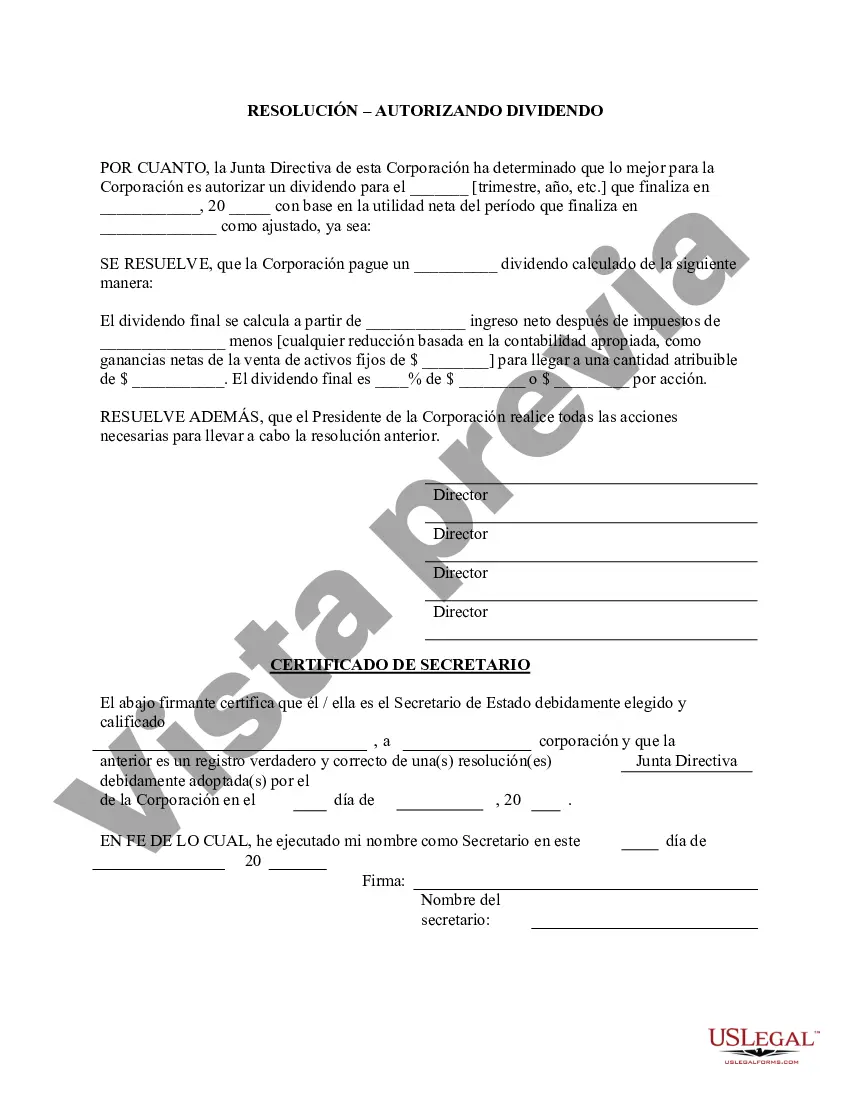

Hennepin County, Minnesota Stock Dividend — Resolution For— - Corporate Resolutions A stock dividend is a distribution of additional shares to existing shareholders of a company's stock. It is often used as a way for companies to reward their shareholders or to indicate the company's healthy financial position. Hennepin County, located in Minnesota, also offers the Stock Dividend — Resolution For— - Corporate Resolutions to facilitate this process smoothly and efficiently. The Hennepin Minnesota Stock Dividend — Resolution For— - Corporate Resolutions is a comprehensive document that outlines the necessary steps, procedures, and resolutions required to initiate and execute a stock dividend for a corporation under Hennepin County's jurisdiction. This form ensures compliance with legal and regulatory requirements while minimizing potential complications during the dividend distribution process. The form typically consists of several sections, including: 1. Introduction: This section provides an overview of the purpose and significance of the stock dividend and its implications for shareholders and the corporation. 2. Corporate Resolutions: Here, the form guides corporations to outline their resolutions pertaining to the stock dividend. It includes the decision to declare the dividend, the number of shares to be distributed per existing share held, and any additional terms or conditions deemed necessary. 3. Shareholder Approval: This section details the requirements and processes involved in obtaining shareholder approval for the dividend resolution. It may cover voting procedures, meeting notices, and any special circumstances that could affect the voting outcome. 4. Distribution Logistics: This part focuses on the mechanics of the stock distribution process, such as record dates, ex-dividend dates, and methods for delivering the new shares to shareholders. It may also address any tax implications related to the stock dividend. 5. Communication and Reporting: The form may include guidelines for shareholder communications and reporting obligations to regulatory authorities. It emphasizes the importance of transparent and timely dissemination of information to keep shareholders informed. Different types of resolutions forms may exist under the Hennepin County, Minnesota Stock Dividend — Corporate Resolutions category, depending on the specific circumstances or characteristics of the dividend. These could include: 1. Regular Stock Dividend Resolution Form: Used for routine dividends distributed on a predetermined schedule, often expressed as a percentage of existing shares. 2. Special Stock Dividend Resolution Form: Applicable when a corporation declares an unscheduled dividend due to exceptional financial performance or other specific reasons. 3. Stock Split Resolution Form: Although technically not a stock dividend, this form covers the process of increasing the number of shares outstanding by splitting existing shares into multiple new shares, proportionally reducing their nominal value. These forms are designed to simplify the stock dividend process and ensure that corporations and shareholders follow the appropriate legal and regulatory protocols. By utilizing the Hennepin Minnesota Stock Dividend — Resolution For— - Corporate Resolutions, companies can facilitate smooth dividend declarations and distributions while maintaining compliance with applicable laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Dividendo en Acciones - Formulario de Resoluciones - Resoluciones Corporativas - Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Hennepin Minnesota Dividendo En Acciones - Formulario De Resoluciones - Resoluciones Corporativas?

How much time does it normally take you to draft a legal document? Considering that every state has its laws and regulations for every life sphere, locating a Hennepin Stock Dividend - Resolution Form - Corporate Resolutions meeting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. In addition to the Hennepin Stock Dividend - Resolution Form - Corporate Resolutions, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Specialists check all samples for their validity, so you can be certain to prepare your paperwork properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required sample, and download it. You can get the document in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Hennepin Stock Dividend - Resolution Form - Corporate Resolutions:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Hennepin Stock Dividend - Resolution Form - Corporate Resolutions.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!