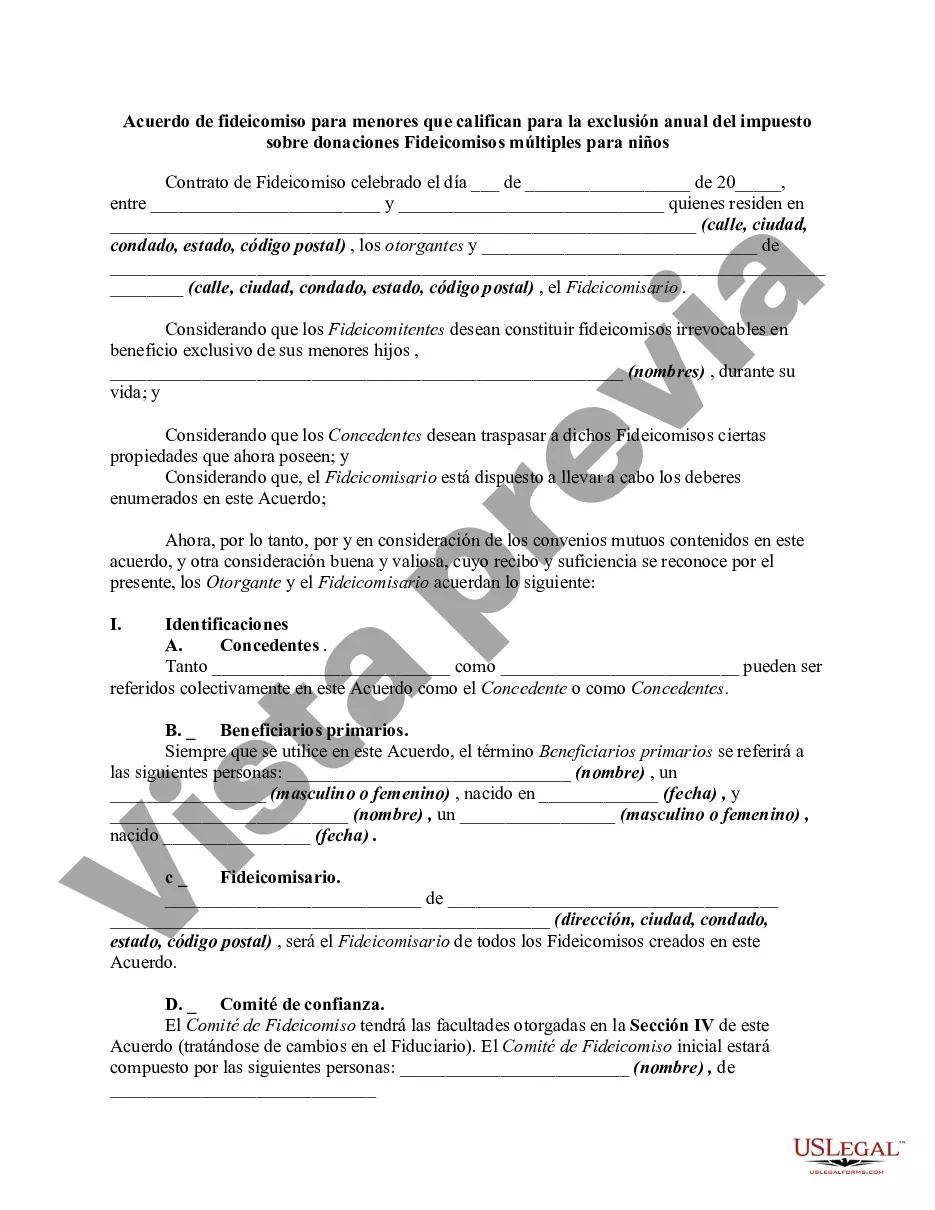

This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

The Lima Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion is a legal document that allows individuals to create multiple trusts for children, while taking advantage of the annual gift tax exclusion. This trust agreement is specifically designed for residents of Lima, Arizona, and provides a comprehensive framework for managing assets and ensuring the financial well-being of minors. By establishing multiple trusts, parents or guardians can effectively distribute assets among several children, minimizing tax implications and maximizing the benefits of the annual gift tax exclusion. This agreement enables the creation of separate trusts for each child, allowing for a more personalized approach to asset management and allocation. The Lima Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion offers flexibility in terms of asset types that can be included in the trusts, including cash, investments, real estate, and other valuable possessions. It also provides options for trustees, who are responsible for managing and administering the trusts on behalf of the minors. By utilizing this trust agreement, individuals can ensure that their children's financial futures are secured, while simultaneously minimizing potential gift tax liabilities. It offers a legal and effective method for transferring assets to the next generation, allowing for tax-efficient wealth preservation. In addition to the standard Lima Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion, there are variations tailored to specific needs or circumstances. These may include: 1. Special Needs Trust Agreement: Designed for children with special needs, this trust arrangement provides for their long-term care and financial support while also protecting their eligibility for government assistance programs. 2. Education Trust Agreement: This agreement emphasizes the allocation of assets towards educational expenses, such as tuition fees, books, and related costs. It ensures that each child's educational needs are considered and prioritized. 3. Risk Mitigation Trust Agreement: Geared towards protecting the assets within the trust from potential risks, such as lawsuits or creditors, this agreement establishes additional safeguards to shield the assets from external claims and liabilities. 4. Charitable Trust Agreement: For individuals who wish to incorporate philanthropic goals into their estate planning, this trust arrangement allows for the donation of assets to charitable organizations while also providing for the financial well-being of the children. Overall, the Lima Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides a comprehensive and flexible solution for estate planning, helping individuals achieve their desired wealth transfer goals while benefiting from tax advantages.The Lima Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion is a legal document that allows individuals to create multiple trusts for children, while taking advantage of the annual gift tax exclusion. This trust agreement is specifically designed for residents of Lima, Arizona, and provides a comprehensive framework for managing assets and ensuring the financial well-being of minors. By establishing multiple trusts, parents or guardians can effectively distribute assets among several children, minimizing tax implications and maximizing the benefits of the annual gift tax exclusion. This agreement enables the creation of separate trusts for each child, allowing for a more personalized approach to asset management and allocation. The Lima Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion offers flexibility in terms of asset types that can be included in the trusts, including cash, investments, real estate, and other valuable possessions. It also provides options for trustees, who are responsible for managing and administering the trusts on behalf of the minors. By utilizing this trust agreement, individuals can ensure that their children's financial futures are secured, while simultaneously minimizing potential gift tax liabilities. It offers a legal and effective method for transferring assets to the next generation, allowing for tax-efficient wealth preservation. In addition to the standard Lima Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion, there are variations tailored to specific needs or circumstances. These may include: 1. Special Needs Trust Agreement: Designed for children with special needs, this trust arrangement provides for their long-term care and financial support while also protecting their eligibility for government assistance programs. 2. Education Trust Agreement: This agreement emphasizes the allocation of assets towards educational expenses, such as tuition fees, books, and related costs. It ensures that each child's educational needs are considered and prioritized. 3. Risk Mitigation Trust Agreement: Geared towards protecting the assets within the trust from potential risks, such as lawsuits or creditors, this agreement establishes additional safeguards to shield the assets from external claims and liabilities. 4. Charitable Trust Agreement: For individuals who wish to incorporate philanthropic goals into their estate planning, this trust arrangement allows for the donation of assets to charitable organizations while also providing for the financial well-being of the children. Overall, the Lima Arizona Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children provides a comprehensive and flexible solution for estate planning, helping individuals achieve their desired wealth transfer goals while benefiting from tax advantages.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.