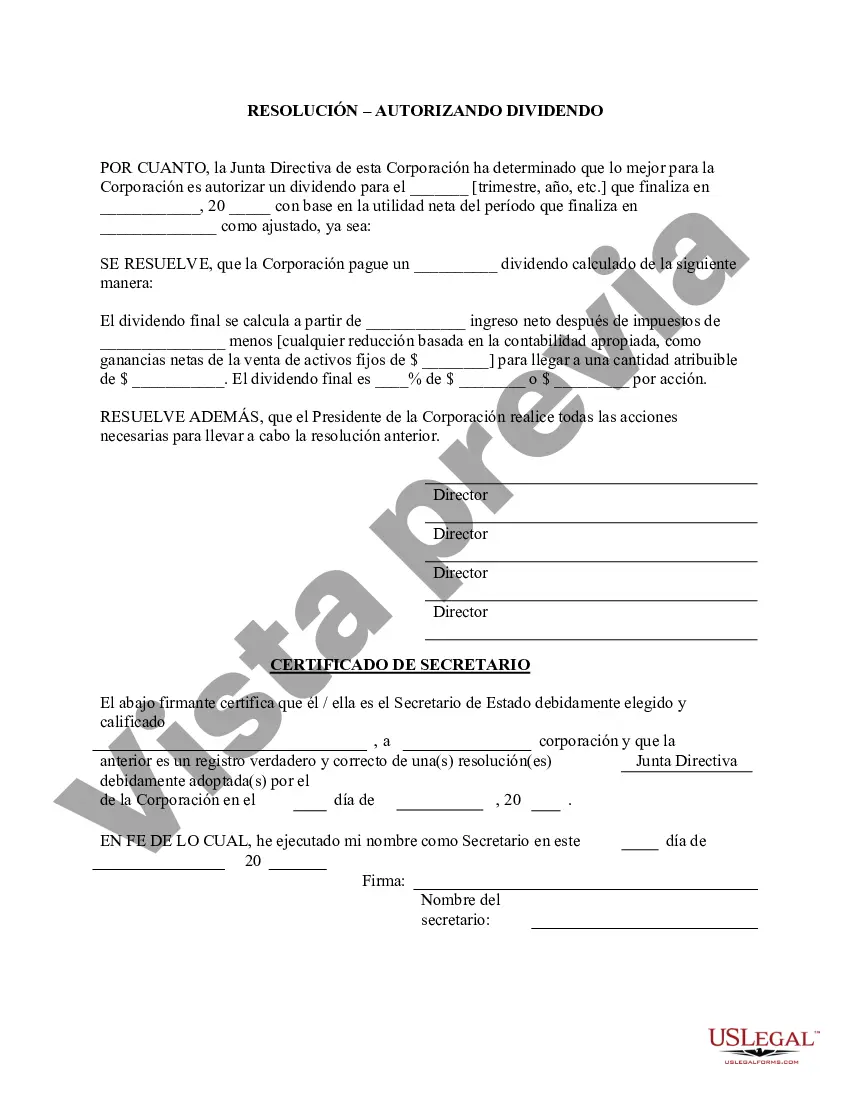

Montgomery, Maryland, is a bustling county located in the state of Maryland, USA. It is home to a diverse population and serves as a major economic center within the state. Montgomery County features numerous businesses and corporations, each with their own set of regulations and resolutions, including the Montgomery Maryland Stock Dividend — Resolution For— - Corporate Resolutions. The Montgomery Maryland Stock Dividend — Resolution For— - Corporate Resolutions is a legal document that outlines the specific process and requirements for distributing stock dividends within a corporate entity in Montgomery County, Maryland. This resolution form is used by corporations to formalize the decision-making process regarding the distribution of stock dividends, ensuring transparency and compliance with relevant laws and regulations. There are several types of Montgomery Maryland Stock Dividend — Resolution For— - Corporate Resolutions that may exist, depending on the specific needs and circumstances of the corporation. Some of these resolutions may include: 1. Regular Dividend Resolution: This type of resolution outlines the standard procedure for distributing stock dividends on a recurring basis, usually quarterly or annually. It defines the eligibility criteria, the percentage of dividends to be distributed, and the timeline for dividend payments. 2. Special Dividend Resolution: In certain situations, corporations may decide to distribute additional dividends beyond the regular schedule. A special dividend resolution addresses the specific circumstances for this exceptional distribution, such as unexpected profits or the sale of assets. 3. Interim Dividend Resolution: An interim dividend resolution allows corporations to distribute dividends between regular dividend periods. This resolution may be utilized when the corporation has generated surplus profits and wants to share them with shareholders before the next regular dividend payment. 4. Scrip Dividend Resolution: Scrip dividends provide shareholders with the option to receive additional shares instead of cash dividends. This resolution outlines the terms and conditions under which shareholders may choose to receive scrip dividends, including the conversion ratio and any applicable fees. It is important to consult legal professionals or corporate advisors familiar with Montgomery County, Maryland, to ensure compliance with local laws and regulations while drafting and implementing stock dividend resolutions. These resolutions play a crucial role in maintaining transparency, accountability, and fair distribution of dividends within the corporate structure of Montgomery County, Maryland.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Dividendo en Acciones - Formulario de Resoluciones - Resoluciones Corporativas - Stock Dividend - Resolution Form - Corporate Resolutions

Description

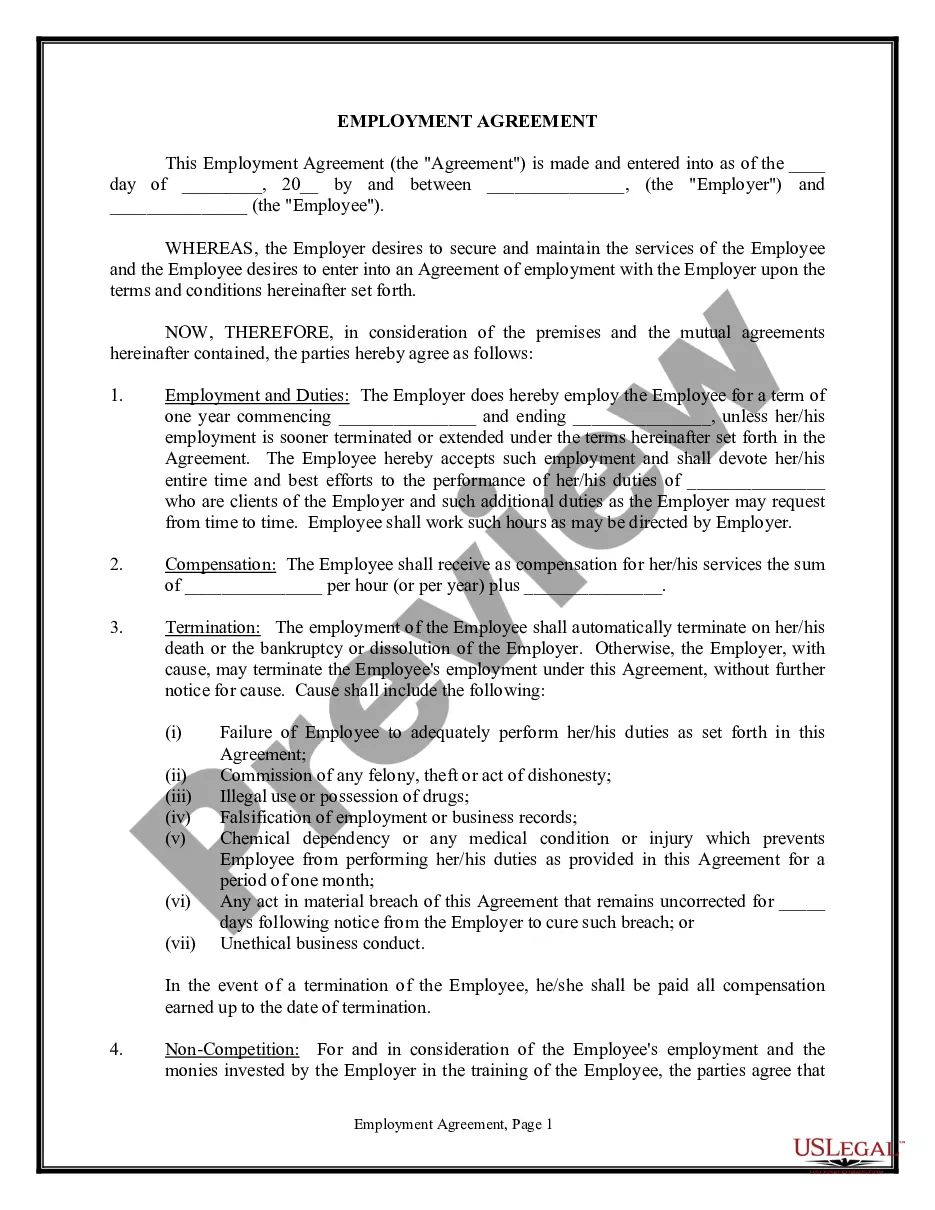

How to fill out Montgomery Maryland Dividendo En Acciones - Formulario De Resoluciones - Resoluciones Corporativas?

If you need to get a reliable legal form supplier to get the Montgomery Stock Dividend - Resolution Form - Corporate Resolutions, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to find and complete various documents.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply select to search or browse Montgomery Stock Dividend - Resolution Form - Corporate Resolutions, either by a keyword or by the state/county the form is created for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Montgomery Stock Dividend - Resolution Form - Corporate Resolutions template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately ready for download as soon as the payment is completed. Now you can complete the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich collection of legal forms makes these tasks less pricey and more affordable. Create your first company, arrange your advance care planning, draft a real estate contract, or execute the Montgomery Stock Dividend - Resolution Form - Corporate Resolutions - all from the convenience of your sofa.

Sign up for US Legal Forms now!