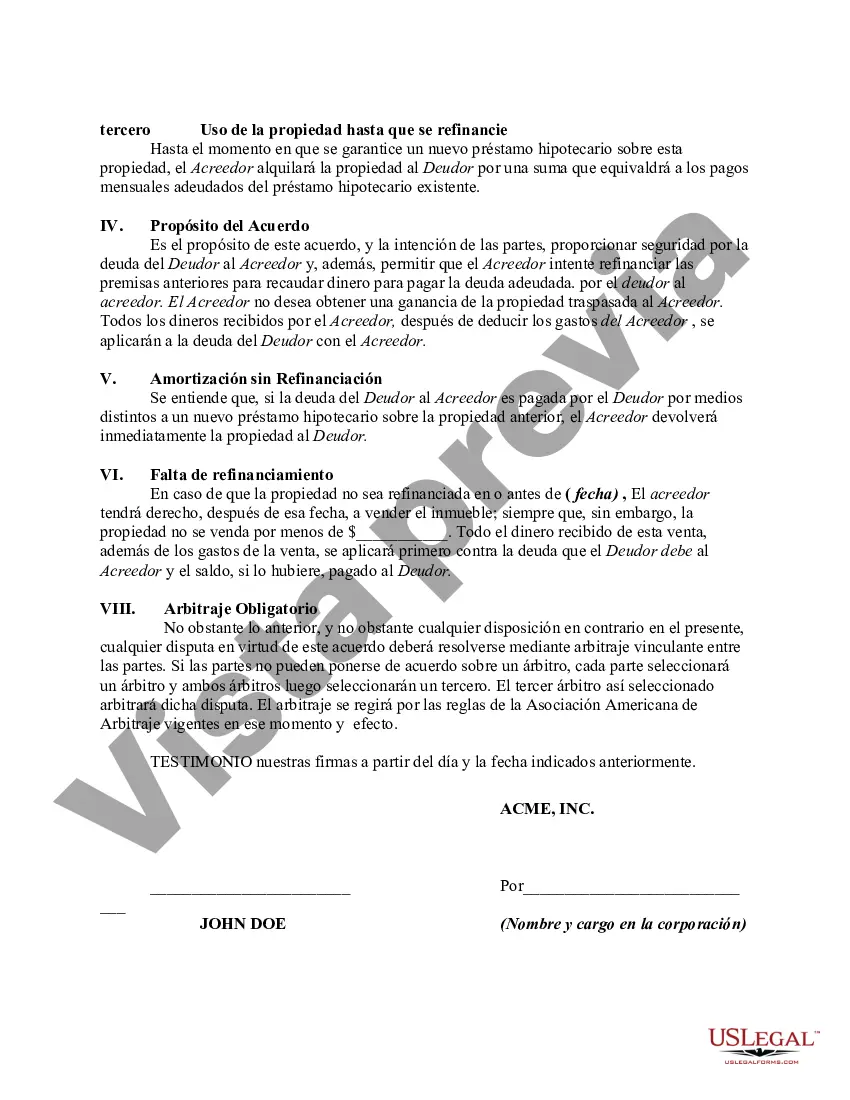

In this form, Creditor agrees to secure a new mortgage loan secured by a mortgage or deed of trust on certain real property owned by Debtor. In the event that Creditor does secure a new mortgage loan, all moneys received by Creditor, over and above the existing secured indebtedness on the premises and over and above the expenses of obtaining a mortgage loan, will be credited to the account of Debtor. In the event that Creditor is able to obtain a new mortgage loan secured by the premises in an amount that would exceed the debt owing Creditor by Debtor, Creditor will refund to Debtor the excess amount. Creditor agrees that, after a mortgage loan has been secured on the above-described property, Creditor will immediately convey the property to Debtor for the sole consideration of the assumption by Debtor of the indebtedness secured by the property.

Until such time as a new mortgage loan is secured on this property, Creditor will rent the property to Debtor for a sum that will equal the monthly payments due on the existing mortgage loan.

San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor is a legal document that outlines the terms and conditions surrounding the refinancing of a debtor's property to settle a debt. This agreement allows the creditor to obtain ownership or control over the debtor's property in exchange for the forgiveness of the outstanding debt. The San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor aims to protect the rights and interests of both parties involved in the transaction. It ensures that the creditor receives the necessary security for the debt while obligating the debtor to comply with the repayment terms laid out in the agreement. Key provisions typically found in this agreement include the identification of the debtor and creditor, detailed description of the property being refinanced, the total outstanding debt amount, the terms of repayment, and the legal consequences in case of default or breach of contract. It's important to note that there can be different types of San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor, depending on the specifics of the situation. Some common variations may include: 1. Residential Property Refinancing Agreement: This type of agreement focuses on the refinancing of residential properties, such as houses or apartments. 2. Commercial Property Refinancing Agreement: This agreement pertains to the refinancing of commercial properties, such as office buildings, retail spaces, or warehouses. 3. Mortgage Refinancing Agreement: This specific type of agreement is used when the debtor's property is encumbered by a mortgage, and the refinancing involves replacing the existing mortgage with a new one. 4. Promissory Note Refinancing Agreement: In cases where the debtor has executed a promissory note for the debt, this type of agreement specifically deals with the refinancing of the underlying promissory note. These different types of San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor help tailor the agreement to the specific nature of the property and debt being dealt with, ensuring clarity and precision in the contractual terms. In conclusion, the San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor is a legally binding document that governs the refinancing of a debtor's property to settle a debt. Its various types, such as residential, commercial, mortgage, or promissory note refinancing agreements, help accommodate different situations and provide a comprehensive framework for the agreement between the debtor and creditor.San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor is a legal document that outlines the terms and conditions surrounding the refinancing of a debtor's property to settle a debt. This agreement allows the creditor to obtain ownership or control over the debtor's property in exchange for the forgiveness of the outstanding debt. The San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor aims to protect the rights and interests of both parties involved in the transaction. It ensures that the creditor receives the necessary security for the debt while obligating the debtor to comply with the repayment terms laid out in the agreement. Key provisions typically found in this agreement include the identification of the debtor and creditor, detailed description of the property being refinanced, the total outstanding debt amount, the terms of repayment, and the legal consequences in case of default or breach of contract. It's important to note that there can be different types of San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor, depending on the specifics of the situation. Some common variations may include: 1. Residential Property Refinancing Agreement: This type of agreement focuses on the refinancing of residential properties, such as houses or apartments. 2. Commercial Property Refinancing Agreement: This agreement pertains to the refinancing of commercial properties, such as office buildings, retail spaces, or warehouses. 3. Mortgage Refinancing Agreement: This specific type of agreement is used when the debtor's property is encumbered by a mortgage, and the refinancing involves replacing the existing mortgage with a new one. 4. Promissory Note Refinancing Agreement: In cases where the debtor has executed a promissory note for the debt, this type of agreement specifically deals with the refinancing of the underlying promissory note. These different types of San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor help tailor the agreement to the specific nature of the property and debt being dealt with, ensuring clarity and precision in the contractual terms. In conclusion, the San Jose, California Agreement for Accord and Satisfaction by Refinancing Debtor's Property in the Name of Creditor is a legally binding document that governs the refinancing of a debtor's property to settle a debt. Its various types, such as residential, commercial, mortgage, or promissory note refinancing agreements, help accommodate different situations and provide a comprehensive framework for the agreement between the debtor and creditor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.