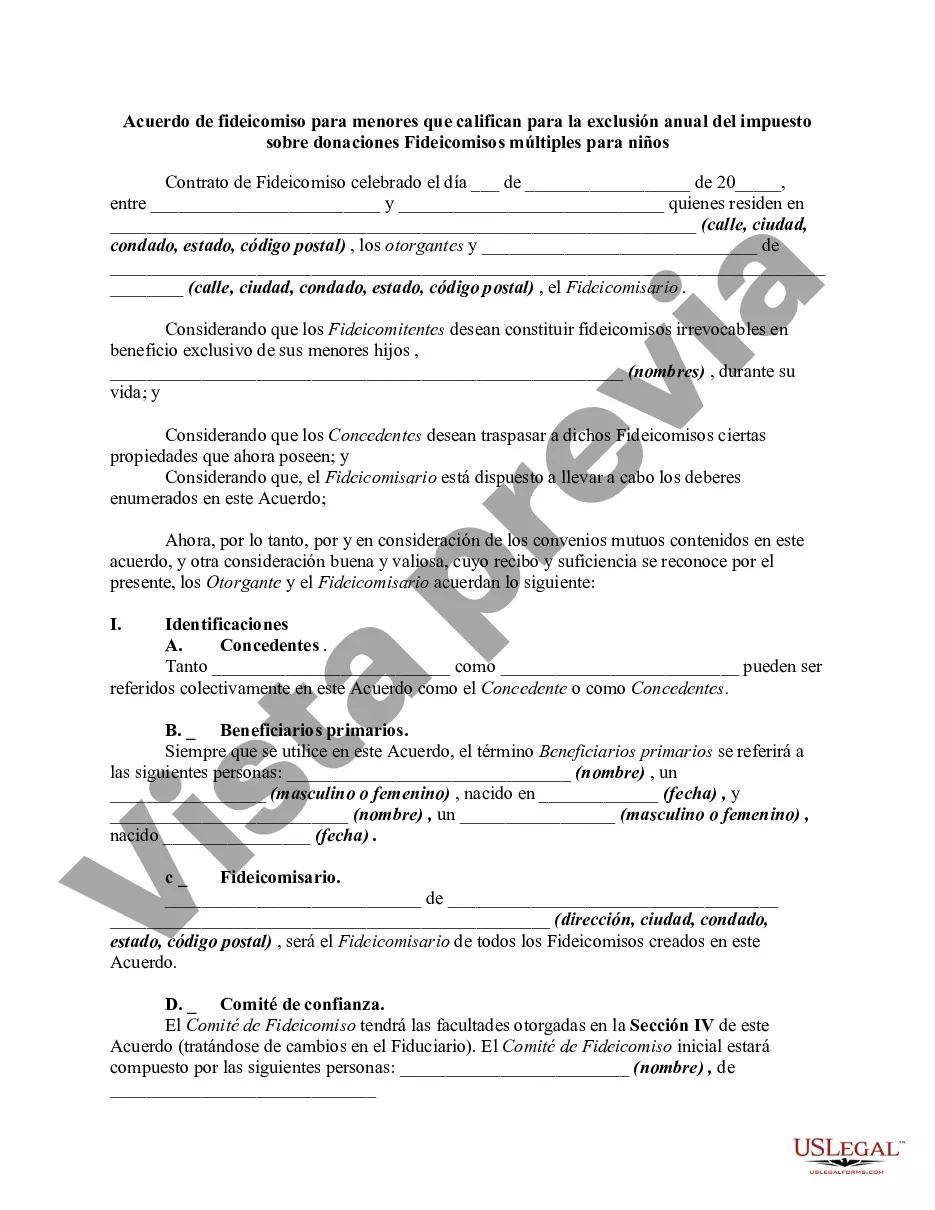

This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

The Mecklenburg North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that allows individuals in Mecklenburg County, North Carolina, to set up multiple trust accounts for children, while also qualifying for the annual gift tax exclusion. This agreement is commonly used by parents or guardians who want to manage and distribute assets to their children in a tax-efficient manner. Keywords: Mecklenburg North Carolina, Trust Agreement, Minors, Qualifying, Annual Gift Tax Exclusion, Multiple Trusts, Children. There are several types of Mecklenburg North Carolina Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, including: 1. Revocable Trust for Minors: This type of trust allows the granter (parent or guardian) to retain control over the trust assets and modify or revoke the trust during their lifetime. The trust assets are held for the benefit of the child and can be distributed according to the granter's instructions. 2. Irrevocable Trust for Minors: This trust cannot be modified or revoked by the granter once it is established. The trust assets are transferred out of the granter's estate, potentially reducing estate taxes. The trustee manages the assets for the child's benefit, following the terms and conditions set forth in the trust agreement. 3. Educational Trust: This type of trust is specifically designed to provide funds for a child's education expenses. The trust assets can be used to cover tuition fees, books, supplies, or other educational needs. By utilizing this trust, parents can ensure that their children have financial support for their educational endeavors. 4. Testamentary Trust: This trust is established through a will and becomes effective upon the granter's death. It enables the granter to distribute assets to their children while avoiding probate and ensuring the assets are managed by a designated trustee until the children reach a certain age or meet specific conditions. 5. Spendthrift Trust: This trust safeguards the trust assets from the beneficiaries' creditors or their own poor financial decisions. It allows the trustee to control the distribution of funds and provide ongoing financial support for the children while protecting their inheritance. In conclusion, the Mecklenburg North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides individuals with various options to manage and distribute assets to their children while qualifying for the annual gift tax exclusion. Depending on their specific needs and preferences, parents or guardians can choose from trust agreements such as revocable trusts, irrevocable trusts, educational trusts, testamentary trusts, or spendthrift trusts.The Mecklenburg North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that allows individuals in Mecklenburg County, North Carolina, to set up multiple trust accounts for children, while also qualifying for the annual gift tax exclusion. This agreement is commonly used by parents or guardians who want to manage and distribute assets to their children in a tax-efficient manner. Keywords: Mecklenburg North Carolina, Trust Agreement, Minors, Qualifying, Annual Gift Tax Exclusion, Multiple Trusts, Children. There are several types of Mecklenburg North Carolina Trust Agreements for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, including: 1. Revocable Trust for Minors: This type of trust allows the granter (parent or guardian) to retain control over the trust assets and modify or revoke the trust during their lifetime. The trust assets are held for the benefit of the child and can be distributed according to the granter's instructions. 2. Irrevocable Trust for Minors: This trust cannot be modified or revoked by the granter once it is established. The trust assets are transferred out of the granter's estate, potentially reducing estate taxes. The trustee manages the assets for the child's benefit, following the terms and conditions set forth in the trust agreement. 3. Educational Trust: This type of trust is specifically designed to provide funds for a child's education expenses. The trust assets can be used to cover tuition fees, books, supplies, or other educational needs. By utilizing this trust, parents can ensure that their children have financial support for their educational endeavors. 4. Testamentary Trust: This trust is established through a will and becomes effective upon the granter's death. It enables the granter to distribute assets to their children while avoiding probate and ensuring the assets are managed by a designated trustee until the children reach a certain age or meet specific conditions. 5. Spendthrift Trust: This trust safeguards the trust assets from the beneficiaries' creditors or their own poor financial decisions. It allows the trustee to control the distribution of funds and provide ongoing financial support for the children while protecting their inheritance. In conclusion, the Mecklenburg North Carolina Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides individuals with various options to manage and distribute assets to their children while qualifying for the annual gift tax exclusion. Depending on their specific needs and preferences, parents or guardians can choose from trust agreements such as revocable trusts, irrevocable trusts, educational trusts, testamentary trusts, or spendthrift trusts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.