This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

When it comes to estate planning for minors, a Los Angeles California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children offers a practical solution for parents or guardians who wish to transfer assets to their children while maximizing potential tax benefits. This type of trust serves as a legal vehicle to manage and safeguard assets, protect the interests of minors, and ensure compliance with the annual gift tax exclusion rules. One of the primary advantages of utilizing a Los Angeles California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion is the ability to make tax-free gifts to children up to a certain limit. As of 2021, the annual gift tax exclusion amount is $15,000 per beneficiary, allowing parents or guardians to contribute this sum without incurring any gift tax liability. There are different types of Los Angeles California Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion, including: 1. Individual Trusts: In this scenario, separate trusts are established for each child, ensuring that the assets are held and managed separately. Each trust will have its own trustee to oversee the administration and distribution of funds. This approach provides greater flexibility in terms of managing assets and tailoring the trust's provisions to suit the needs of each child. 2. Pooled Trusts: Instead of setting up individual trusts for each child, this option allows for the pooling of assets into a single trust. The pooled trust simplifies the administration process and can be advantageous when dealing with multiple beneficiaries. However, it may be less flexible in terms of tailoring the trust's terms to meet the individual needs of each child. 3. Customized Trust Provisions: Depending on the circumstances and specific goals of the granter, a Los Angeles California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion can be customized to include specific provisions. For example, the trust can outline conditions for distribution, such as age or educational milestones, or establish guidelines for the use of trust funds, such as college tuition or medical expenses. Customization ensures that the trust aligns with the granter's intentions and the unique needs of the children involved. In Los Angeles, California, establishing a Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion requires careful consideration of state laws, tax regulations, and individual circumstances. Working with a competent estate planning attorney is crucial to navigate the complexities of creating and maintaining these trusts. By structuring assets through a Los Angeles California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, parents or guardians can lay a solid foundation for their children's financial future while enjoying the benefits of gift tax exclusions and efficient estate planning.When it comes to estate planning for minors, a Los Angeles California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children offers a practical solution for parents or guardians who wish to transfer assets to their children while maximizing potential tax benefits. This type of trust serves as a legal vehicle to manage and safeguard assets, protect the interests of minors, and ensure compliance with the annual gift tax exclusion rules. One of the primary advantages of utilizing a Los Angeles California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion is the ability to make tax-free gifts to children up to a certain limit. As of 2021, the annual gift tax exclusion amount is $15,000 per beneficiary, allowing parents or guardians to contribute this sum without incurring any gift tax liability. There are different types of Los Angeles California Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion, including: 1. Individual Trusts: In this scenario, separate trusts are established for each child, ensuring that the assets are held and managed separately. Each trust will have its own trustee to oversee the administration and distribution of funds. This approach provides greater flexibility in terms of managing assets and tailoring the trust's provisions to suit the needs of each child. 2. Pooled Trusts: Instead of setting up individual trusts for each child, this option allows for the pooling of assets into a single trust. The pooled trust simplifies the administration process and can be advantageous when dealing with multiple beneficiaries. However, it may be less flexible in terms of tailoring the trust's terms to meet the individual needs of each child. 3. Customized Trust Provisions: Depending on the circumstances and specific goals of the granter, a Los Angeles California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion can be customized to include specific provisions. For example, the trust can outline conditions for distribution, such as age or educational milestones, or establish guidelines for the use of trust funds, such as college tuition or medical expenses. Customization ensures that the trust aligns with the granter's intentions and the unique needs of the children involved. In Los Angeles, California, establishing a Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion requires careful consideration of state laws, tax regulations, and individual circumstances. Working with a competent estate planning attorney is crucial to navigate the complexities of creating and maintaining these trusts. By structuring assets through a Los Angeles California Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, parents or guardians can lay a solid foundation for their children's financial future while enjoying the benefits of gift tax exclusions and efficient estate planning.

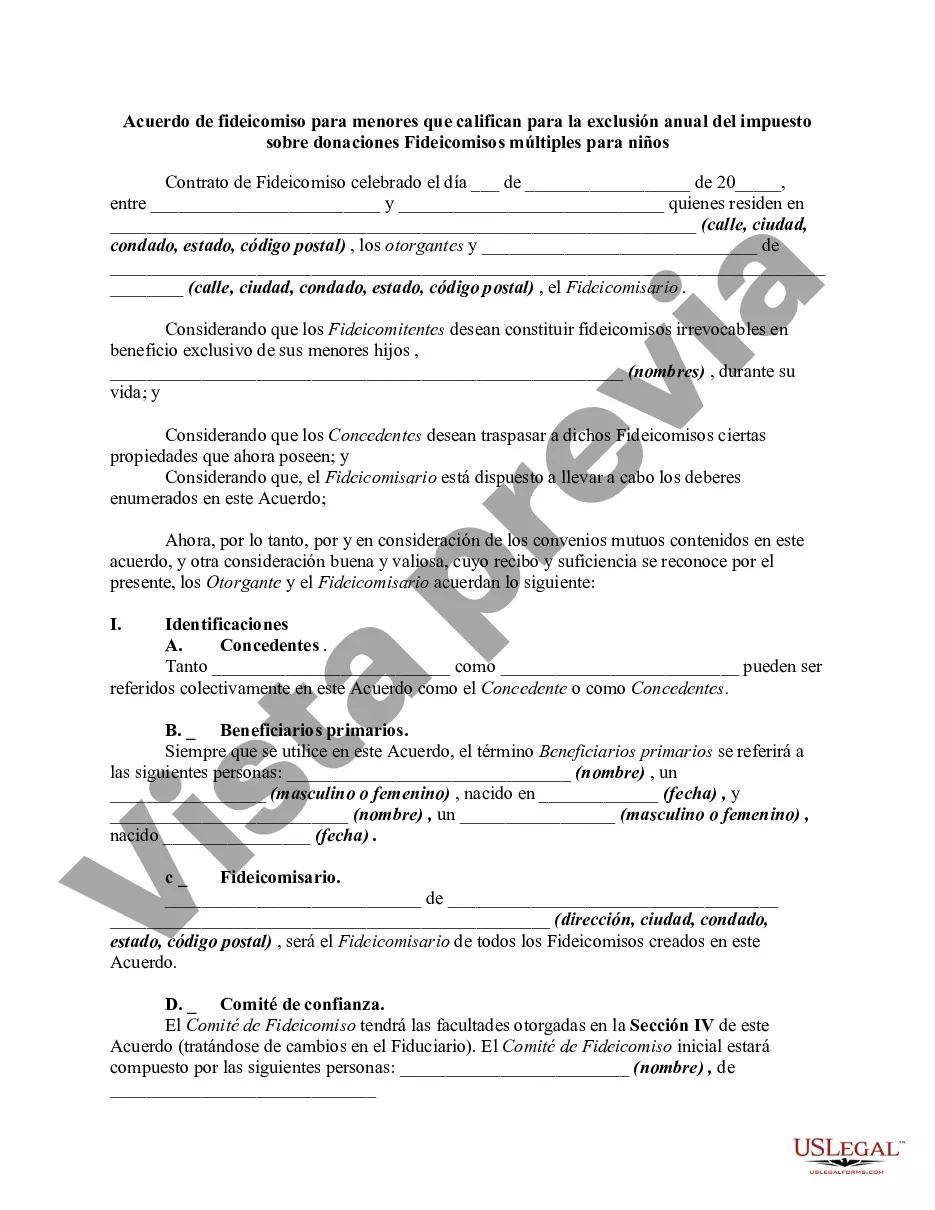

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.