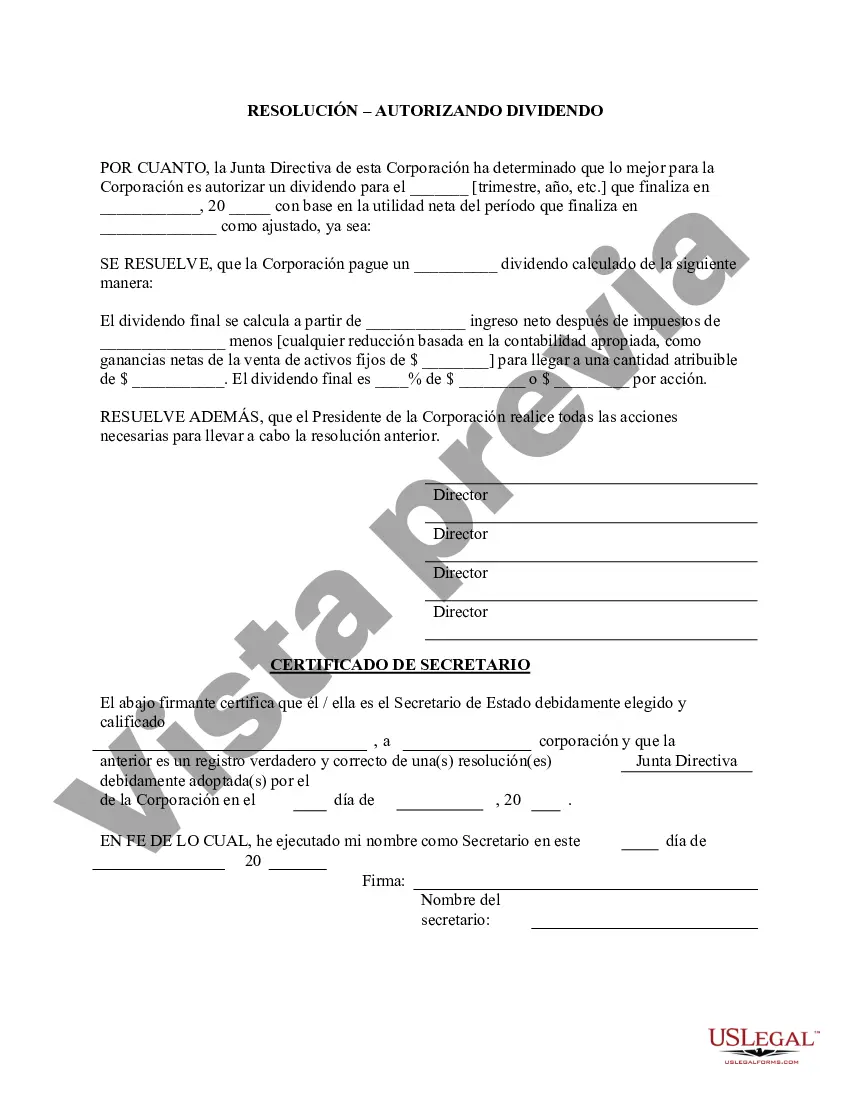

Harris Texas Stock Dividend — Resolution For— - Corporate Resolutions are legal documents that outline the decision-making process for distributing dividends to stockholders in the state of Texas. These resolutions serve as official records and guidelines for corporations to follow when determining the distribution of stock dividends. The Harris Texas Stock Dividend — Resolution For— - Corporate Resolutions typically includes various sections to ensure a comprehensive and lawful process. This form outlines the details of the dividend distribution, including the amount or percentage to be distributed, the payment method, and the timeline for the distribution. It also addresses any restrictions or qualifications that may apply to stockholders. In addition to the standard Harris Texas Stock Dividend — Resolution Form, there can be variations or additional types depending on the specific circumstances or requirements of a corporation. Some of these variations may include: 1. Stock Dividend — Ordinary Resolution: This type of resolution is commonly used when the dividend distribution is within the ordinary course of business and does not require any extraordinary measures or approvals. 2. Stock Dividend — Special Resolution: When a dividend distribution involves more significant changes or deviations from the standard practices, a special resolution may be required. This type of resolution typically necessitates additional approval from the board of directors or the shareholders. 3. Stock Dividend — Board Resolution: In certain cases, the board of directors may need to pass a resolution to authorize the dividend distribution. This type of resolution demonstrates board approval and may involve more comprehensive documentation and reporting. 4. Stock Dividend — Shareholder Resolution: If the decision to distribute dividends requires the direct involvement or approval of the shareholders, a shareholder resolution may be necessary. This type of resolution typically requires a majority vote or consent from the shareholders. These various types of Harris Texas Stock Dividend — Resolution Forms are designed to meet the specific needs of a corporation and ensure compliance with Texas state laws and regulations. It is essential for corporations to carefully consider the appropriate type of resolution form and follow the required processes to maintain legal compliance and transparency in dividend distributions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Dividendo en Acciones - Formulario de Resoluciones - Resoluciones Corporativas - Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Harris Texas Dividendo En Acciones - Formulario De Resoluciones - Resoluciones Corporativas?

Do you need to quickly draft a legally-binding Harris Stock Dividend - Resolution Form - Corporate Resolutions or probably any other document to manage your own or corporate matters? You can go with two options: hire a legal advisor to write a legal document for you or draft it entirely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific document templates, including Harris Stock Dividend - Resolution Form - Corporate Resolutions and form packages. We offer templates for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- To start with, carefully verify if the Harris Stock Dividend - Resolution Form - Corporate Resolutions is tailored to your state's or county's laws.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the search over if the form isn’t what you were looking for by using the search bar in the header.

- Select the subscription that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Harris Stock Dividend - Resolution Form - Corporate Resolutions template, and download it. To re-download the form, just go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the paperwork we provide are updated by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!