This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

The Harris Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document specifically designed to establish and manage trusts that allow minors to qualify for the annual gift tax exclusion. This agreement enables individuals to make gifts to multiple trusts on behalf of children while taking advantage of the annual gift tax exclusion limit, which is currently set at $15,000 per year per recipient. By creating multiple trusts under this Harris Texas Trust Agreement, individuals can distribute their assets to different beneficiaries, ensuring each child receives their own separate trust fund. This allows for better organization and management of funds and ensures that the gift tax exclusion is maximized for every child. The Harris Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children offers various types of trusts to cater to different needs and circumstances. These types of trusts may include but are not limited to: 1. Income-only trusts: This type of trust allows for the distribution of income generated by the trust assets to the minor beneficiary while preserving the principal amount intact. Once the beneficiary reaches a certain age or achieves specific milestones, the principal may be distributed as well. 2. Education trusts: Education trusts are specifically structured to provide funds exclusively for the beneficiary's education-related expenses. These trusts can cover tuition fees, books, supplies, and other educational costs until the beneficiary graduates or reaches a predetermined age. 3. Health and well-being trusts: These trusts focus on providing for the beneficiary's health-related needs and overall well-being. The trust funds can be used for medical expenses, health insurance premiums, mental health support, and general welfare until the beneficiary reaches a certain age. 4. Restricted access trusts: This type of trust allows for more control over the distribution of the trust funds. The trustee can decide when and how the beneficiary can access the funds, ensuring they are used responsibly and appropriately for the beneficiary's benefit. It's essential to consult with a qualified attorney or financial advisor to determine the most suitable type(s) of trust(s) to establish under the Harris Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children. This ensures compliance with applicable laws and maximizes the benefits of gifting under the annual gift tax exclusion while safeguarding the financial future of the children involved.The Harris Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document specifically designed to establish and manage trusts that allow minors to qualify for the annual gift tax exclusion. This agreement enables individuals to make gifts to multiple trusts on behalf of children while taking advantage of the annual gift tax exclusion limit, which is currently set at $15,000 per year per recipient. By creating multiple trusts under this Harris Texas Trust Agreement, individuals can distribute their assets to different beneficiaries, ensuring each child receives their own separate trust fund. This allows for better organization and management of funds and ensures that the gift tax exclusion is maximized for every child. The Harris Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children offers various types of trusts to cater to different needs and circumstances. These types of trusts may include but are not limited to: 1. Income-only trusts: This type of trust allows for the distribution of income generated by the trust assets to the minor beneficiary while preserving the principal amount intact. Once the beneficiary reaches a certain age or achieves specific milestones, the principal may be distributed as well. 2. Education trusts: Education trusts are specifically structured to provide funds exclusively for the beneficiary's education-related expenses. These trusts can cover tuition fees, books, supplies, and other educational costs until the beneficiary graduates or reaches a predetermined age. 3. Health and well-being trusts: These trusts focus on providing for the beneficiary's health-related needs and overall well-being. The trust funds can be used for medical expenses, health insurance premiums, mental health support, and general welfare until the beneficiary reaches a certain age. 4. Restricted access trusts: This type of trust allows for more control over the distribution of the trust funds. The trustee can decide when and how the beneficiary can access the funds, ensuring they are used responsibly and appropriately for the beneficiary's benefit. It's essential to consult with a qualified attorney or financial advisor to determine the most suitable type(s) of trust(s) to establish under the Harris Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children. This ensures compliance with applicable laws and maximizes the benefits of gifting under the annual gift tax exclusion while safeguarding the financial future of the children involved.

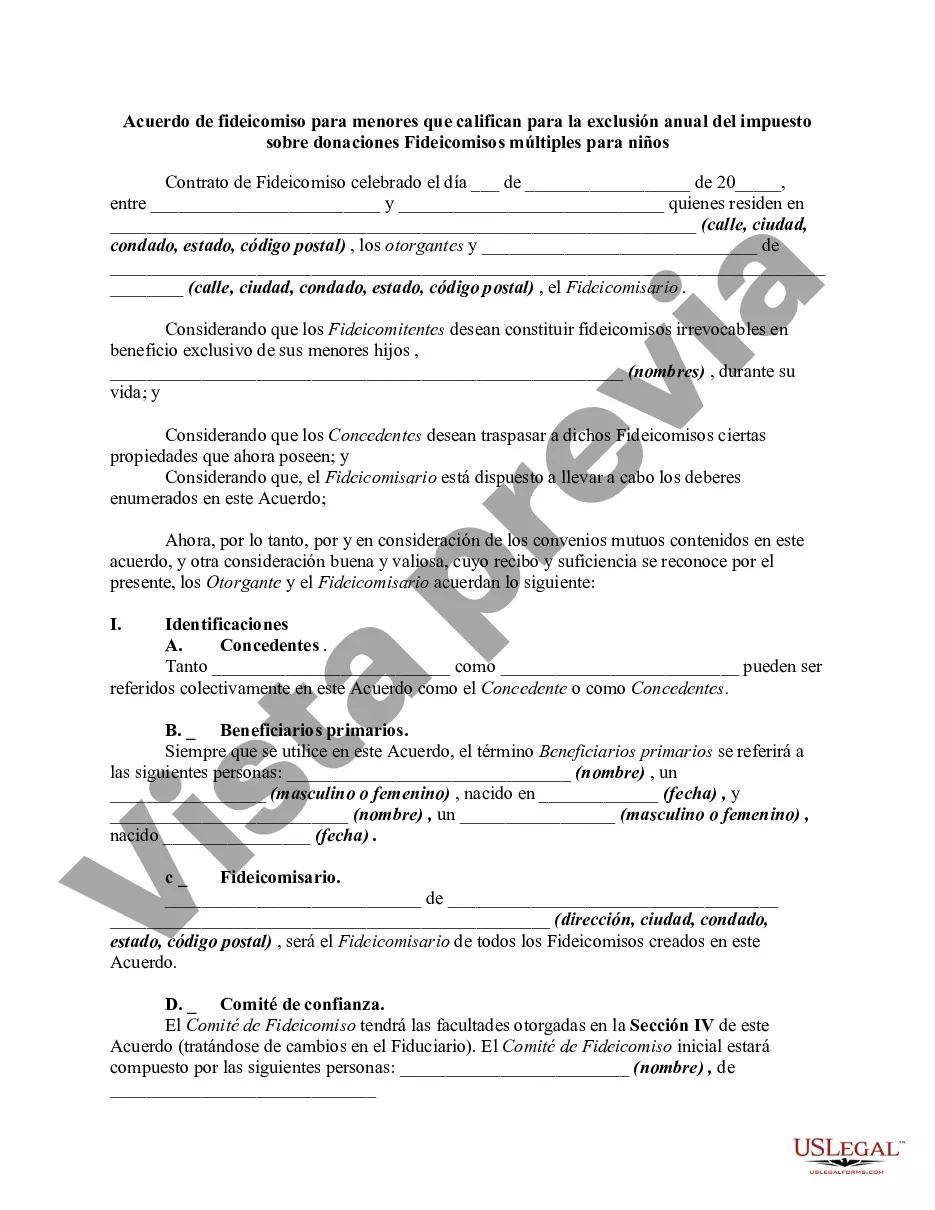

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.