This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Fairfax Virginia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document specifically designed to help parents or guardians establish trust funds for their children while taking advantage of the annual gift tax exclusion. This trust agreement allows individuals to gift money or assets to their children without incurring gift taxes, while ensuring the funds are managed and distributed appropriately until the minor reaches a specified age or milestone. The Fairfax Virginia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children comes with several types, including: 1. Standard Multiple Trusts for Children: This type of trust agreement allows the granter to create separate trusts for each child. Each trust is tailored to meet the specific needs and circumstances of the child, taking into account their age, financial requirements, educational goals, and other factors. The assets within each trust are managed separately, ensuring that the child's individual needs are addressed. 2. Educational Trusts: This type of trust focuses primarily on providing funds for the child's education. It ensures that the child's educational expenses, including tuition fees, books, supplies, and other related costs, are covered until a predetermined age or milestone is reached. This trust agreement ensures that the child's education is prioritized and well-supported. 3. Special Needs Trusts: Special needs trusts are created to provide for children with disabilities or special needs. This type of trust agreement safeguards the child's financial future while allowing them to remain eligible for government benefits. It ensures that the child's unique needs and circumstances are taken into consideration, providing financial stability and support throughout their life. 4. Lifetime Support Trusts: Lifetime support trusts are designed to ensure ongoing financial support for the child even after they reach adulthood. This trust agreement helps secure the child's financial future by providing for their long-term needs, including medical expenses, housing, and other essential costs. It offers peace of mind to parents knowing that their child will be taken care of throughout their life. 5. Testamentary Trusts: Testamentary trusts are established through a will and come into effect upon the granter's death. This type of trust agreement allows parents or guardians to designate how the assets will be distributed to their children and how they will be managed until the child reaches a certain age or milestone. Testamentary trusts provide control, flexibility, and protection for the children's inheritances. The Fairfax Virginia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children helps parents or guardians establish a secure financial future for their children while minimizing tax implications. It offers various trust types tailored to the individual needs of the children, ensuring their specific requirements and circumstances are considered. By utilizing these trust agreements, parents can leave a lasting legacy for their children, offering financial stability and support for years to come.Fairfax Virginia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document specifically designed to help parents or guardians establish trust funds for their children while taking advantage of the annual gift tax exclusion. This trust agreement allows individuals to gift money or assets to their children without incurring gift taxes, while ensuring the funds are managed and distributed appropriately until the minor reaches a specified age or milestone. The Fairfax Virginia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children comes with several types, including: 1. Standard Multiple Trusts for Children: This type of trust agreement allows the granter to create separate trusts for each child. Each trust is tailored to meet the specific needs and circumstances of the child, taking into account their age, financial requirements, educational goals, and other factors. The assets within each trust are managed separately, ensuring that the child's individual needs are addressed. 2. Educational Trusts: This type of trust focuses primarily on providing funds for the child's education. It ensures that the child's educational expenses, including tuition fees, books, supplies, and other related costs, are covered until a predetermined age or milestone is reached. This trust agreement ensures that the child's education is prioritized and well-supported. 3. Special Needs Trusts: Special needs trusts are created to provide for children with disabilities or special needs. This type of trust agreement safeguards the child's financial future while allowing them to remain eligible for government benefits. It ensures that the child's unique needs and circumstances are taken into consideration, providing financial stability and support throughout their life. 4. Lifetime Support Trusts: Lifetime support trusts are designed to ensure ongoing financial support for the child even after they reach adulthood. This trust agreement helps secure the child's financial future by providing for their long-term needs, including medical expenses, housing, and other essential costs. It offers peace of mind to parents knowing that their child will be taken care of throughout their life. 5. Testamentary Trusts: Testamentary trusts are established through a will and come into effect upon the granter's death. This type of trust agreement allows parents or guardians to designate how the assets will be distributed to their children and how they will be managed until the child reaches a certain age or milestone. Testamentary trusts provide control, flexibility, and protection for the children's inheritances. The Fairfax Virginia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children helps parents or guardians establish a secure financial future for their children while minimizing tax implications. It offers various trust types tailored to the individual needs of the children, ensuring their specific requirements and circumstances are considered. By utilizing these trust agreements, parents can leave a lasting legacy for their children, offering financial stability and support for years to come.

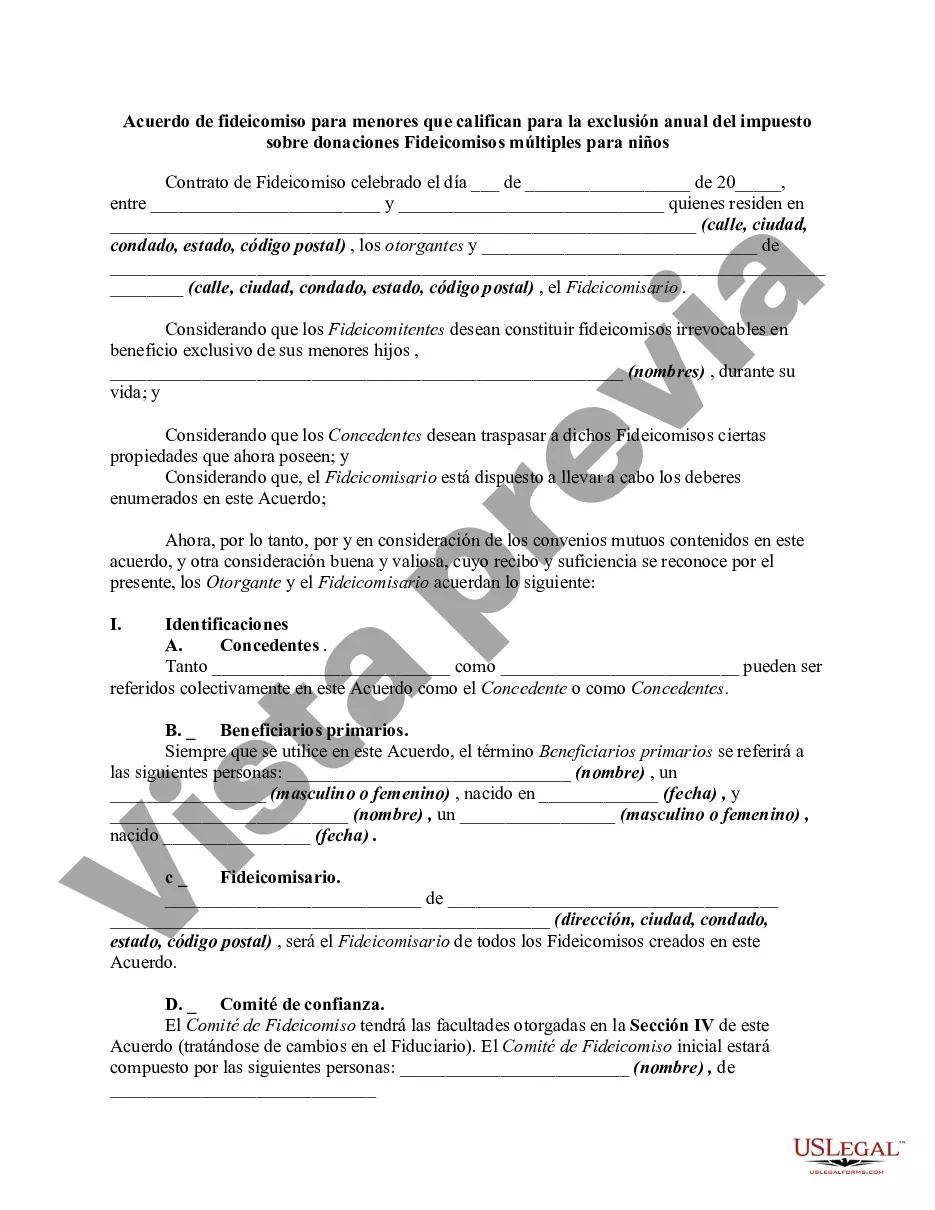

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.