This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Chicago Illinois Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children In Chicago, Illinois, the Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that enables parents or guardians to establish trusts for their children with the goal of minimizing gift taxes while providing financial security for their future. By utilizing this trust agreement, parents can take advantage of the annual gift tax exclusion, which allows individuals to gift a certain amount of money or assets to each child without incurring any gift tax. In the context of multiple trusts for children, this agreement becomes particularly useful as it allows parents to create separate trusts for each child, maximizing the benefits of the annual gift tax exclusion. The Chicago Illinois Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children typically includes the following key elements: 1. Trustees: The agreement appoints one or more trustees who will manage the trusts on behalf of the children until they reach the age of majority or any other specified age. 2. Beneficiaries: Each trust will have a designated child as the beneficiary. The agreement outlines the rights and entitlements of each beneficiary to the income and principal of their respective trust. 3. Assets: Parents may transfer various assets into the trust, such as cash, stocks, real estate, or other investments. These assets will be held by the trustee for the benefit of the children, subject to the terms of the agreement. 4. Distribution Provisions: The trust agreement specifies the circumstances under which distributions can be made to the beneficiaries. This may include guidelines for educational expenses, healthcare needs, or other specific purposes. 5. Terms and Conditions: The agreement establishes the terms and conditions governing each trust, including the provisions for any contingencies like the death or incapacity of a trustee or beneficiary. Different types of Chicago Illinois Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children may include the following: 1. Revocable Trusts: These trusts can be modified or revoked by the parent or guardian during their lifetime, providing flexibility in managing the assets and allowing them to adapt to changing circumstances. 2. Irrevocable Trusts: Irrevocable trusts cannot be changed or revoked without the consent of the beneficiaries. These trusts provide asset protection as well as potential tax savings, but come with less flexibility. 3. Testamentary Trusts: This type of trust is included in a parent or guardian's will, and it becomes effective upon their death. Testamentary trusts allow for more control over the distribution of assets and can also include provisions for minor children. In summary, the Chicago Illinois Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children offers parents a valuable tool for both tax planning and wealth preservation. By leveraging the annual gift tax exclusion and creating separate trusts for each child, parents can ensure financial security for their children's future while minimizing their own tax liability.Chicago Illinois Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children In Chicago, Illinois, the Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that enables parents or guardians to establish trusts for their children with the goal of minimizing gift taxes while providing financial security for their future. By utilizing this trust agreement, parents can take advantage of the annual gift tax exclusion, which allows individuals to gift a certain amount of money or assets to each child without incurring any gift tax. In the context of multiple trusts for children, this agreement becomes particularly useful as it allows parents to create separate trusts for each child, maximizing the benefits of the annual gift tax exclusion. The Chicago Illinois Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children typically includes the following key elements: 1. Trustees: The agreement appoints one or more trustees who will manage the trusts on behalf of the children until they reach the age of majority or any other specified age. 2. Beneficiaries: Each trust will have a designated child as the beneficiary. The agreement outlines the rights and entitlements of each beneficiary to the income and principal of their respective trust. 3. Assets: Parents may transfer various assets into the trust, such as cash, stocks, real estate, or other investments. These assets will be held by the trustee for the benefit of the children, subject to the terms of the agreement. 4. Distribution Provisions: The trust agreement specifies the circumstances under which distributions can be made to the beneficiaries. This may include guidelines for educational expenses, healthcare needs, or other specific purposes. 5. Terms and Conditions: The agreement establishes the terms and conditions governing each trust, including the provisions for any contingencies like the death or incapacity of a trustee or beneficiary. Different types of Chicago Illinois Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children may include the following: 1. Revocable Trusts: These trusts can be modified or revoked by the parent or guardian during their lifetime, providing flexibility in managing the assets and allowing them to adapt to changing circumstances. 2. Irrevocable Trusts: Irrevocable trusts cannot be changed or revoked without the consent of the beneficiaries. These trusts provide asset protection as well as potential tax savings, but come with less flexibility. 3. Testamentary Trusts: This type of trust is included in a parent or guardian's will, and it becomes effective upon their death. Testamentary trusts allow for more control over the distribution of assets and can also include provisions for minor children. In summary, the Chicago Illinois Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children offers parents a valuable tool for both tax planning and wealth preservation. By leveraging the annual gift tax exclusion and creating separate trusts for each child, parents can ensure financial security for their children's future while minimizing their own tax liability.

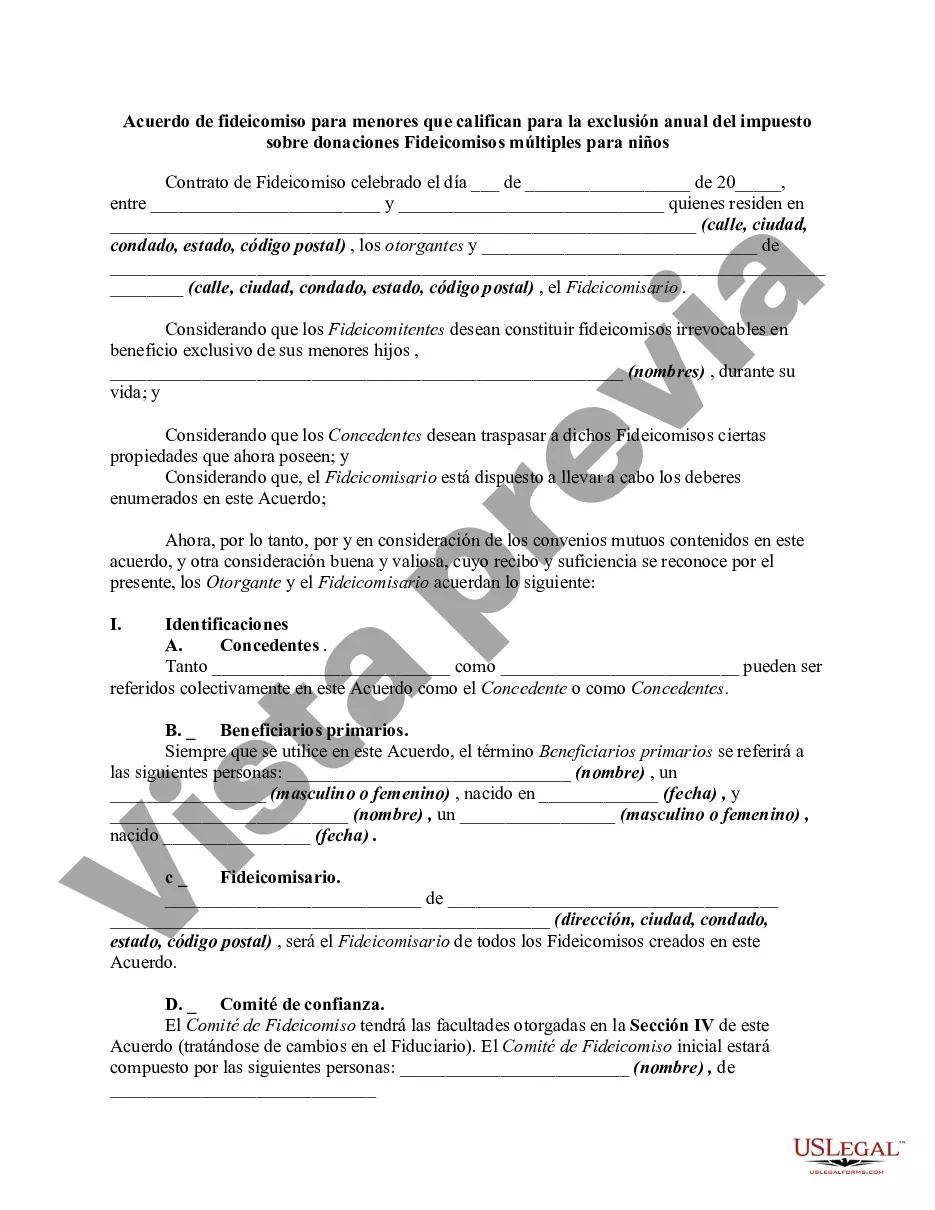

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.