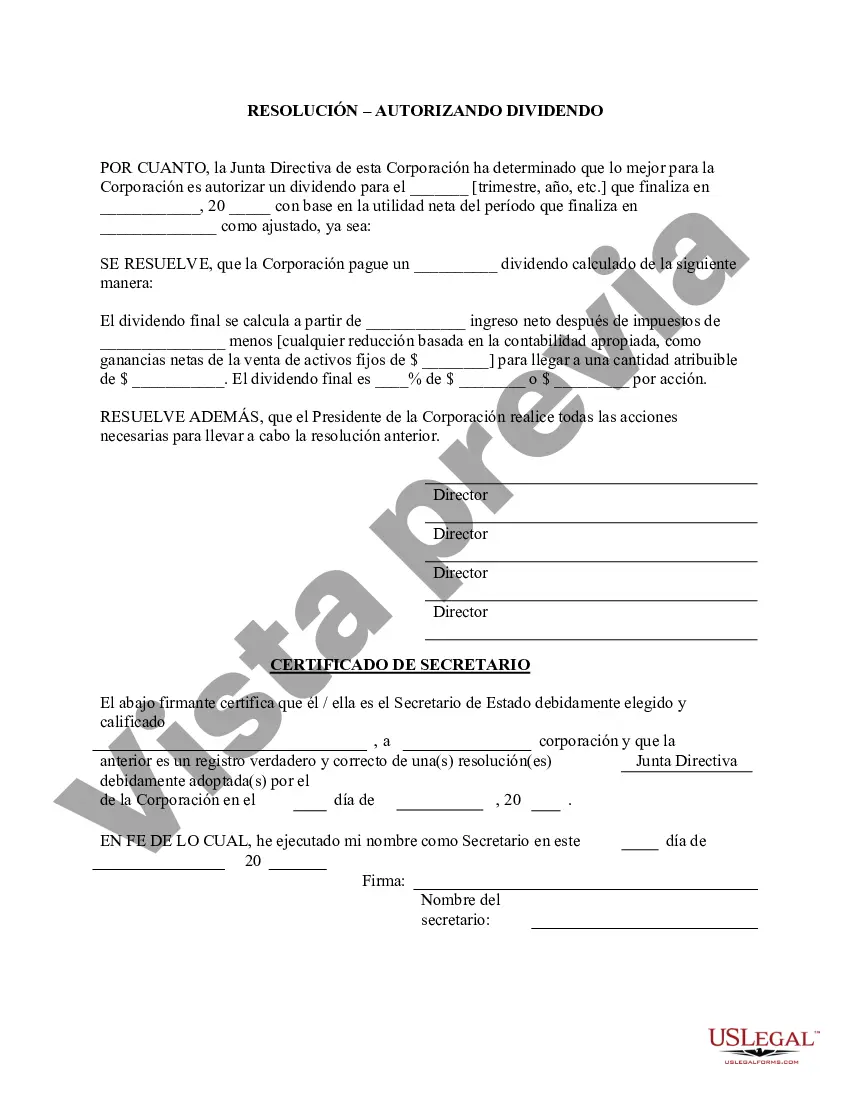

Travis Texas Stock Dividend — Resolution For— - Corporate Resolutions is a legally binding document used by corporate entities to declare dividends on stock holdings. This resolution form outlines the specific details and conditions under which dividends will be distributed to shareholders, ensuring transparency and compliance with legal requirements. The Travis Texas Stock Dividend — Resolution For— - Corporate Resolutions serves as a written record of the decision-making process within the company's board of directors or the shareholders themselves. By utilizing this form, corporations can demonstrate their commitment to fair and equitable distribution of profits among stockholders. The content of the Travis Texas Stock Dividend — Resolution For— - Corporate Resolutions typically includes relevant information such as the exact amount of the dividend per share, the payment schedule or timeline, the eligibility criteria for shareholders, and any additional terms or conditions associated with the distribution of dividends. Some different types of Travis Texas Stock Dividend — Resolution Form— - Corporate Resolutions may include: 1. Cash Dividend Resolution Form: This type of resolution form outlines the declaration of dividends in the form of cash payments to shareholders, representing a portion of the company's profits. 2. Stock Dividend Resolution Form: This form signifies the distribution of additional shares of a corporation's stock as dividends, rather than cash payments. Shareholders receive a certain number of new shares for every share they already hold. 3. Property Dividend Resolution Form: In certain cases, a corporation may decide to distribute non-cash dividends in the form of property or assets it holds. This type of resolution form outlines the details of such distributions, including the nature and value of the property being distributed. 4. Scrip Dividend Resolution Form: Scrip dividends refer to the issuance of promissory notes or certificates to shareholders instead of cash or additional stock. These certificates can be redeemed in the future for either cash or additional shares, providing an alternative to immediate cash dividends. 5. Special Dividend Resolution Form: This specific type of resolution form is used when a corporation decides to declare a dividend that deviates from its regular dividend policy. Special dividends are usually one-time payments made to shareholders due to extraordinary circumstances, such as the sale of a significant asset or an unexpected windfall. In summary, the Travis Texas Stock Dividend — Resolution For— - Corporate Resolutions is a crucial document for corporations to formalize the declaration and distribution of dividends to their shareholders. By using this form, companies ensure clarity, compliance, and fairness in the dividend distribution process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Dividendo en Acciones - Formulario de Resoluciones - Resoluciones Corporativas - Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Travis Texas Dividendo En Acciones - Formulario De Resoluciones - Resoluciones Corporativas?

Are you looking to quickly draft a legally-binding Travis Stock Dividend - Resolution Form - Corporate Resolutions or probably any other document to manage your own or corporate matters? You can go with two options: contact a professional to draft a valid paper for you or draft it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms provides a rich catalog of over 85,000 state-specific document templates, including Travis Stock Dividend - Resolution Form - Corporate Resolutions and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for over 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and get the necessary document without extra troubles.

- To start with, double-check if the Travis Stock Dividend - Resolution Form - Corporate Resolutions is adapted to your state's or county's laws.

- If the form includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the template isn’t what you were seeking by using the search bar in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Travis Stock Dividend - Resolution Form - Corporate Resolutions template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Moreover, the documents we offer are reviewed by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!