This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

A Houston Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that allows individuals to create multiple trusts for their children, while taking advantage of the annual gift tax exclusion. This trust agreement is specifically designed for residents of Houston, Texas, and ensures that the assets gifted to the children are protected, managed, and distributed according to the wishes of the granter. By establishing this trust agreement, parents or guardians can create separate trusts for each child, allowing for individualized management and distribution of assets. This is particularly beneficial when the needs and goals of each child differ. The trust agreement helps ensure that the annual gift tax exclusion of the Internal Revenue Service (IRS) is utilized to its maximum potential, minimizing potential tax liabilities. The primary purpose of this trust agreement is to protect and preserve the assets for the minors until they reach a certain age or specific milestones defined by the granter. By placing the assets in a trust, the granter can appoint a trustee to manage the trust on behalf of the minor, ensuring that the assets are well-maintained and used for their benefit. The trustee can be a trusted family member, friend, or a professional fiduciary with experience in managing trusts. Houston Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children can be further categorized into various types, depending on the specific needs and preferences of the granter. Some common types include: 1. Education Trust: This type of trust focuses on providing funds for the education expenses of the minor beneficiaries, such as tuition fees, books, and related educational expenses. The trust can also specify the educational institutions the funds can be used for. 2. Health and Welfare Trust: This type of trust ensures that the minor beneficiaries have access to necessary healthcare and welfare support. It can cover medical expenses, insurance premiums, and other healthcare-related costs. Additionally, it may provide funds for general welfare purposes, such as clothing, shelter, and necessities. 3. Special Needs Trust: This trust is designed for minors with special needs, ensuring that they have financial resources to support their unique requirements without jeopardizing their eligibility for government assistance programs. 4. Accumulation Trust: This type of trust channels the income and assets into investments, allowing them to grow over time, ensuring financial stability and potential wealth accumulation for the minors. 5. Testamentary Trust: Created through a will, this trust comes into effect upon the death of the granter. It allows the granter to outline specific instructions regarding the management and distribution of assets to the minor beneficiaries. Houston Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides a flexible and customizable solution for parents or guardians who want to ensure the financial security and well-being of their children. By utilizing this trust agreement, one can take advantage of tax-efficient gifting strategies while maintaining control over the assets until the minors are ready to manage them independently.A Houston Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that allows individuals to create multiple trusts for their children, while taking advantage of the annual gift tax exclusion. This trust agreement is specifically designed for residents of Houston, Texas, and ensures that the assets gifted to the children are protected, managed, and distributed according to the wishes of the granter. By establishing this trust agreement, parents or guardians can create separate trusts for each child, allowing for individualized management and distribution of assets. This is particularly beneficial when the needs and goals of each child differ. The trust agreement helps ensure that the annual gift tax exclusion of the Internal Revenue Service (IRS) is utilized to its maximum potential, minimizing potential tax liabilities. The primary purpose of this trust agreement is to protect and preserve the assets for the minors until they reach a certain age or specific milestones defined by the granter. By placing the assets in a trust, the granter can appoint a trustee to manage the trust on behalf of the minor, ensuring that the assets are well-maintained and used for their benefit. The trustee can be a trusted family member, friend, or a professional fiduciary with experience in managing trusts. Houston Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children can be further categorized into various types, depending on the specific needs and preferences of the granter. Some common types include: 1. Education Trust: This type of trust focuses on providing funds for the education expenses of the minor beneficiaries, such as tuition fees, books, and related educational expenses. The trust can also specify the educational institutions the funds can be used for. 2. Health and Welfare Trust: This type of trust ensures that the minor beneficiaries have access to necessary healthcare and welfare support. It can cover medical expenses, insurance premiums, and other healthcare-related costs. Additionally, it may provide funds for general welfare purposes, such as clothing, shelter, and necessities. 3. Special Needs Trust: This trust is designed for minors with special needs, ensuring that they have financial resources to support their unique requirements without jeopardizing their eligibility for government assistance programs. 4. Accumulation Trust: This type of trust channels the income and assets into investments, allowing them to grow over time, ensuring financial stability and potential wealth accumulation for the minors. 5. Testamentary Trust: Created through a will, this trust comes into effect upon the death of the granter. It allows the granter to outline specific instructions regarding the management and distribution of assets to the minor beneficiaries. Houston Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides a flexible and customizable solution for parents or guardians who want to ensure the financial security and well-being of their children. By utilizing this trust agreement, one can take advantage of tax-efficient gifting strategies while maintaining control over the assets until the minors are ready to manage them independently.

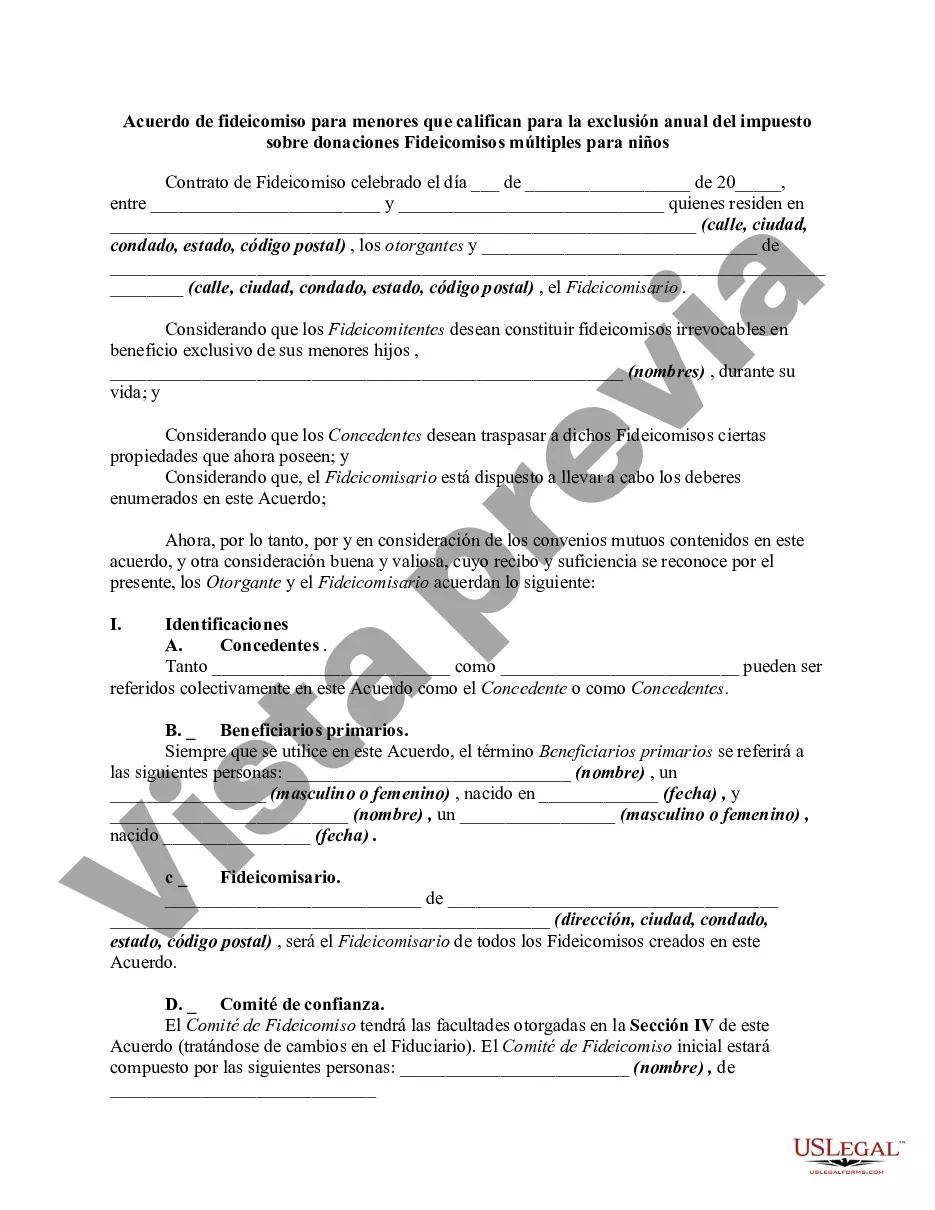

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.