This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

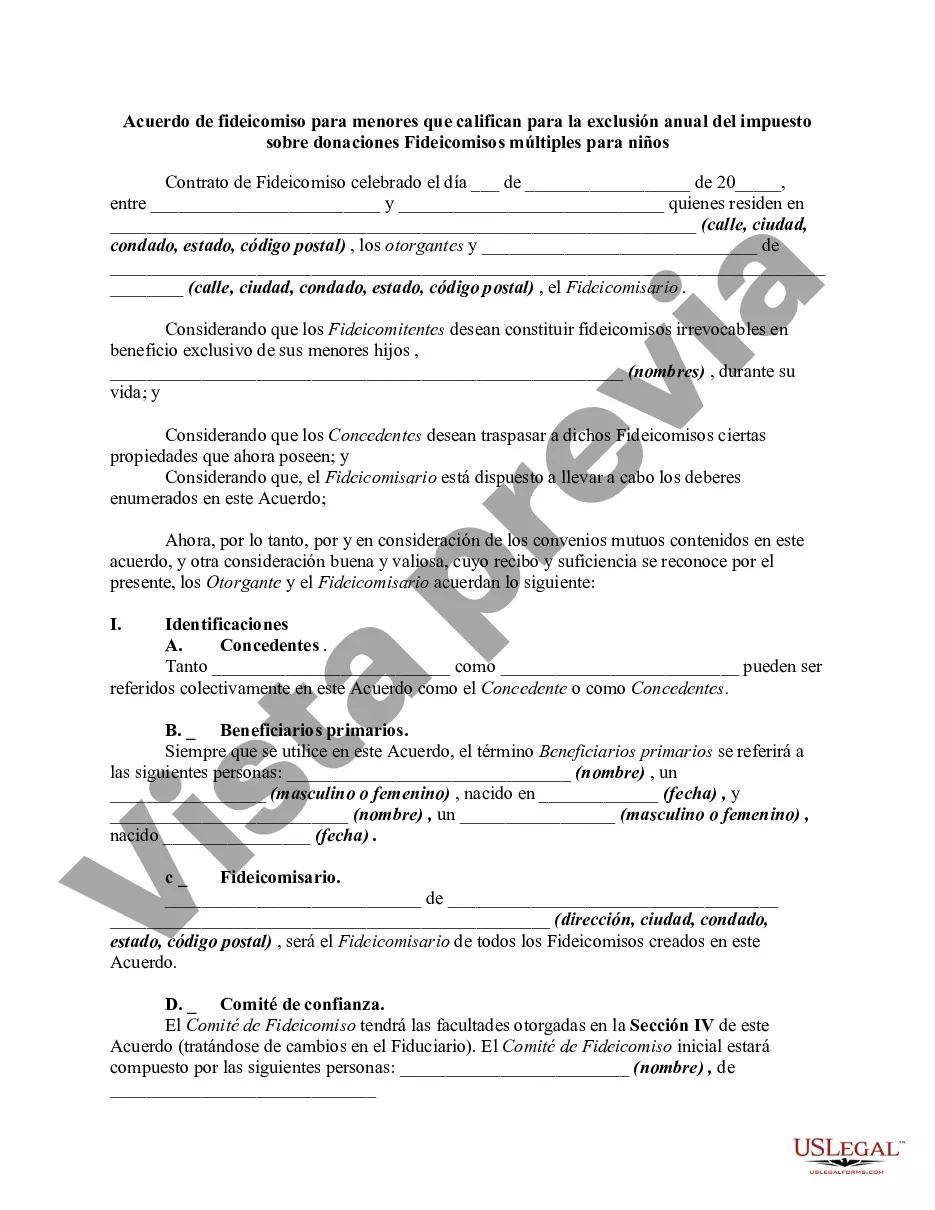

San Antonio Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal arrangement designed to ensure the proper management and distribution of assets for minor beneficiaries while allowing the granter to take advantage of the annual gift tax exclusion. This type of trust is a popular estate planning tool for individuals in San Antonio, Texas, who have multiple children and wish to minimize tax liabilities while providing for their offspring's future financial security. The general purpose of this trust agreement is to establish separate trusts for each child, allowing the granter to contribute assets up to the annual gift tax exclusion amount without incurring gift taxes. The annual gift tax exclusion is set by the Internal Revenue Service (IRS) and is subject to change, but as of 2021, it is $15,000 per beneficiary. By creating multiple trusts, the granter can leverage this exclusion per child, maximizing the tax benefits. Within the San Antonio Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, specific provisions and guidelines are outlined. These include: 1. Appointment and selection of trustee: The granter must appoint a responsible and trustworthy individual or institution to act as the trustee of each trust. The trustee's role is to manage and invest the trust assets, make distributions for the beneficiaries' well-being, and ensure compliance with applicable laws and regulations. 2. Trust funding: The granter transfers assets into each separate trust for the benefit of the designated child. These assets can include cash, securities, real estate, or any other property the granter wishes to allocate. It is essential to ensure that the transfer of assets is completed correctly to avoid potential gift tax consequences. 3. Discretionary distributions: The trustee has discretionary powers to make distributions from each trust for the child's education, healthcare, maintenance, or other needs. The trust agreement may specify guidelines for making these distributions, such as age restrictions, approval from a designated advisor, or specific purposes for which the funds can be used. 4. Termination of the trust: The trust agreement may specify when the trust terminates, such as when the beneficiary reaches a certain age or achieves certain milestones, like completing higher education or starting a business. At termination, the remaining trust assets are typically distributed outright to the beneficiary, allowing them full control over the assets. While the San Antonio Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a general framework, there can be variations or specific types, such as: 1. Educational Trusts: These trusts are focused on providing for the child's education-related expenses, ensuring that funds are available for tuition, books, and other educational needs. They may have restrictions on distributions for non-education-related expenses. 2. Special Needs Trusts: Specifically designed for children with disabilities or special needs, these trusts are created to ensure that the child's eligibility for government benefits is not compromised while still providing supplemental financial support. 3. Family Trusts: In scenarios where multiple children have similar financial needs and circumstances, a family trust may be established. This trust pools the assets for all children and allows the trustee to determine distributions based on the collective needs of the beneficiaries. It is essential to consult with an experienced estate planning attorney in San Antonio, Texas, to customize the trust agreement according to individual requirements and to ensure compliance with relevant laws and regulations.San Antonio Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a legal arrangement designed to ensure the proper management and distribution of assets for minor beneficiaries while allowing the granter to take advantage of the annual gift tax exclusion. This type of trust is a popular estate planning tool for individuals in San Antonio, Texas, who have multiple children and wish to minimize tax liabilities while providing for their offspring's future financial security. The general purpose of this trust agreement is to establish separate trusts for each child, allowing the granter to contribute assets up to the annual gift tax exclusion amount without incurring gift taxes. The annual gift tax exclusion is set by the Internal Revenue Service (IRS) and is subject to change, but as of 2021, it is $15,000 per beneficiary. By creating multiple trusts, the granter can leverage this exclusion per child, maximizing the tax benefits. Within the San Antonio Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children, specific provisions and guidelines are outlined. These include: 1. Appointment and selection of trustee: The granter must appoint a responsible and trustworthy individual or institution to act as the trustee of each trust. The trustee's role is to manage and invest the trust assets, make distributions for the beneficiaries' well-being, and ensure compliance with applicable laws and regulations. 2. Trust funding: The granter transfers assets into each separate trust for the benefit of the designated child. These assets can include cash, securities, real estate, or any other property the granter wishes to allocate. It is essential to ensure that the transfer of assets is completed correctly to avoid potential gift tax consequences. 3. Discretionary distributions: The trustee has discretionary powers to make distributions from each trust for the child's education, healthcare, maintenance, or other needs. The trust agreement may specify guidelines for making these distributions, such as age restrictions, approval from a designated advisor, or specific purposes for which the funds can be used. 4. Termination of the trust: The trust agreement may specify when the trust terminates, such as when the beneficiary reaches a certain age or achieves certain milestones, like completing higher education or starting a business. At termination, the remaining trust assets are typically distributed outright to the beneficiary, allowing them full control over the assets. While the San Antonio Texas Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion — Multiple Trusts for Children is a general framework, there can be variations or specific types, such as: 1. Educational Trusts: These trusts are focused on providing for the child's education-related expenses, ensuring that funds are available for tuition, books, and other educational needs. They may have restrictions on distributions for non-education-related expenses. 2. Special Needs Trusts: Specifically designed for children with disabilities or special needs, these trusts are created to ensure that the child's eligibility for government benefits is not compromised while still providing supplemental financial support. 3. Family Trusts: In scenarios where multiple children have similar financial needs and circumstances, a family trust may be established. This trust pools the assets for all children and allows the trustee to determine distributions based on the collective needs of the beneficiaries. It is essential to consult with an experienced estate planning attorney in San Antonio, Texas, to customize the trust agreement according to individual requirements and to ensure compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.