This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

The Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that allows individuals to establish multiple trusts for their children in order to take advantage of the annual gift tax exclusion. This trust agreement is specifically designed for residents of Cuyahoga County, Ohio. The annual gift tax exclusion allows individuals to gift a certain amount of money or assets to another person, tax-free. As of 2021, the annual gift tax exclusion limit is $15,000 per person. By creating multiple trusts for their children, parents or guardians can effectively utilize this tax exclusion for each child, potentially reducing the overall taxable estate. The Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion allows parents or guardians to designate specific assets or property to be held in trust for their children until they reach a certain age or milestone, such as turning 18 or 21 years old. The trust agreement outlines the terms and conditions of the trust, including the trustee's powers and responsibilities, the distribution provisions, and any restrictions on the use of the trust assets. Different types of Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children may include: 1. Individual Child Trust: This type of trust agreement establishes a separate trust for each child, allowing parents or guardians to tailor the terms and conditions to the specific needs and circumstances of each child. 2. Sibling Trust: In some cases, parents or guardians may choose to create one trust that encompasses multiple children, pooling the assets and allowing for joint management and distribution of the trust assets. 3. Age-based Trust: This type of trust agreement may divide the trust assets based on the children's ages, with different portions of the assets becoming available to each child at different stages of their lives (e.g., 25%, 50%, and 100% at ages 18, 21, and 25, respectively). 4. Special Needs Trust: If a child has special needs or disabilities, a special needs trust can be established within the Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion. This type of trust ensures that the child's needs are met while preserving their eligibility for government benefits. By utilizing the Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, parents or guardians can effectively manage and distribute their assets to their children while minimizing potential gift tax liabilities. It is important to consult with an experienced estate planning attorney or financial advisor to understand the specific requirements and implications of establishing these trusts.The Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that allows individuals to establish multiple trusts for their children in order to take advantage of the annual gift tax exclusion. This trust agreement is specifically designed for residents of Cuyahoga County, Ohio. The annual gift tax exclusion allows individuals to gift a certain amount of money or assets to another person, tax-free. As of 2021, the annual gift tax exclusion limit is $15,000 per person. By creating multiple trusts for their children, parents or guardians can effectively utilize this tax exclusion for each child, potentially reducing the overall taxable estate. The Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion allows parents or guardians to designate specific assets or property to be held in trust for their children until they reach a certain age or milestone, such as turning 18 or 21 years old. The trust agreement outlines the terms and conditions of the trust, including the trustee's powers and responsibilities, the distribution provisions, and any restrictions on the use of the trust assets. Different types of Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children may include: 1. Individual Child Trust: This type of trust agreement establishes a separate trust for each child, allowing parents or guardians to tailor the terms and conditions to the specific needs and circumstances of each child. 2. Sibling Trust: In some cases, parents or guardians may choose to create one trust that encompasses multiple children, pooling the assets and allowing for joint management and distribution of the trust assets. 3. Age-based Trust: This type of trust agreement may divide the trust assets based on the children's ages, with different portions of the assets becoming available to each child at different stages of their lives (e.g., 25%, 50%, and 100% at ages 18, 21, and 25, respectively). 4. Special Needs Trust: If a child has special needs or disabilities, a special needs trust can be established within the Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion. This type of trust ensures that the child's needs are met while preserving their eligibility for government benefits. By utilizing the Cuyahoga Ohio Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, parents or guardians can effectively manage and distribute their assets to their children while minimizing potential gift tax liabilities. It is important to consult with an experienced estate planning attorney or financial advisor to understand the specific requirements and implications of establishing these trusts.

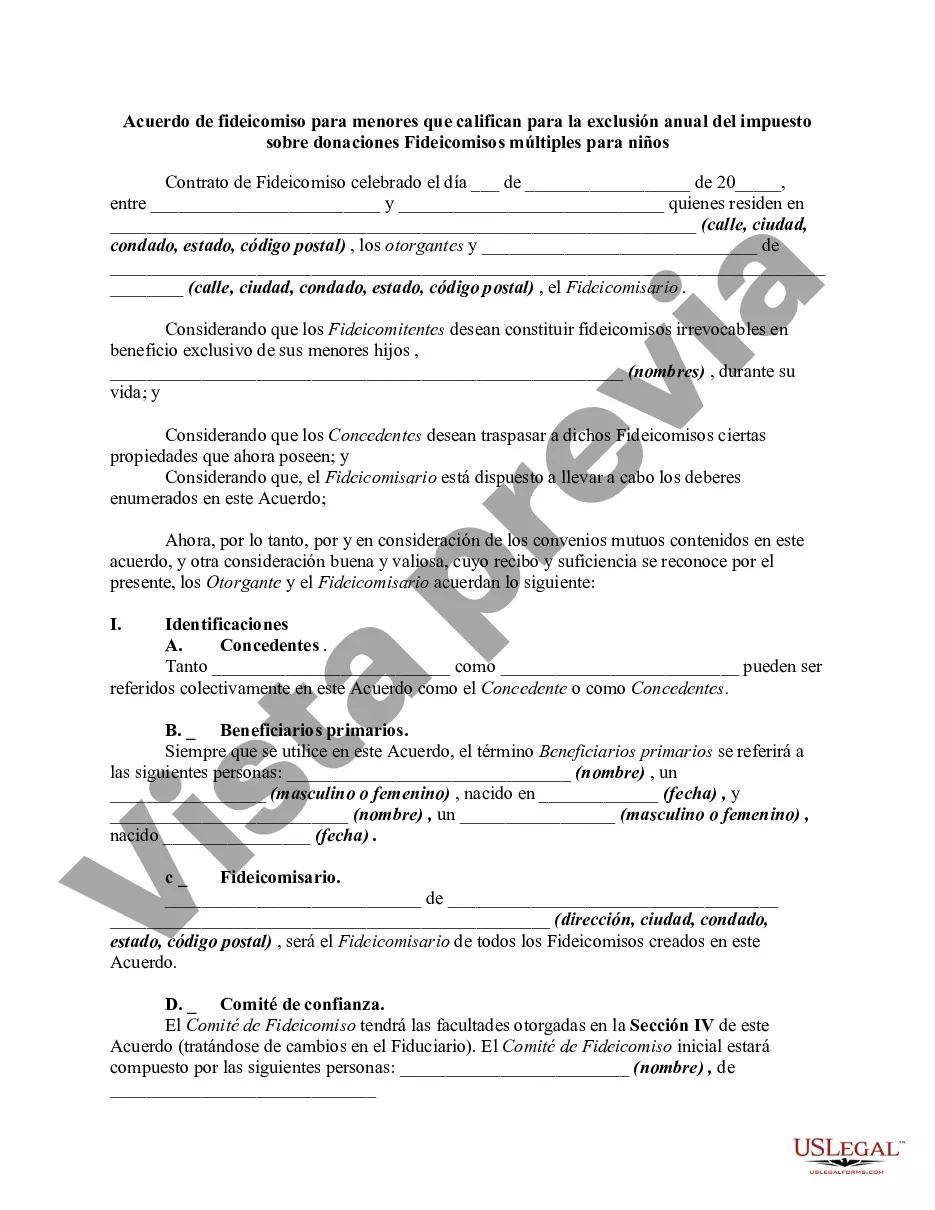

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.