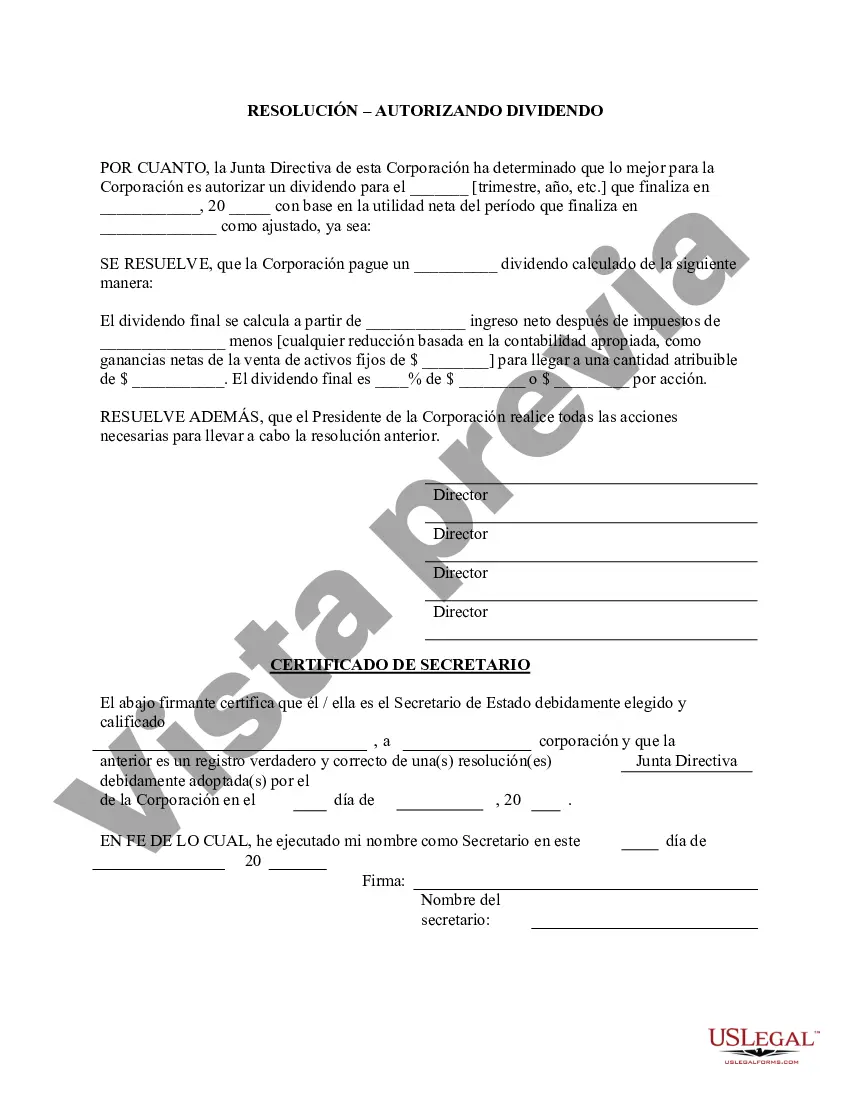

San Antonio, Texas is a vibrant city located in the southern part of the state, known for its rich history, diverse culture, and booming economy. As a major financial hub, it is not uncommon for businesses in San Antonio to issue stock dividends to their shareholders. In order to execute this process smoothly, corporations often utilize a Stock Dividend — Resolution For— - Corporate Resolutions. A Stock Dividend — Resolution For— - Corporate Resolutions is a legal document that outlines the decision to distribute additional shares of stock to existing shareholders as a form of dividend. This form serves as a written record of the corporation's resolution to offer stock dividends and includes relevant details such as the number of shares to be issued, the eligibility criteria for shareholders, and any restrictions or conditions associated with the dividend. There are different types of Stock Dividend — Resolution For— - Corporate Resolutions that corporations in San Antonio may utilize, depending on their specific needs and circumstances. Some of these types include: 1. Regular Cash Dividend — This type of dividend is paid in the form of cash to shareholders, typically at a fixed rate per share. The Stock Dividend — Resolution For— - Corporate Resolutions for regular cash dividends would specify the amount per share and the payable date. 2. Stock Dividend — In this case, the dividend is paid in the form of additional shares of stock, rather than cash. The Stock Dividend — Resolution For— - Corporate Resolutions for stock dividends would specify the ratio or percentage of additional shares to be issued to eligible shareholders. 3. Special Dividend — This type of dividend is typically issued on top of regular dividends and is usually paid out in extraordinary circumstances, such as when a corporation has excess profits or significant one-time gains. The Stock Dividend — Resolution For— - Corporate Resolutions for special dividends would outline the rationale for the special distribution and any specific conditions or requirements. In San Antonio, Texas, businesses understand the importance of adhering to legal procedures and documentation when it comes to issuing stock dividends. Utilizing a Stock Dividend — Resolution For— - Corporate Resolutions helps ensure transparency, clarity, and compliance throughout the process, benefiting both the corporation and its shareholders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Dividendo en Acciones - Formulario de Resoluciones - Resoluciones Corporativas - Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out San Antonio Texas Dividendo En Acciones - Formulario De Resoluciones - Resoluciones Corporativas?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you need to prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so picking a copy like San Antonio Stock Dividend - Resolution Form - Corporate Resolutions is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you several more steps to get the San Antonio Stock Dividend - Resolution Form - Corporate Resolutions. Follow the guidelines below:

- Make certain the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the file when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio Stock Dividend - Resolution Form - Corporate Resolutions in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!