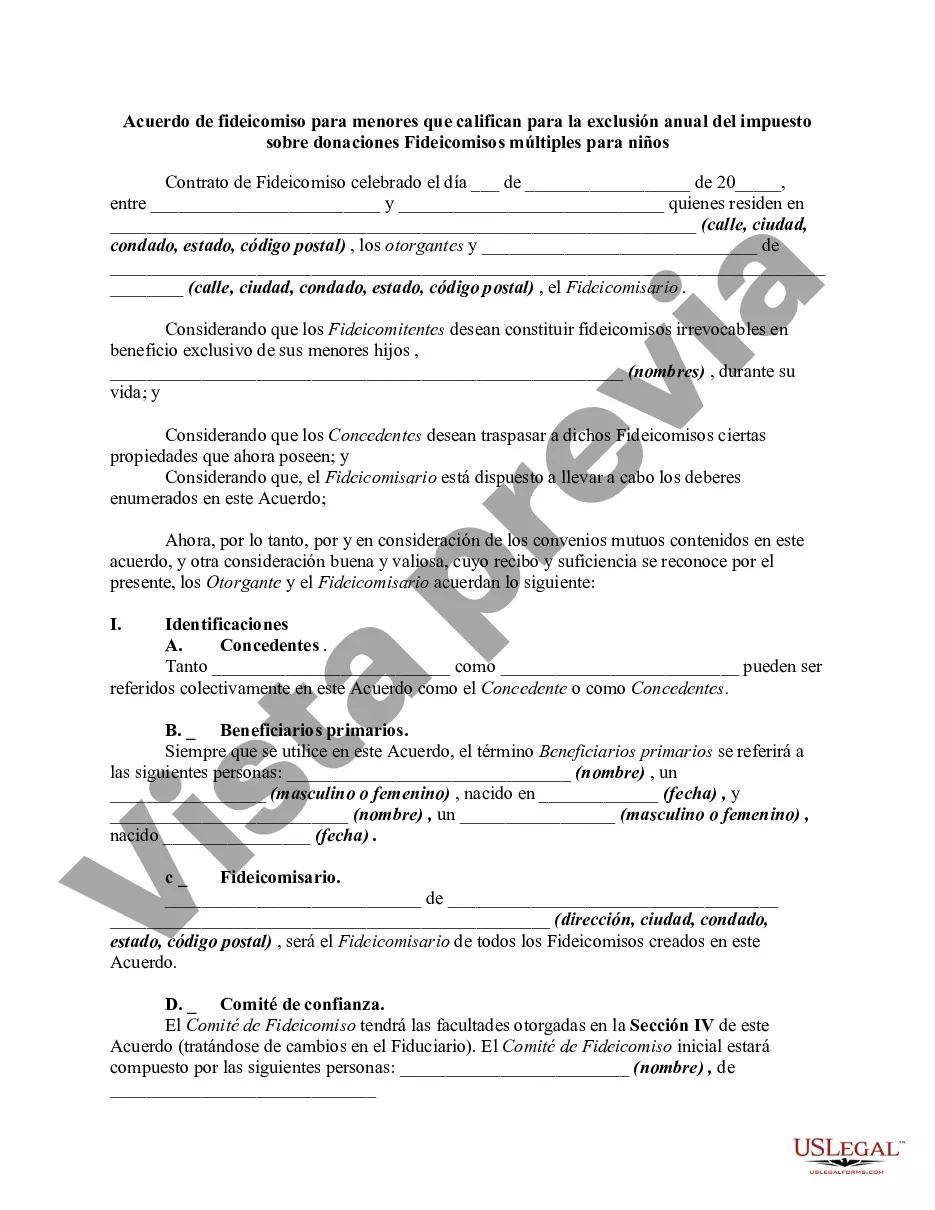

This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Oakland Michigan Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that enables individuals in the Oakland area of Michigan to establish trusts for minors, ensuring the eligibility for the annual gift tax exclusion. This agreement serves as a comprehensive framework for managing and securing assets to benefit children while minimizing tax liabilities. The Oakland Michigan Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion allows individuals to create multiple trusts, catering to the specific needs and circumstances of each child. These trusts facilitate the effective distribution and management of assets, ensuring that the children's financial requirements are met until they reach adulthood. Keywords: Oakland Michigan, Trust Agreement, Minors, Annual Gift Tax Exclusion, Multiple Trusts, Children, Legal Document, Assets, Tax Liabilities, Distribution, Management, Financial Requirements, Adulthood. Different Types of Oakland Michigan Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children: 1. Individual Trusts: This type of trust agreement allows each child to have their individual trust, customized to their unique needs and tailored according to the assets designated for their benefit. It ensures personalized management and distribution of assets for each child. 2. Shared Trusts: In some cases, individuals may choose to create a shared trust for multiple children. This arrangement consolidates their assets within a single trust structure, simplifying administration and potentially reducing costs. 3. Educational Trusts: A specific type of trust agreement within the Oakland Michigan framework is designed to prioritize educational expenses for minors. This trust ensures that funds are set aside exclusively for educational purposes, such as tuition fees, books, or extracurricular activities. 4. Special Needs Trusts: Some children may require long-term financial support due to physical or mental disabilities. The Oakland Michigan Trust Agreement allows individuals to establish special needs trusts, which cater to these unique circumstances, ensuring the children receive proper care and support throughout their lives. 5. Testamentary Trusts: These types of trusts are created within a will and only go into effect after the individual's death. Testamentary trusts established through the Oakland Michigan Trust Agreement can provide for minors, ensuring their financial wellbeing is protected and managed according to the individual's wishes. Keywords: Individual Trusts, Shared Trusts, Educational Trusts, Special Needs Trusts, Testamentary Trusts, Unique Needs, Educational Expenses, Support, Proper Care, Financial Wellbeing, Wishes.Oakland Michigan Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal document that enables individuals in the Oakland area of Michigan to establish trusts for minors, ensuring the eligibility for the annual gift tax exclusion. This agreement serves as a comprehensive framework for managing and securing assets to benefit children while minimizing tax liabilities. The Oakland Michigan Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion allows individuals to create multiple trusts, catering to the specific needs and circumstances of each child. These trusts facilitate the effective distribution and management of assets, ensuring that the children's financial requirements are met until they reach adulthood. Keywords: Oakland Michigan, Trust Agreement, Minors, Annual Gift Tax Exclusion, Multiple Trusts, Children, Legal Document, Assets, Tax Liabilities, Distribution, Management, Financial Requirements, Adulthood. Different Types of Oakland Michigan Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children: 1. Individual Trusts: This type of trust agreement allows each child to have their individual trust, customized to their unique needs and tailored according to the assets designated for their benefit. It ensures personalized management and distribution of assets for each child. 2. Shared Trusts: In some cases, individuals may choose to create a shared trust for multiple children. This arrangement consolidates their assets within a single trust structure, simplifying administration and potentially reducing costs. 3. Educational Trusts: A specific type of trust agreement within the Oakland Michigan framework is designed to prioritize educational expenses for minors. This trust ensures that funds are set aside exclusively for educational purposes, such as tuition fees, books, or extracurricular activities. 4. Special Needs Trusts: Some children may require long-term financial support due to physical or mental disabilities. The Oakland Michigan Trust Agreement allows individuals to establish special needs trusts, which cater to these unique circumstances, ensuring the children receive proper care and support throughout their lives. 5. Testamentary Trusts: These types of trusts are created within a will and only go into effect after the individual's death. Testamentary trusts established through the Oakland Michigan Trust Agreement can provide for minors, ensuring their financial wellbeing is protected and managed according to the individual's wishes. Keywords: Individual Trusts, Shared Trusts, Educational Trusts, Special Needs Trusts, Testamentary Trusts, Unique Needs, Educational Expenses, Support, Proper Care, Financial Wellbeing, Wishes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.