This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

The Fulton Georgia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document designed to ensure the efficient management and protection of assets transferred to minors, while also taking advantage of the annual gift tax exclusion. This trust agreement allows individuals to establish multiple trusts for their children, each qualifying for the annual gift tax exclusion, thereby minimizing tax implications. By utilizing this trust agreement, parents can transfer assets to their children without incurring gift taxes. The Fulton Georgia Trust Agreement allows for flexibility by enabling parents to establish and manage different types of trusts based on specific needs and circumstances. These different types may include: 1. Revocable Trust: This type of trust allows the parents to retain control over the assets transferred to the trust while still qualifying for the annual gift tax exclusion. The trust agreement can be amended or revoked at any time during the parents' lifetime. 2. Irrevocable Trust: Unlike the revocable trust, the irrevocable trust cannot be altered or revoked once it is established. This provides additional protection and ensures that the assets are preserved for the beneficiaries' well-being. 3. Testamentary Trust: This trust is established through a will and comes into effect upon the parents' death. It allows parents to designate how their assets will be managed and distributed for the benefit of their children while taking advantage of the annual gift tax exclusion. 4. Special Needs Trust: This trust is specifically tailored to provide for children with disabilities or special needs. It allows parents to transfer assets to the trust for the benefit of the child, ensuring they are adequately cared for without jeopardizing their eligibility for government benefits. 5. Educational Trust: An educational trust is created with the purpose of funding a child's education expenses. This trust can help parents save for their children's future education while minimizing the tax implications associated with gifting. The Fulton Georgia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides a comprehensive and customizable framework for parents to protect and manage their assets while taking advantage of the annual gift tax exclusion. By establishing various types of trusts, parents can ensure that their children's financial well-being is secured while minimizing their overall tax liability.The Fulton Georgia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document designed to ensure the efficient management and protection of assets transferred to minors, while also taking advantage of the annual gift tax exclusion. This trust agreement allows individuals to establish multiple trusts for their children, each qualifying for the annual gift tax exclusion, thereby minimizing tax implications. By utilizing this trust agreement, parents can transfer assets to their children without incurring gift taxes. The Fulton Georgia Trust Agreement allows for flexibility by enabling parents to establish and manage different types of trusts based on specific needs and circumstances. These different types may include: 1. Revocable Trust: This type of trust allows the parents to retain control over the assets transferred to the trust while still qualifying for the annual gift tax exclusion. The trust agreement can be amended or revoked at any time during the parents' lifetime. 2. Irrevocable Trust: Unlike the revocable trust, the irrevocable trust cannot be altered or revoked once it is established. This provides additional protection and ensures that the assets are preserved for the beneficiaries' well-being. 3. Testamentary Trust: This trust is established through a will and comes into effect upon the parents' death. It allows parents to designate how their assets will be managed and distributed for the benefit of their children while taking advantage of the annual gift tax exclusion. 4. Special Needs Trust: This trust is specifically tailored to provide for children with disabilities or special needs. It allows parents to transfer assets to the trust for the benefit of the child, ensuring they are adequately cared for without jeopardizing their eligibility for government benefits. 5. Educational Trust: An educational trust is created with the purpose of funding a child's education expenses. This trust can help parents save for their children's future education while minimizing the tax implications associated with gifting. The Fulton Georgia Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides a comprehensive and customizable framework for parents to protect and manage their assets while taking advantage of the annual gift tax exclusion. By establishing various types of trusts, parents can ensure that their children's financial well-being is secured while minimizing their overall tax liability.

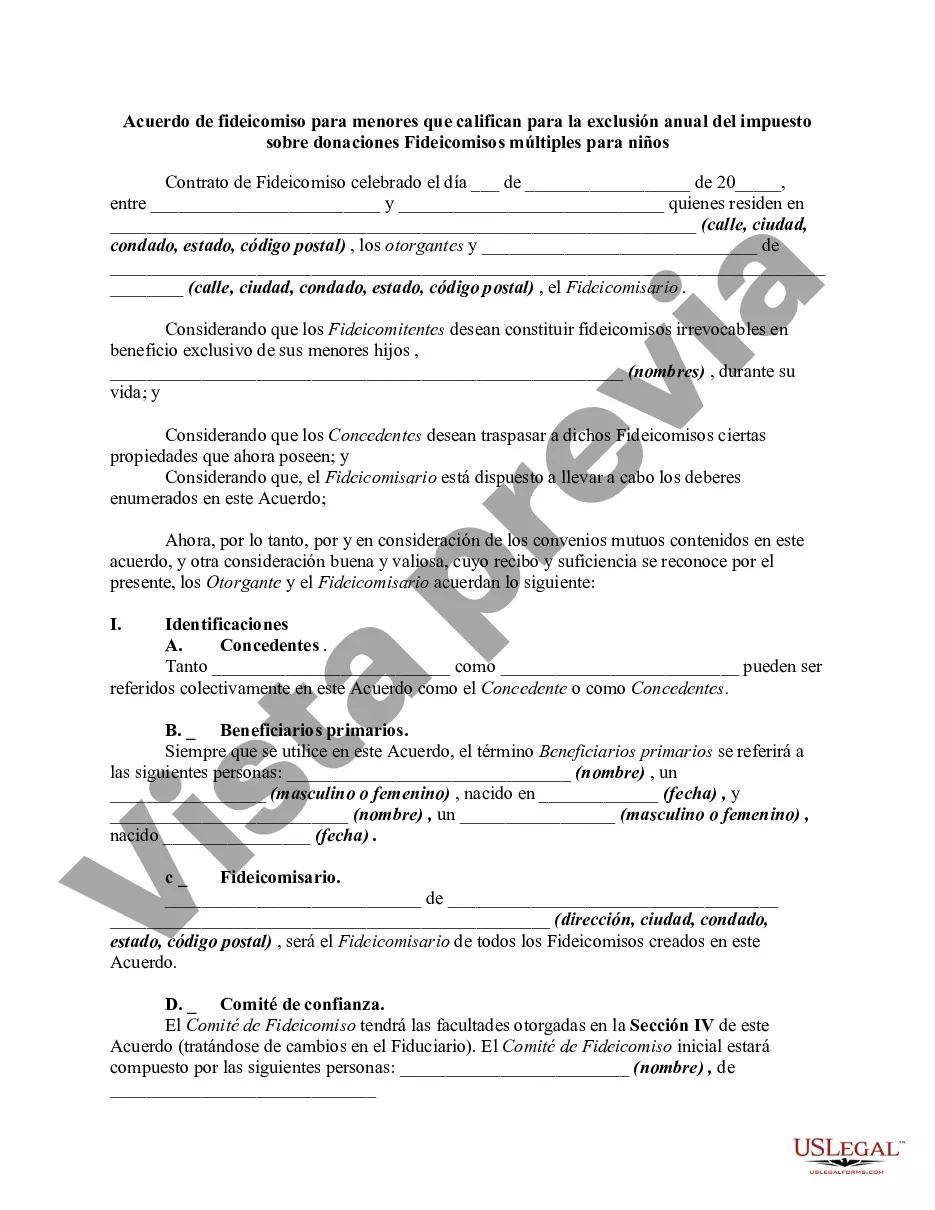

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.