This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Bronx New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children: A Bronx New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion is a legal document designed to protect and manage assets gifted by a benefactor for the benefit of minor children residing in the Bronx, New York. This specialized trust agreement allows for the annual gifting of assets to minors without incurring gift tax liabilities up to a certain threshold, as determined by the Internal Revenue Service (IRS). Keywords: Bronx New York, Trust Agreement, Minors, Annual Gift Tax Exclusion, Multiple Trusts, Children. There are different types of Bronx New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children: 1. Individual Trusts: This type of trust agreement establishes separate trust funds for each individual child, allowing for customized management and distribution of assets. Each child's trust operates independently, ensuring the unique financial needs and circumstances of each child are met. 2. Sibling Trusts: In cases where multiple children are involved, a sibling trust agreement can be created. This arrangement allows for the pooling of assets into a single trust fund, which benefits all the children equally. The trust's terms and conditions are designed to ensure fair and equitable distribution of assets among siblings. 3. Customizable Trusts: Some Bronx New York Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion can be customized to suit the specific needs and preferences of the benefactor. These trusts may allow for various investment strategies, specific conditions for distribution of assets, and other tailored provisions that align with the benefactor's intentions. 4. Testamentary Trusts: A testamentary trust is a type of trust that comes into effect only after the death of the benefactor. It can be established in a will and specified to qualify for the annual gift tax exclusion. This type of trust enables the benefactor to provide for the financial well-being of minor children in the Bronx, New York, even after their passing. 5. Education Trusts: Education-focused trusts allow the benefactor to allocate funds specifically for the education and related expenses of the minor children. These trusts ensure that the children have access to quality education, covering tuition fees, books, supplies, and other educational necessities, while still benefiting from the annual gift tax exclusion. In summary, a Bronx New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children serves as a powerful tool for asset protection, customization, and tax planning, ensuring that minor children in the Bronx, New York, receive financial benefits while minimizing tax liabilities. Whether it's through individual or sibling trusts, customizable options, testamentary trusts, or education-focused trusts, these agreements help secure a brighter financial future for the children involved.Bronx New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children: A Bronx New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion is a legal document designed to protect and manage assets gifted by a benefactor for the benefit of minor children residing in the Bronx, New York. This specialized trust agreement allows for the annual gifting of assets to minors without incurring gift tax liabilities up to a certain threshold, as determined by the Internal Revenue Service (IRS). Keywords: Bronx New York, Trust Agreement, Minors, Annual Gift Tax Exclusion, Multiple Trusts, Children. There are different types of Bronx New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children: 1. Individual Trusts: This type of trust agreement establishes separate trust funds for each individual child, allowing for customized management and distribution of assets. Each child's trust operates independently, ensuring the unique financial needs and circumstances of each child are met. 2. Sibling Trusts: In cases where multiple children are involved, a sibling trust agreement can be created. This arrangement allows for the pooling of assets into a single trust fund, which benefits all the children equally. The trust's terms and conditions are designed to ensure fair and equitable distribution of assets among siblings. 3. Customizable Trusts: Some Bronx New York Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion can be customized to suit the specific needs and preferences of the benefactor. These trusts may allow for various investment strategies, specific conditions for distribution of assets, and other tailored provisions that align with the benefactor's intentions. 4. Testamentary Trusts: A testamentary trust is a type of trust that comes into effect only after the death of the benefactor. It can be established in a will and specified to qualify for the annual gift tax exclusion. This type of trust enables the benefactor to provide for the financial well-being of minor children in the Bronx, New York, even after their passing. 5. Education Trusts: Education-focused trusts allow the benefactor to allocate funds specifically for the education and related expenses of the minor children. These trusts ensure that the children have access to quality education, covering tuition fees, books, supplies, and other educational necessities, while still benefiting from the annual gift tax exclusion. In summary, a Bronx New York Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children serves as a powerful tool for asset protection, customization, and tax planning, ensuring that minor children in the Bronx, New York, receive financial benefits while minimizing tax liabilities. Whether it's through individual or sibling trusts, customizable options, testamentary trusts, or education-focused trusts, these agreements help secure a brighter financial future for the children involved.

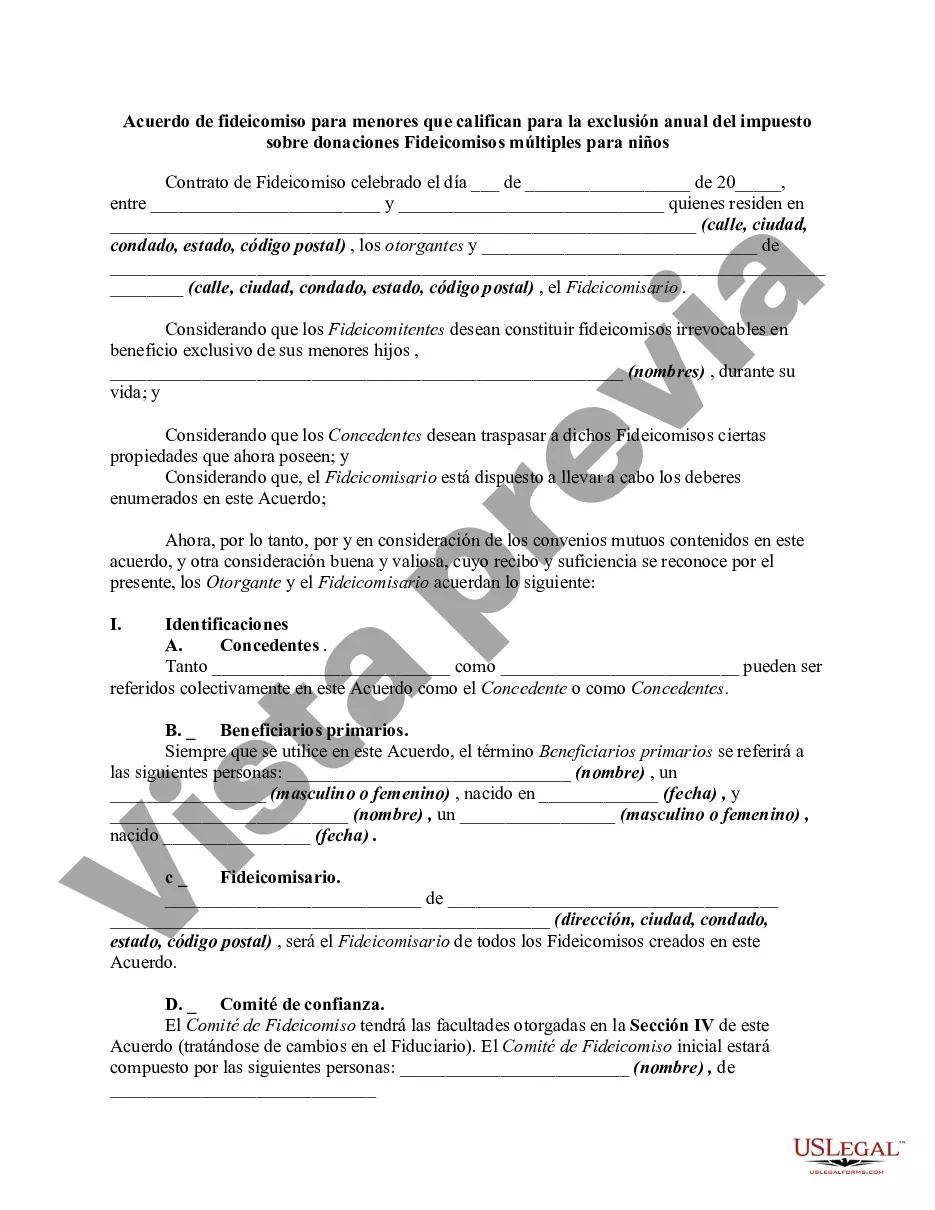

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.